Welcome to  -

HRXpert

-

HRXpert

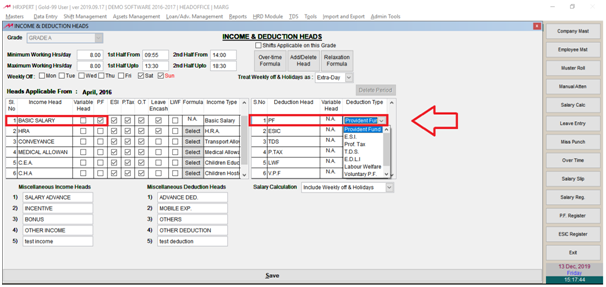

Home > Hrxpert > Heads Of Income Deduction > How to resolve this issue, if P.F. not deduct in HRXpert software ?

How to resolve this issue, if P.F. not deduct in HRXpert software ?

Cause

1. P.F. deduction head is not mapped with the Provident fund deduction type in income & deduction head.

2. When user has not selected the bases of calculation of P.F.

3. P.F. number not entered in Employee master.

Solution

Case-1 & Case-2 :

1. Go to Masters > Heads of Income/Deduction. Press Enter.

2. An Income and Deduction Heads window will appear. The user will now select the Grade.

3. The user will now click on ‘Edit’.

4. Now, the user needs to mapped P.F. deduction type with the Provident fund deduction type and select the bases on which user needs to calculate P.F. as shown below:

Case-3

1. Go to Masters > Employee Master.

2. An employee master window will appear. Click on Find option and search employee which employee P.F. not calculate.

3. Press enter key.

4. Select Organization tab.

5. Click on Edit.

6. In 'E.P.F.', the user will enter the P.F. number.

7. Click on Save to save the changes.