Welcome to  -

HRXpert

-

HRXpert

Home > Hrxpert > Ctc Breakup Setup > How to Bifurcate Salary in HRXpert Software ?

How to Bifurcate Salary in HRXpert Software ?

Overview of Salary Bifurcation in HRXpert Software

Process of Salary Bifurcation in HRXpert Software

OVERVIEW OF SALARY BIFURCATION IN HRXPERT SOFTWARE

-

CTC or Cost to Company is the total amount that a company spends (directly or indirectly) on an employee. CTC is inclusive of monthly components such as basic pay, various allowances, reimbursements, etc. and annual components such as gratuity, annual variable pay, annual bonus etc.

-

With the help of this option, you can easily bifurcate the salary of the employee according to the income heads.

PROCESS OF SALARY BIFURCATION IN HRXPERT SOFTWARE

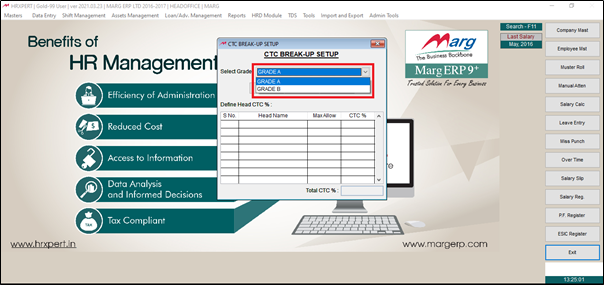

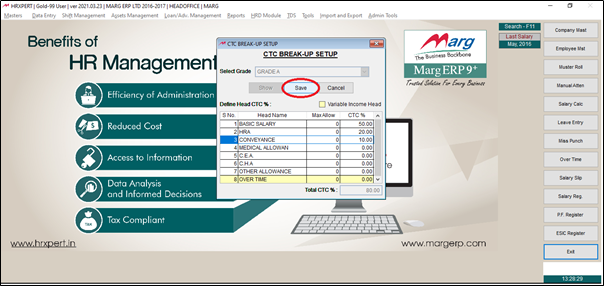

- Go to Admin Tools > CTC Breakup Setup.

- A 'CTC Breakup Setup' window will appear.

- In 'Select Grade' option, select the grade as per the requirement.

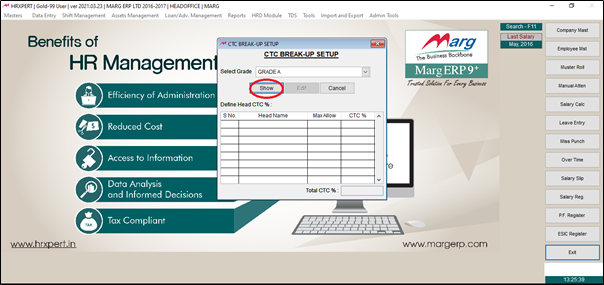

- Suppose select 'Grade-A'.

- Click on 'Show' button.

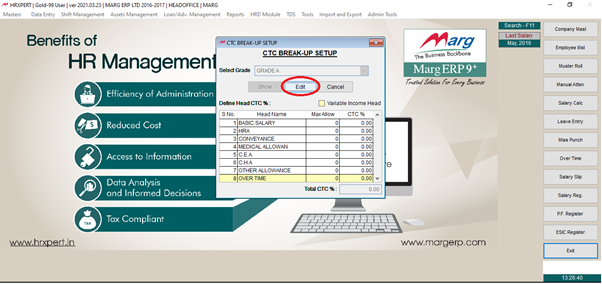

- All the income heads will get display, click on 'Edit' button.

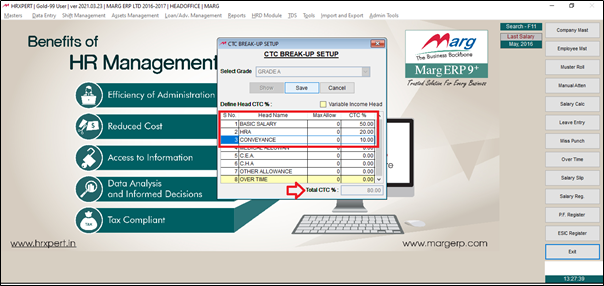

- Now, the employer will enter the percentage (%) beside the heads name as per the requirement.

Note: The P.F. and ESI are not included in this income heads, so make sure the total percentage of CTC should be 80%.

- After mentioning the percentage of heads, click on 'Save' button to save the details.

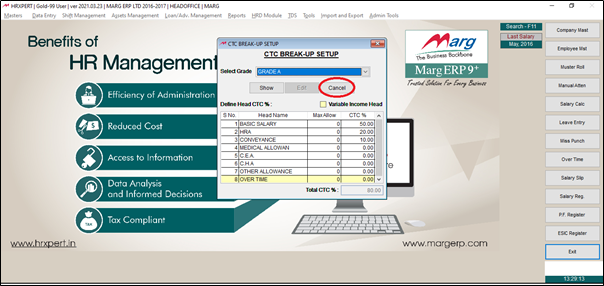

- Now click on 'Cancel' button in order to exit from this window.

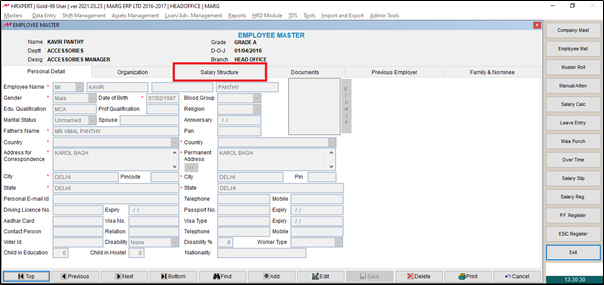

- Then, go to Masters > Employee Master.

- Select the employee and click on 'Salary Structure' head.

- Click on 'Edit'.

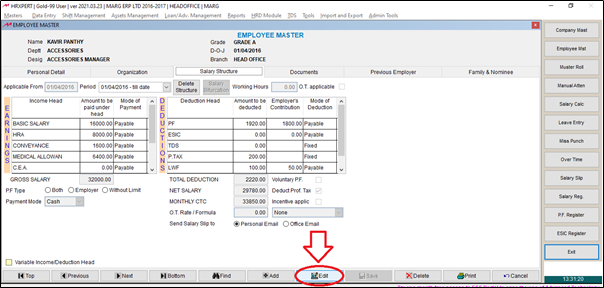

- Now the employer will select 'Salary Bifurcation' button.

- Now, the employer can view the CTC of the employee will be bifurcated as per the mentioned percentage (%).

Note: If the salary is not bifurcated as per the percentage which mentioned in the CTC breakup setup, then click on the 'Show' button.

- Now the employer will click on 'Save' to save the changes.