Home > Marg Books > Statutory Report > How to view GSTR-9 Report in Marg Books ?

How to view GSTR-9 Report in Marg Books ?

Overview of GSTR-9 in Marg Books

Process to Generate GSTR-9 in Marg Books

OVERVIEW OF GSTR-9 IN MARG BOOKS

- GSTR-9 is an annual return to be filed yearly by the taxpayers. These are for those taxpayers who are registered under GST, but some taxpayers who do not have to file GSTR 9 like Casual Taxable Person, Input Service distributors, Non-resident taxable persons, and Persons paying TDS under section 51 of CGST Act.

- It consists of details regarding the outward and inward supplies made/received during the relevant financial year under different tax heads (CGST, SGST & IGST, and HSN codes).

- Marg Books has provided a provision in the software through which the user can generate GSTR-9 in a single click & can also export it in an Excel format as per the requirement.

PROCESS TO GENERATE GSTR-9 IN MARG BOOKS

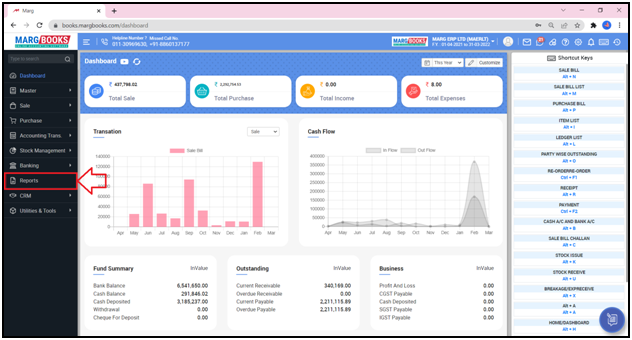

- Firstly, click on the 'Reports'.

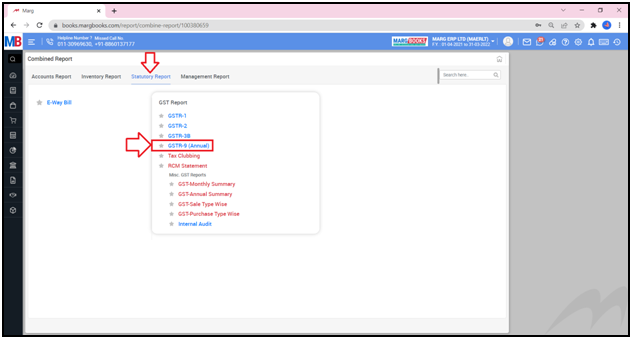

- A 'Combined Report' window will appear.

- Select GSTR-9 Annual' option under ‘Statutory Report’ tab.

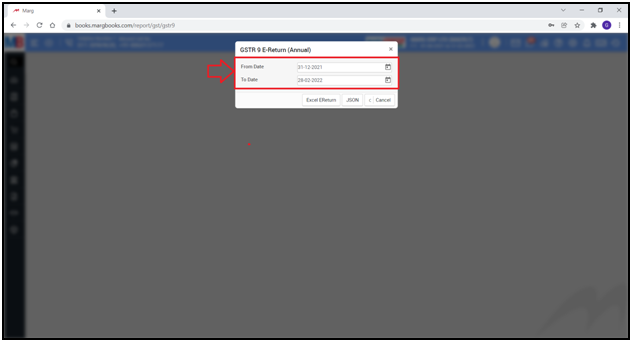

- A ‘GSTR 9 E-Return (Annual)’ window will appear with few fields:

a. From Date & To Date: Select the date of that financial year of which GSTR-9 needs to be filed.

Suppose select from ‘31-12-2021’ till ‘28-02-2022’.

- The user can generate GSTR-9 in ‘Excel EReturn’ & ‘JSON’ as per the requirement.

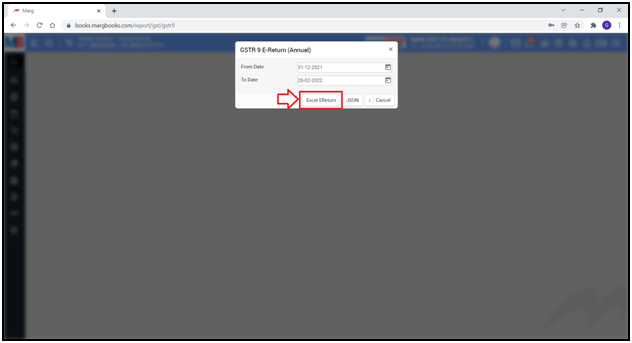

- Suppose click on ‘Excel EReturn’.

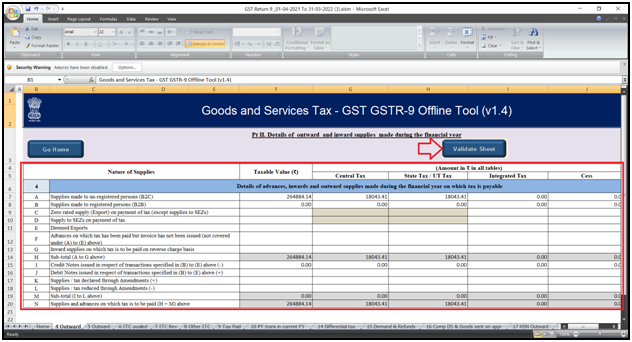

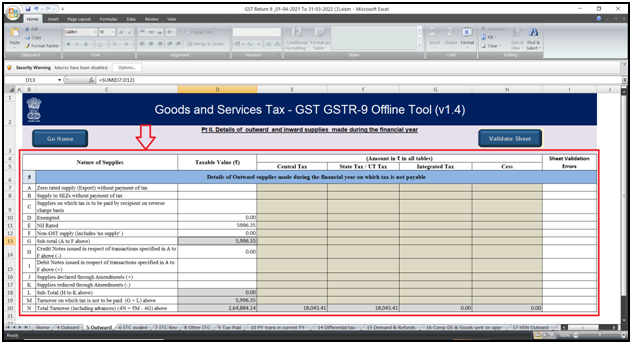

- The user can view that an Excel file has been generated.

- Here, ‘Validate Sheet’ button is given on every sheet and the user needs to click on ‘Validate Sheet’ button on every sheet in order to know about the errors if any in the given sheets and correct it as per the requirement.

Fig 1: View of GSTR-9 Report in Marg Books

-

Marg Books

-

Marg Books