Welcome to  -

HRXpert

-

HRXpert

Home > Hrxpert > Employee Report > How to view Income / Deduction detail of selected Employee in HRXpert Software ?

How to view Income / Deduction detail of selected Employee in HRXpert Software ?

Overview of Income/Deduction Detail in HRXpert Software

Process of Income/Deduction Detail in HRXpert Software

OVERVIEW OF INCOME/DEDUCTION DETAIL IN HRXPERT SOFTWARE

- Income/Deduction Detail option in HRXpert Software enables the employer to view the month wise income and deduction detail of the employees in the organisation like their income heads, gross income, deduction heads, gross deduction and net income.

PROCESS OF INCOME/DEDUCTION DETAIL IN HRXPERT SOFTWARE

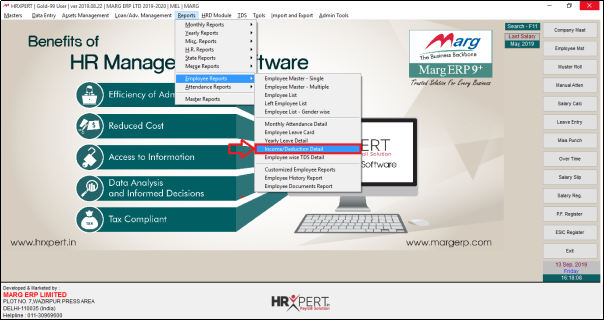

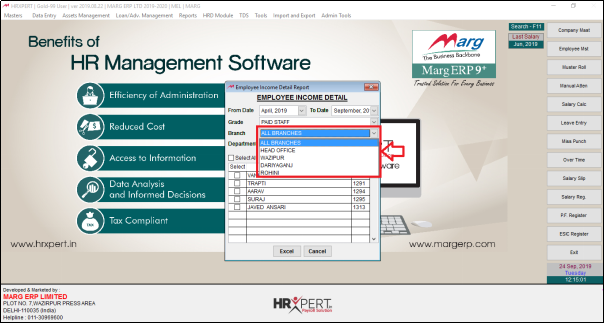

- Go to Reports > Employee Reports > Income and Deduction Detail.

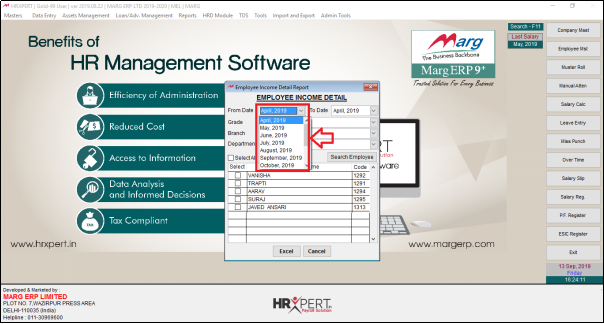

- An 'Employee Income Detail Report' window will appear.

- In 'From Date', option the employer will select from which month the employer needs to view the income/deduction details of employees.

- Suppose, select ‘April, 2019’.

- In 'To Date', option the employer will select till which month the employer needss to view the income/deduction details of employees.

- Suppose select ‘September, 2019’.

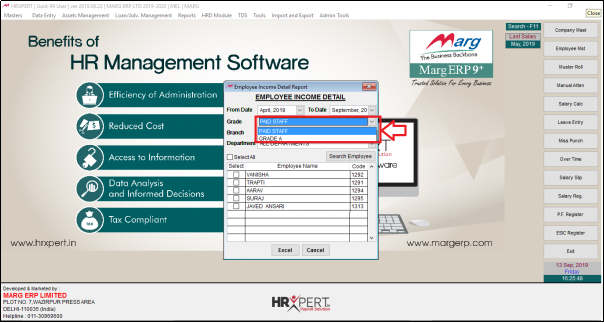

- In 'Grade', option the employer will select the grade of the employees to view their income/deduction detail.

- Suppose, select ‘Paid Staff’.

- In 'Branch' option, the employer will select the branch of the employees to view their income/deduction detail.

- Suppose, select ‘All branches’.

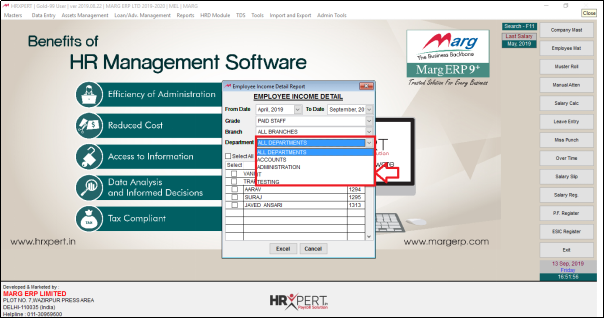

- In 'Department' option the employer will select that particular department to view their income/deduction detail.

- Suppose select ‘All Department’.

- All Employees list will appear.

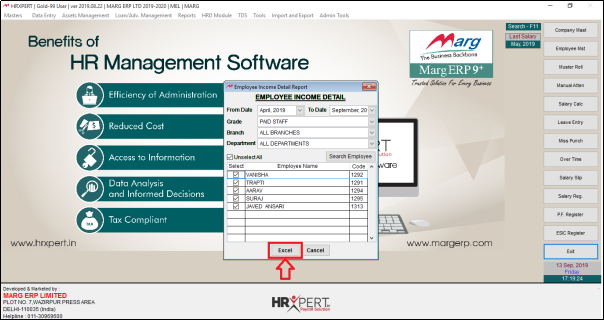

- The employer will place check mark on selected employee for which report needs to be view otherwise place check mark on 'Select All'.

- Click on ‘Excel’.

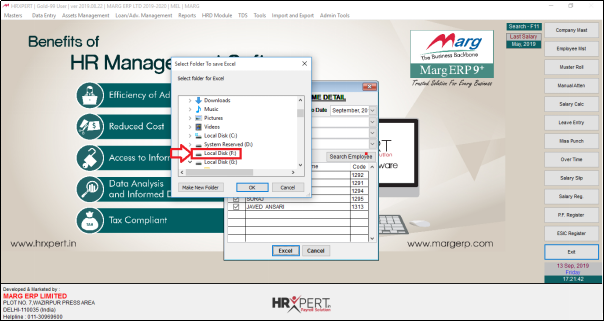

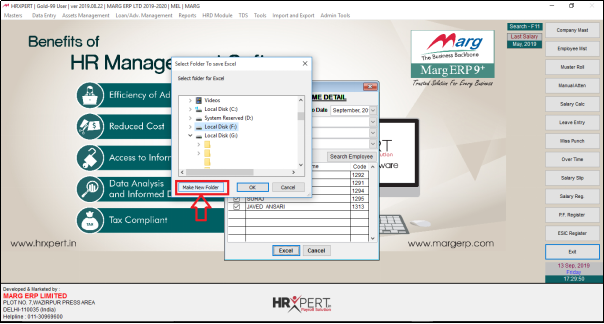

- A 'Select Folder to save Excel' window will appear.

- The employer will select the folder to export excel.

- Suppose select ‘Local Disk F’.

- Select the folder or click on ‘Make new folder’ to export excel.

- Suppose click on ‘Make new Folder’.

- Now the employer will edit the name of the folder as per the requirement.

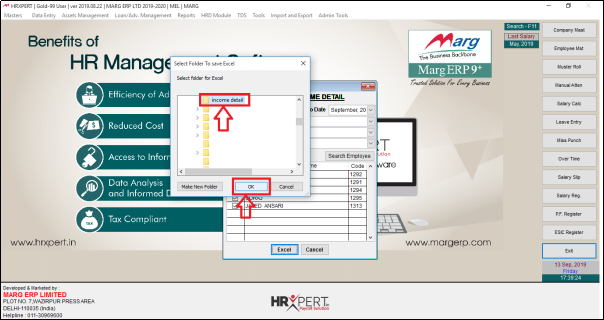

- Suppose enter 'Income detail'.

- Select the created folder and click on ‘Ok’.

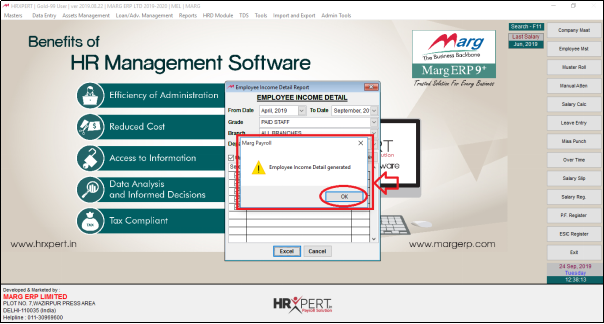

- A message of ‘Employee Income Detail Generated’ will appear.

- The employer will click on ‘OK’.

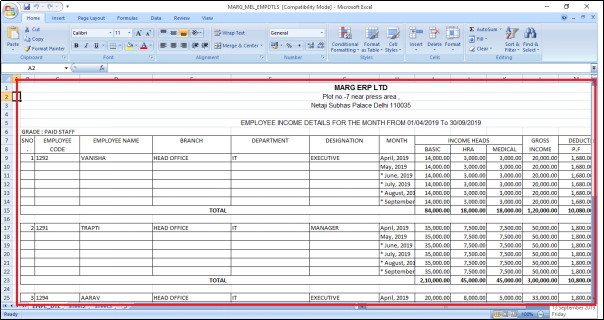

After following the above steps, the employer can view Income / Deduction detail of selected Employee will get generate in Excel Format in HRXpert Software.