Home > Marg Books > Bank Reconciliation > What is the Process of Bank Reconciliation in Marg Books ?

What is the Process of Bank Reconciliation in Marg Books ?

Overview/Introduction to Bank Reconciliation in Marg Books

Process of Bank Reconciliation in Marg Books

Process to View Cleared Cheques in Marg Books

Process to View Un-cleared Cheques in Marg Books

Shortcut Keys of Bank Reconciliation Report in Marg Books

OVERVIEW/INTRODUCTION TO BANK RECONCILIATION IN MARG BOOKS

Bank Reconciliation Statement

Bank Reconciliation Statement is a statement prepared to reconcile and explain the causes of difference between the bank balance as per cash book and the same as per pass book as on a particular date.

Objectives of Bank Reconciliation

1. To determine that all payments made by the bank are properly charged to the bank account.

2. To ascertain that all amounts deposited are properly credited by the bank.

3. To make certain that opening and closing balances carried by the bank are correctly computed.

4. To verify periodically the accuracy of the firm’s own computation of bank balances.

Know more about Bank Reconciliation?

- It highlights the causes of difference between bank balance as per cash book and bank balance as per bank statement. Necessary adjustments or corrections can therefore be made at the earliest

- It reduces the chances of fraud by the staff, handling cash

- There is a moral check on the staff to keep the cash records always up-to-date

- Cheques issued but not yet presented for payment

- Cheques deposited into bank but not yet cleared

- Cheques received and entered in the bank column of the cash book but omitted to be deposited into bank

- Interest on deposit credited in the bank statement but not entered in the cash book

- Bank charges and interest on overdraft debited in the bank statement but not yet recorded in the cash book

- Dishonoured cheques debited in the bank statement but not yet recorded in the cash book

- Amounts directly deposited into bank by debtors and not entered in the cash book

- Payments by bank under standing order not recorded in the cash book

- Incomes collected by bank under standing order not recorded in cash book

PROCESS OF BANK RECONCILIATION IN MARG BOOKS

Once we have pass all the entries related to Bank after that Bank reconciliation process will be started. Through this process we can put a clearance date as per the Bank Statement so that we can confirm in our record that the cheques which we have deposited or Issued to any party will be cleared as per our bank records.

Although if any charges charged by the Bank Eg; Bank Charges, Bank Interest etc. for that we can also pass the fresh entries.

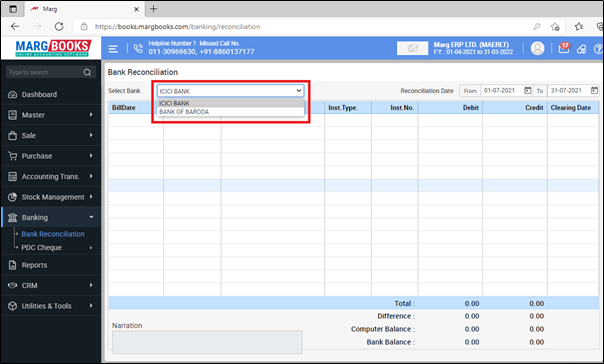

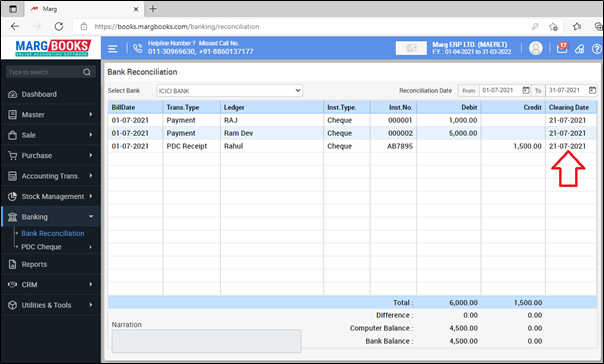

- Go to Banking >> Bank Reconciliation.

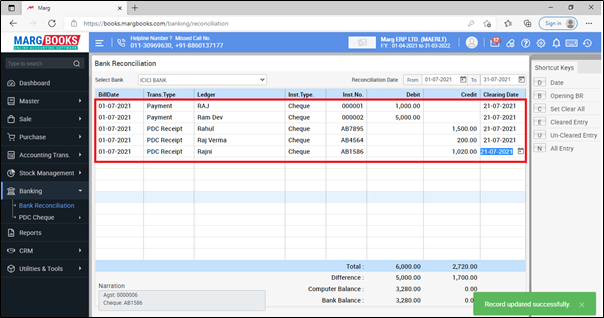

- A 'Bank Reconciliation' window will appear in which the user will select the Bank with whom the reconciliation needs to be done.

- Suppose select ‘ICICI’ for reconciliation.

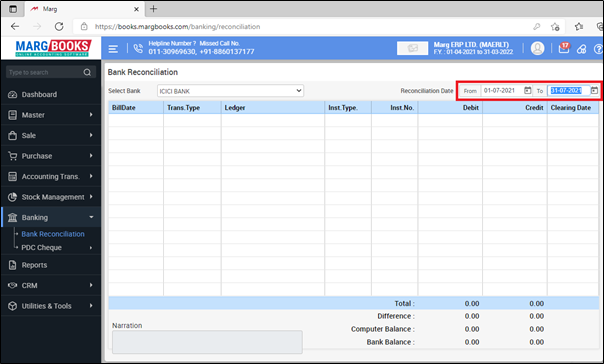

- Select Reconciliation date as per the requirement.

- Suppose select '01/07/2021 To 31/07/2021'. Press 'Enter'.

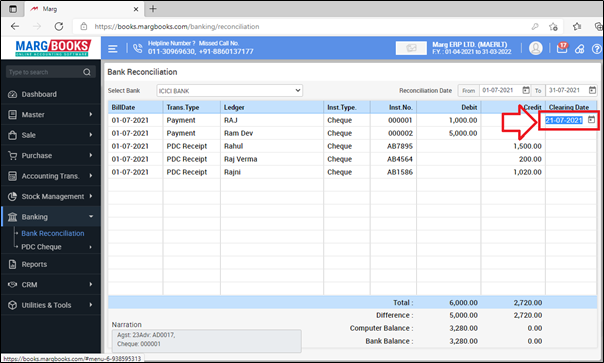

- Now the list of all the cheques that have been deposited in the bank will get displayed.

- Thereafter mention the date of clearance(Closing date) of the cheque to make the cheque clear in your records.

- Suppose mention '21-07-2021'.

Note: In order to mention current date, the user will press 'Enter' key on the date field.

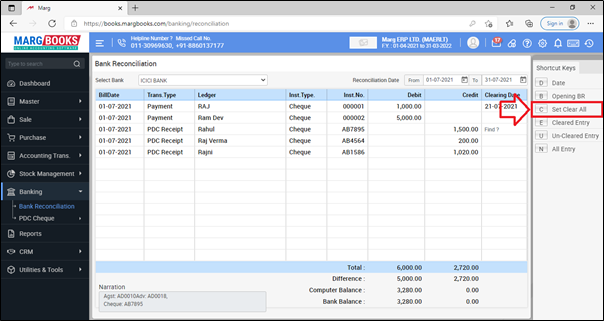

Note: 'Set Clear All' option is used to make the all cheque clear of same slip number in the same date.

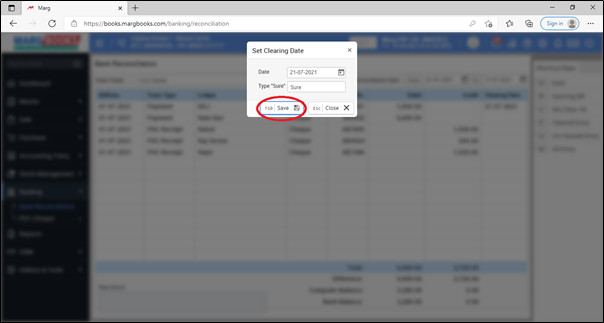

- Suppose click on ‘Set Clear All’.

- A 'Set Clearing Date' window will appear in which the user will select the date of clearing the cheques.

- Type "Sure".

- Then click on 'Save' to clear all the cheques.

- Now the user can view, software will automatically pick the clearing date in all the cheques.

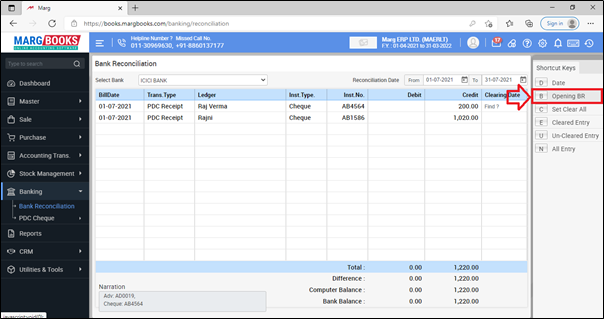

- In order to mention Bank opening details, the user will click on the 'Opening BR' option which is showing in the shortcut key on the right side.

- An 'Open Bank Reconciliation' window will appear with some different options:

1. Date: Mention the date on which the user will are putting the ledger opening.

2. Account: Select the Bank account whose opening balance needs to be entered.

3. Trans. Type: Select the transaction type i.e. Deposits & Issues as per the requirement.

4. Inst. Type: Select the instrument type i.e. Cheque, D.D., RTGS, etc. as per the requirement.

5. Inst. No.: Enter the instrument number.

6. Inst. Date: Enter the instrument date.

7. Remark: Enter the remark as per the requirement.

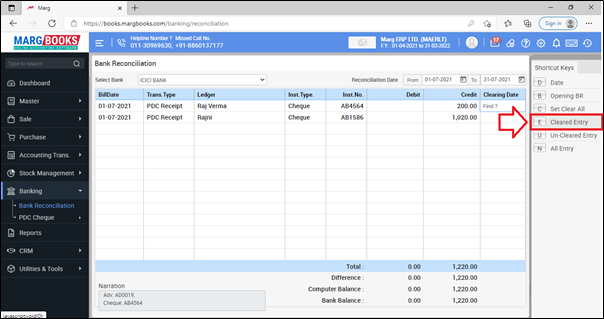

PROCESS TO VIEW CLEARED CHEQUES IN MARG BOOKS

In order to view the cleared cheques, the user will follow the below steps:

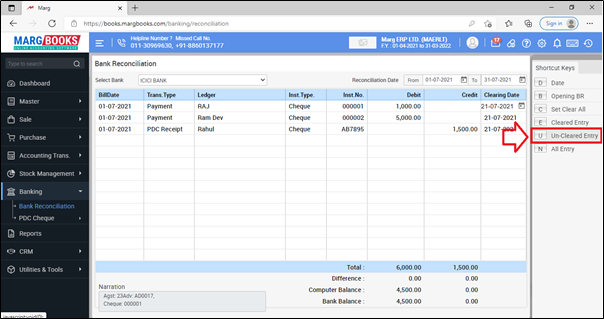

- Firstly click on ‘Cleared Entry’ shortcut key.

- The user can view all the cleared cheques will get appeared.

Note: if the user has mistakenly cleared the cheque in your accounts then you can simply unclear it by removing the date from the field of ‘Clearing Date’.

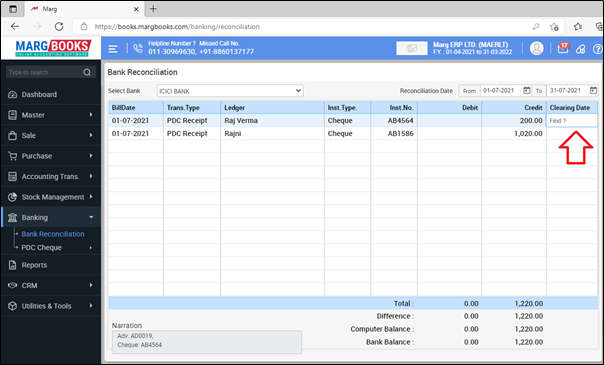

PROCESS TO VIEW UN-CLEARED CHEQUES IN MARG BOOKS

In order to view Un- cleared cheques, the user will follow the below steps:

- Firstly click on ‘Un-cleared Entry’ shortcut key.

- The user can view all the un-cleared cheques will get appeared.

Note: if the user needs to clear the unclear cheques then you can simply clear it by mentioning the date in the field of ‘Clearing Date’.

SHORTCUT KEYS OF BANK RECONCILIATION REPORT IN MARG BOOKS

| # | Use | Shortcut Key |

|---|---|---|

| 1 | Date wise Bank Reconciliation | D |

| 2 | Feed opening details of Bank | B |

| 3 | Clear All Cheques | C |

| 4 | View Cleared Cheques | E |

| 5 | View Un-Cleared Cheques | U |

| 6 | View All Cheques Entry(Cleared & Un-Cleared) | N |

-

Marg Books

-

Marg Books