Home > Marg Books > Statutory Report > What is the process to File GSTR 3B in Marg Books?

What is the process to File GSTR 3B in Marg Books?

Process to file GSTR 3B in Marg Books

OVERVIEW OF GSTR 3B

- GSTR 3B is also known as a monthly self-declaration which needs to be filled by a registered GST dealer along with his GSTR1 and GSTR2 forms. It is a clarified return to declare summary GST tax.

Some Important Guidelines for GSTR-3B

- A user must file GSTR 3B even when there is no business activity.

- GSTR 3B cannot be changed or amended.

- For each GSTIN user possess, a separate GSTR 3B must be submitted.

- With MargBooks, the user can do all these filing processes easily. Also, the user will be able to view their monthly consolidated summary. Through this summary report, the user can analyse its input tax credit avail, tax payable, tax paid, etc. details in depth.

PROCESS TO FILE GSTR-3B IN MARG BOOKS

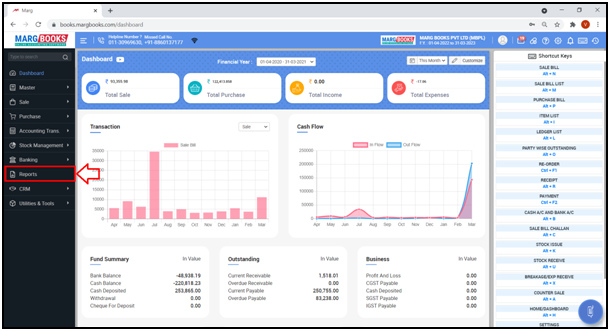

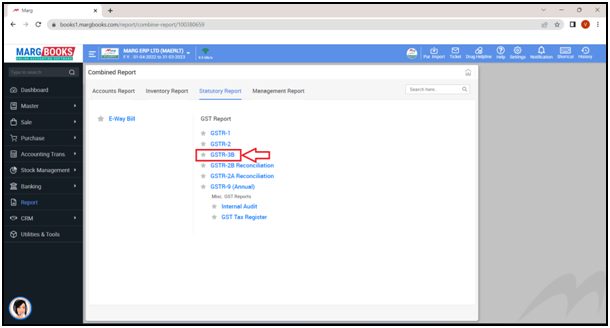

- Firstly, click on the 'Reports'.

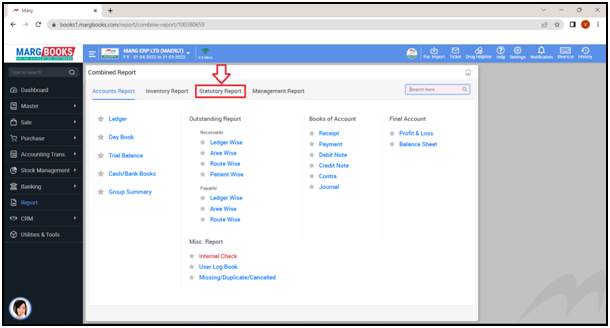

- A 'Combined Report' window will appear.

- Click on 'Statutory Report' tab.

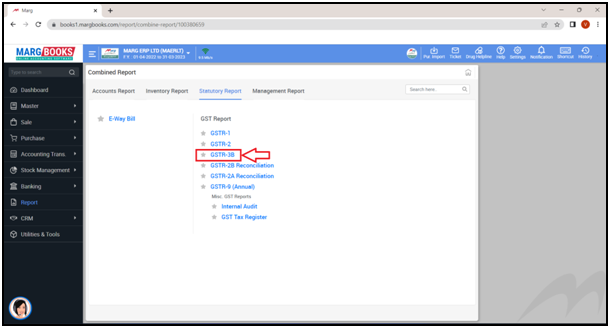

- Click on ‘GSTR-3B’ option.

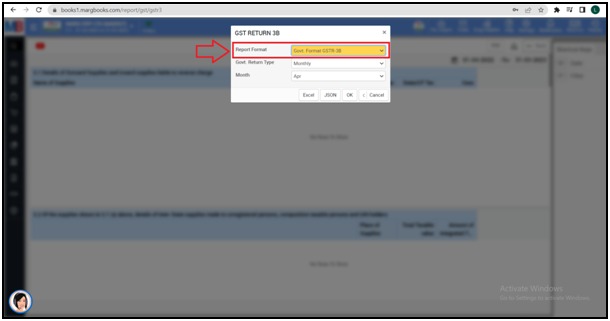

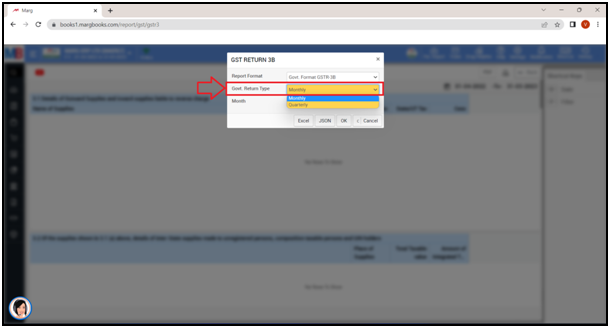

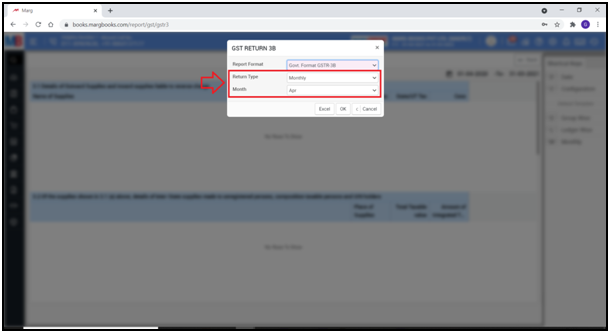

- A ‘GST Return 3B’ window will appear.

- Select the ‘Report Format’ as per the requirement.

- Select the ‘Return type’ i.e. ‘Monthly’ or ‘Quarterly’.

- Suppose select ‘Monthly’.

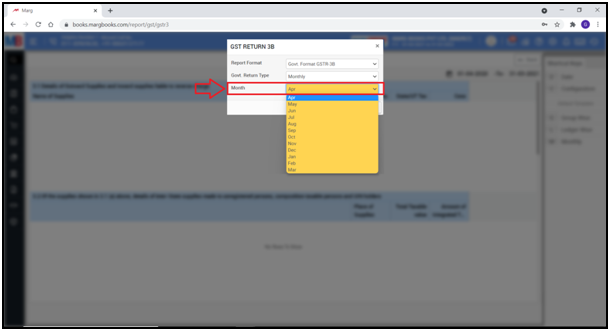

- Select the Month as per the requirement.

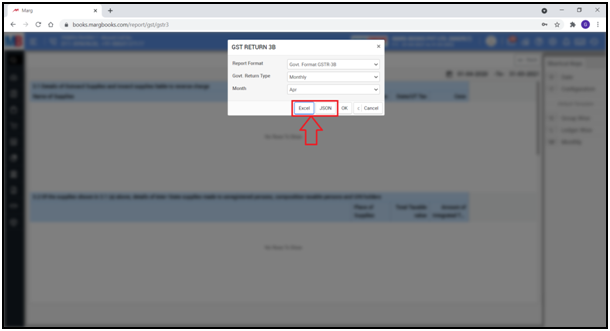

- The user can also export the data to ‘Excel’ or ‘JSON.’

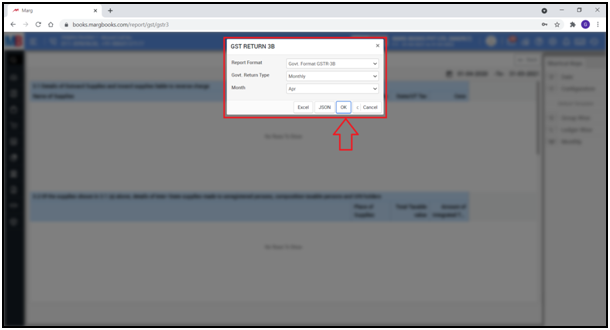

- Click on ‘Ok’

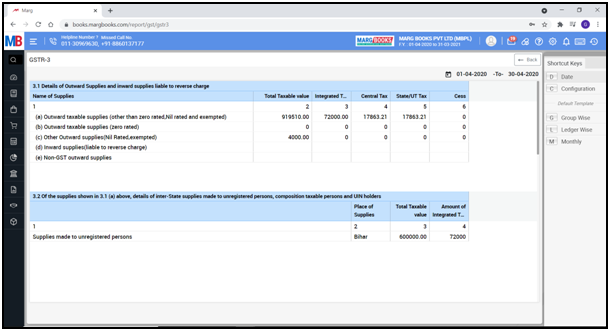

- A ‘GSTR-3B’ report will get displayed.

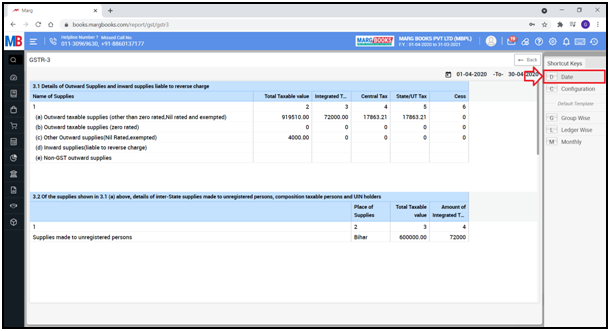

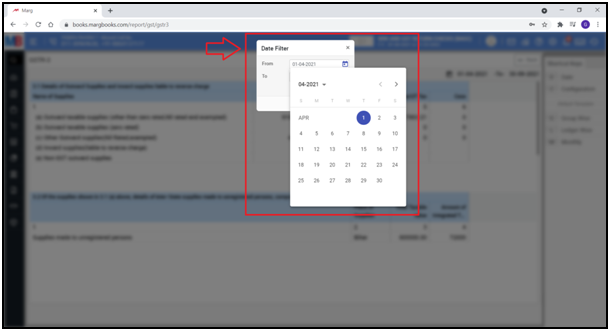

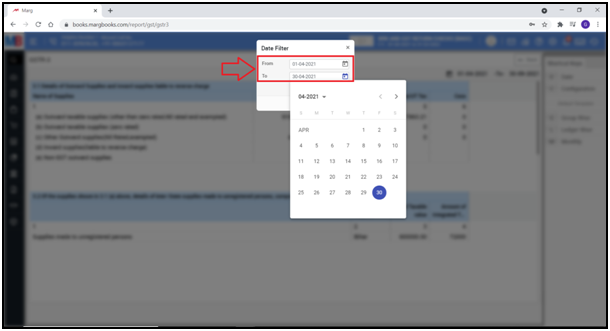

- In order to view the GSTR-3B Report for a particular period, click on ‘Date’ tab from the right side of the dashboard.

- A ‘Date Filter’ window will appear.

- Select the date i.e. from which date till which date the user needs to view the GSTR 3B Report.

- Suppose select ‘1-08-2021’ to ‘31-08-2021’.

- Then click on ‘OK’ tab.

- The user can view the GSTR-3B Report for the selected period.

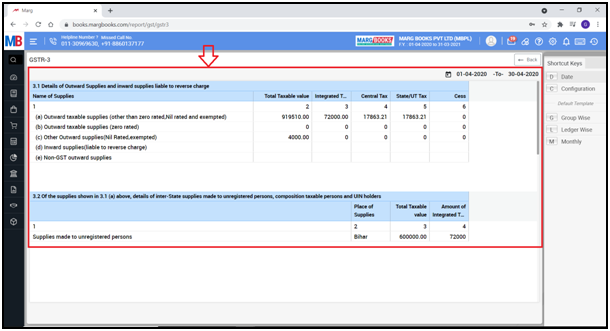

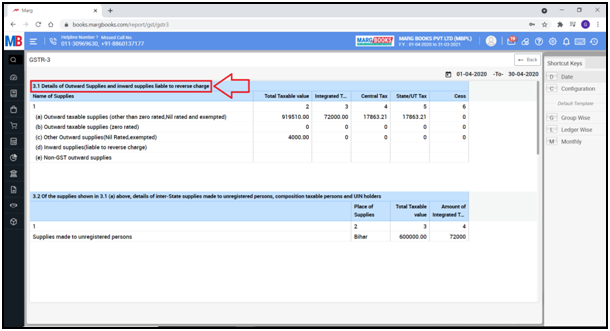

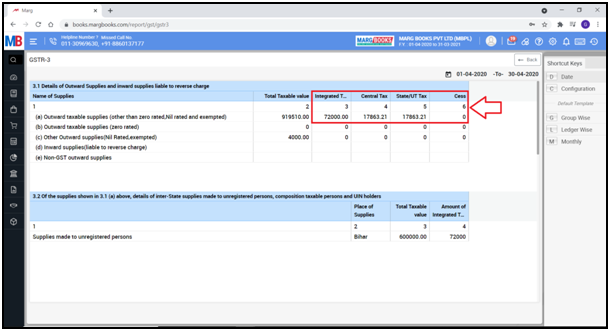

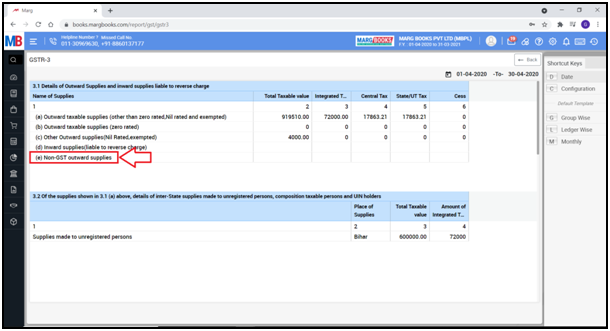

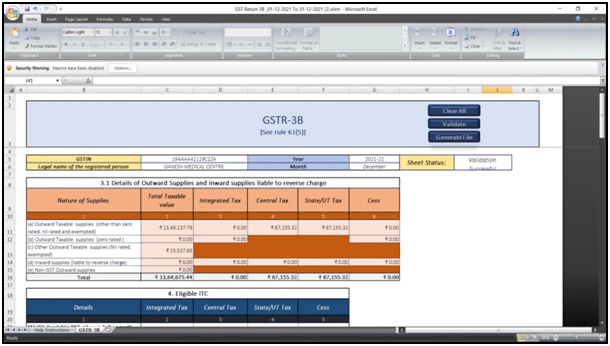

Section 3.1

‘Detail of outward supplies and inward supplies liable to reverse charge’- Tax liabilities will come here

- This section provides the details of outward supplies that includes records of all invoices, debit notes, credit notes, advances received; advances adjusted and revised invoices issued in relation to outward supplies made during any tax period.

- On the other hand, Inward Supply refers to receiving products or services from another person, whether through purchase, acquisition, or another method, with or without consideration.

Name of supplies:

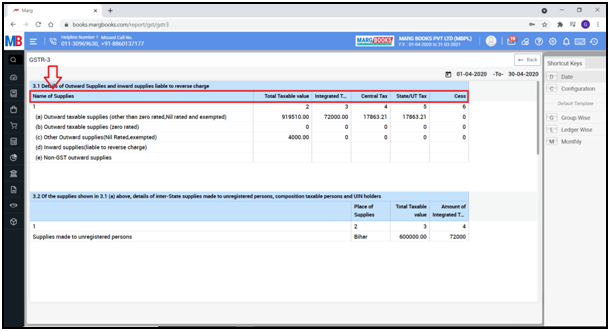

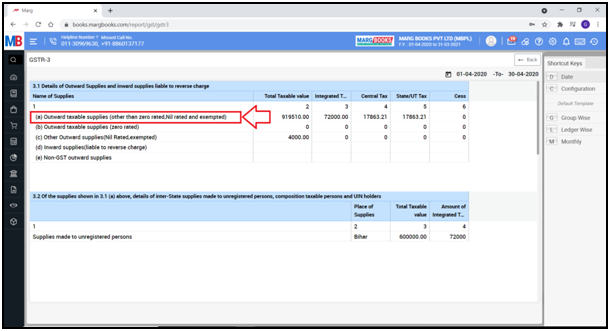

a. ‘Outward taxable supplies (Other than zero rated, NIL rated and exempted)’ - All taxable supplies will come here.

- If there is IGST, then Integrated Tax will come here. CGST in Central Tax, SGST in State/UT Tax and Cess will come here.

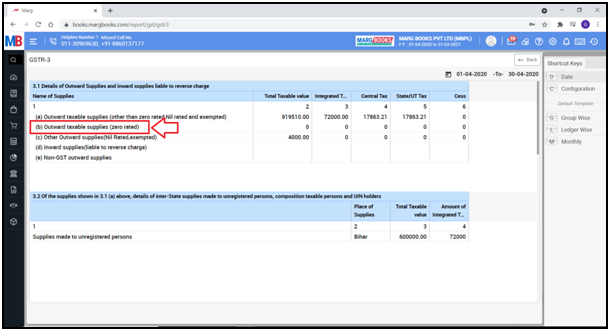

b. ‘Outward taxable supplies (Zero rated)’- Only supplies with a 0% GST rate will be included here. Exports or supplies made to SEZ are considered zero-rated supplies.

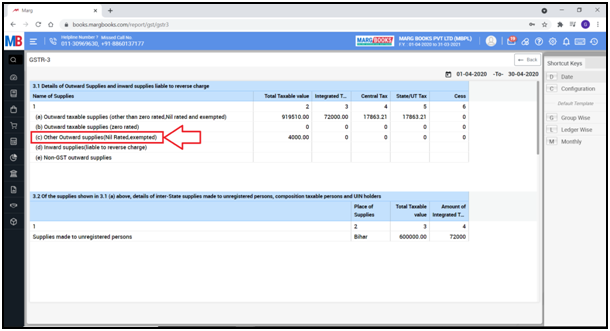

c. Other outward supplies (Nil rated exempted) - Supplies that are exempt from GST or are nil rated are included in the category of 'other outward supplies' (nil rated, exempt).

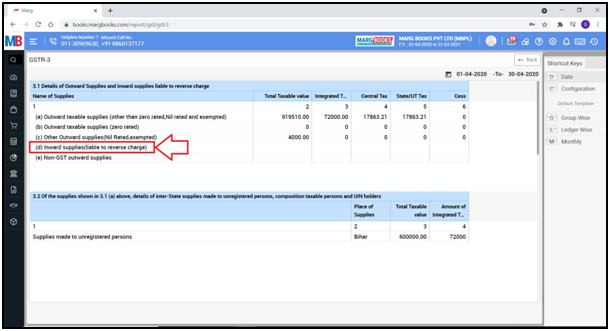

d. Inward supplies (liable to reverse charge)- Reverse Charge describes a delivery of goods or services where the recipient is responsible for paying tax rather than the supplier in the case of certain categories of supply.

e. Non GST outward supplies- For the categories like petrol, diesel etc. where VAT is not applicable, only their taxable value will be come here and not the tax amount.

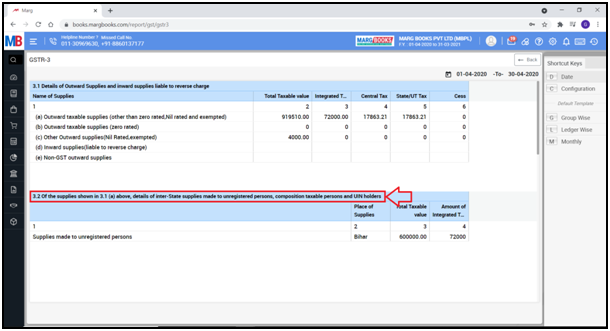

Section 3.2

of supplies shown in 3.1 (a) above, details of inter- State supplies made to unregistered persons, composition taxable persons and UNN holders’: State-wise different details of unregistered persons, composition taxable persons and UNN holders, taxable value and Tax amount.

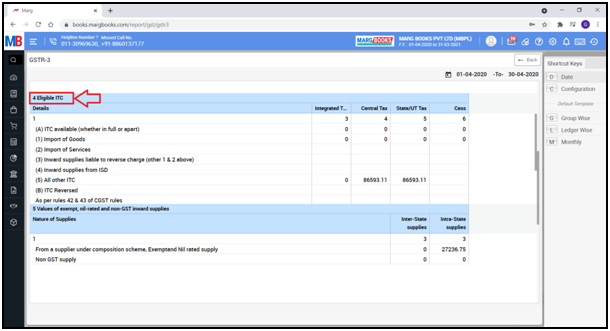

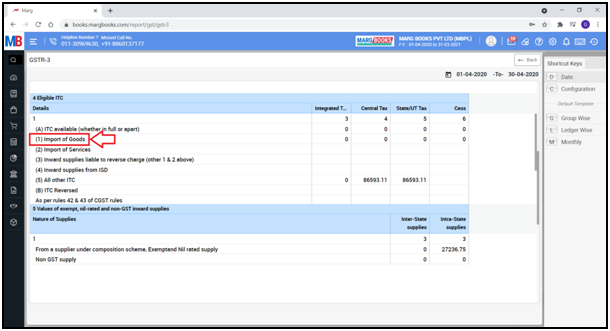

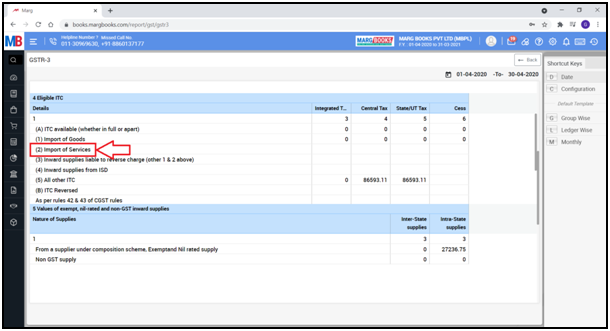

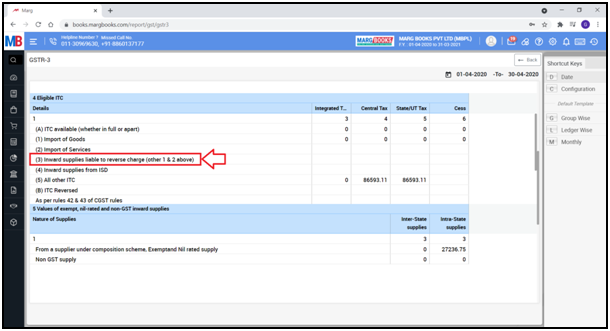

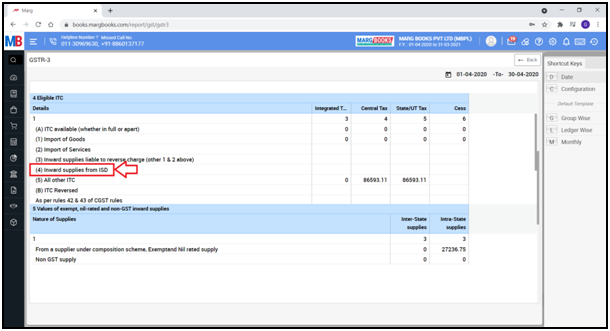

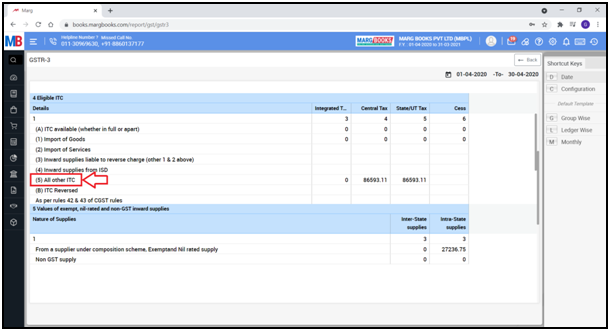

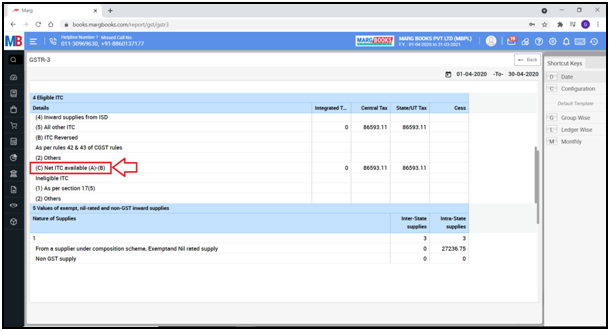

Section 4

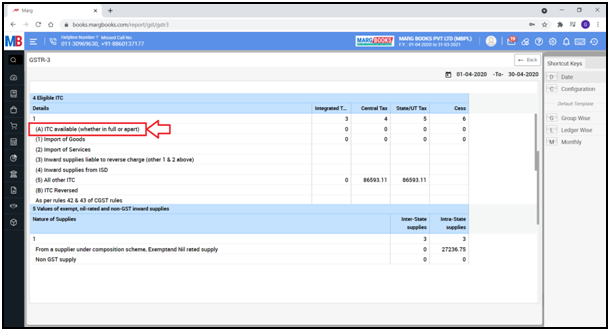

Eligible ITC – means input tax credit, basically the tax amount of how much ITC the user wants to claim will come here.

A. ITC available (whether in full or apart) – The details of ITC whether in full or apart their details will come here.

1. Import of Goods –The available ITC will come here.

2. Import of services –The available services will come here.

3. Inward supplies liable to reverse charge (other 1 &2 above) – In 3.1 section (d) unregistered purchases where reverse charge is applicable that same amount will come here.

4. Inward supplies from ISD – means the tax claim from the input service distributor those details will come here.

5. All other ITC – Except from Import, reverse charge, ISD all other ITC will come here.

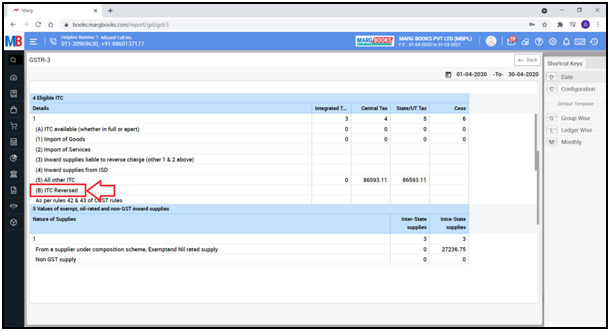

B. ITC Reversed – If ITCs have been reversed that will come here.

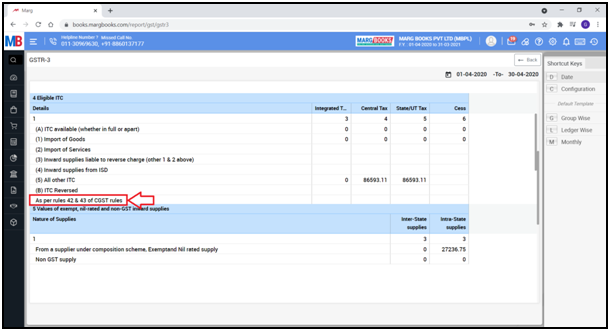

As per rules 42 & 43 of CGST rules- If the user has a composite supply which is also being used for business or partially for personal use it will be equally reversed similarly the exempted service or for taxable service that will also according to rule 42 & 43 on the basis of that will be reversed.

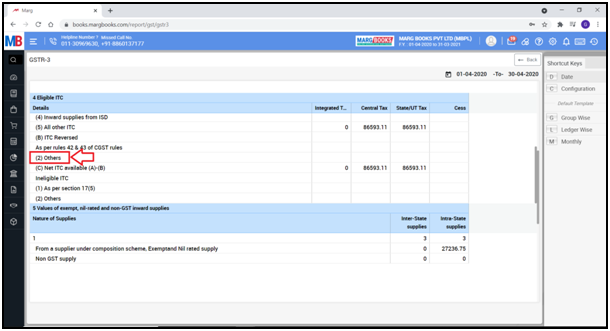

(2) Others- means the debit note will come here.

C. Net ITC available (A) – (B) – A minus B, means the available ITC after A minus B will come here.

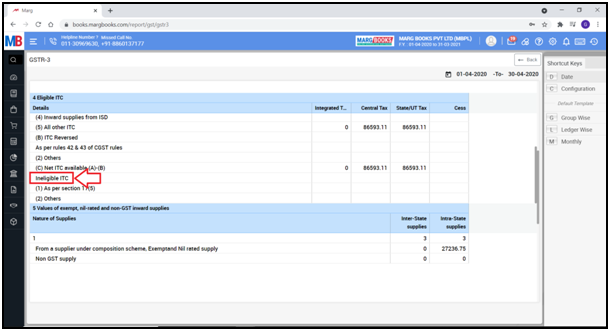

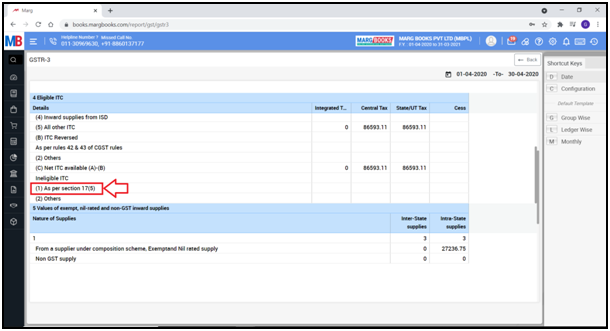

Ineligible ITC- Those where the user gets no input.

1. As per section 17(5) – It is for the blocked credit, for example if the user has purchased a car for the business and take food and beverages services, outdoor catering service or spa services there is no input tax available, they come under the blocked credit category, their details will comes here.

2. Others - Those who does not come under 17(5) category and still the ITC is not available on them those details will come here.

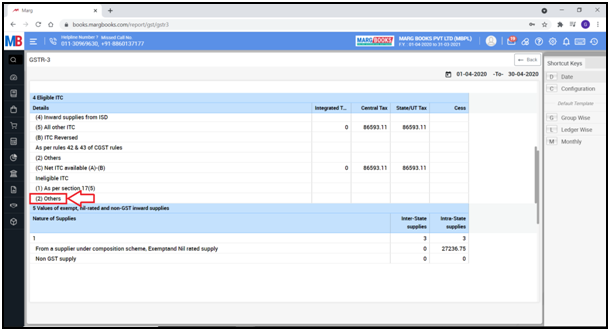

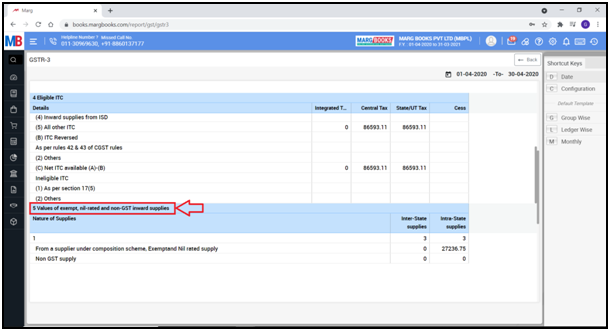

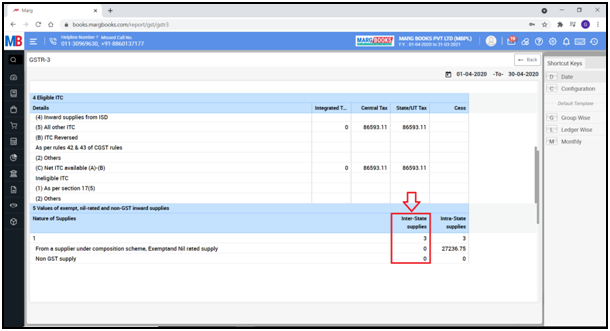

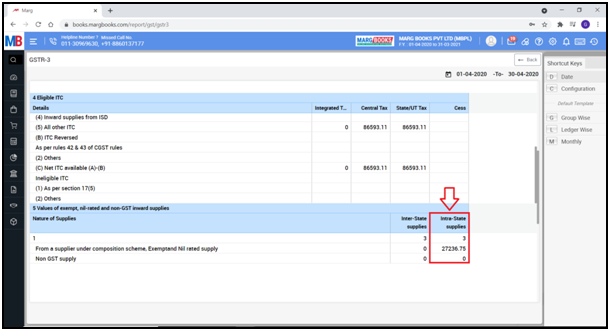

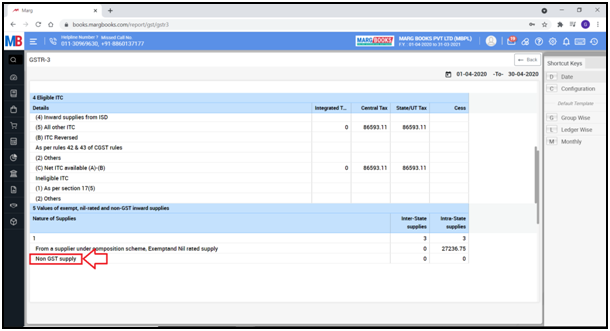

Section 5

‘Values of exempt, nil-rated and non- GST inward supplies’- Composition scheme purchase, exempt and nil-rated purchase details will come here.

- ‘Inter-State supplies’ will come here.

- ‘Intra-State supplies’ will come here.

‘Non GST supply’ – where GST does not apply on a product those will come here.

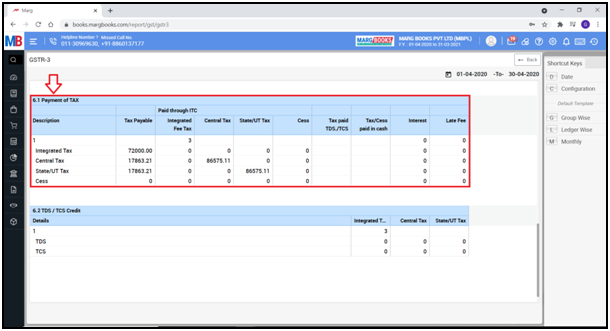

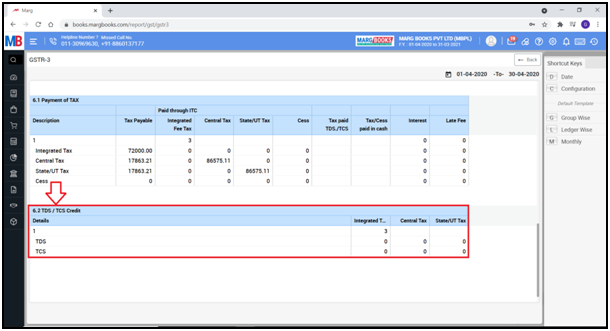

Section 6.1

‘Payment of Tax’ – The details picked from 3.1 section will come here.

Section 6.2

‘TDS/TCS Credit’ – which is not applicable now.

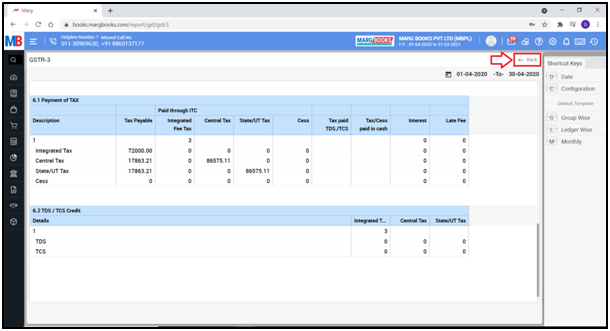

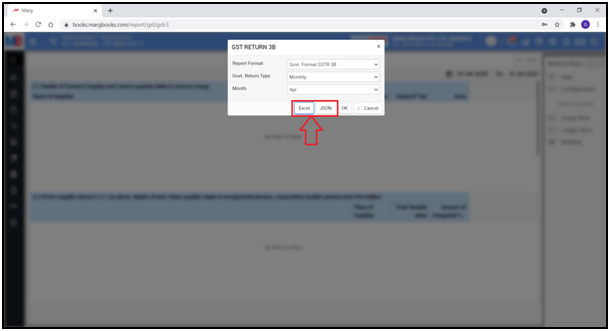

- Let’s see how the user can export the GSTR -3B Report

- Click on ‘Back’

- The user will come to GSTR – 3B.

- Then the user will select ‘return type’ and’ month’ as per the requirement.

- Now the user will select the format i.e. ‘Excel’ or ‘JSON’ in which report needs to be generated.

- Suppose select ‘Excel’

- The user can view that GSTR-3B Report has been generated in an Excel format.

-

Marg Books

-

Marg Books