Welcome to  -

HRXpert

-

HRXpert

Home > Hrxpert > Heads Of Income Deduction > How to calculate P.F. on the other income in HRXpert Software?

How to calculate P.F. on the other income in HRXpert Software?

With this option in HRXpert Software, you can set on which value the P.F. should be calculated i.e. Basic, other income, over time, HRA etc. as per the requirement.

In order to calculate P.F. on the other income, please follow the below steps:

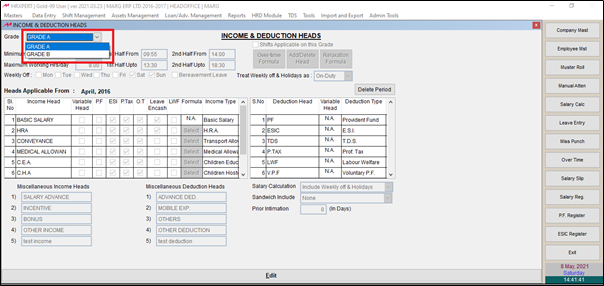

- Go to Masters > Heads of Income/Deduction.

- An income & deduction heads window will appear.

- Select grade from the drop down.

- Suppose, select 'Grade-A'.

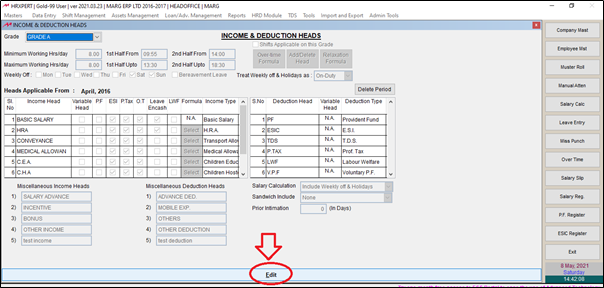

- Then click on 'Edit' button.

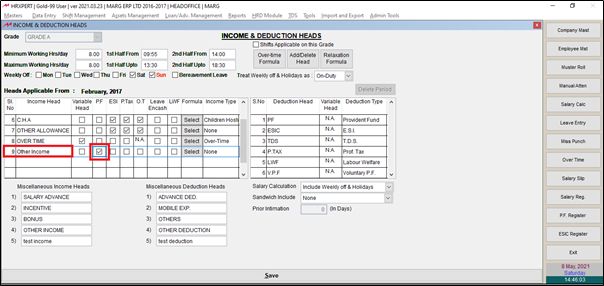

- In order to apply P.F. on 'Other income', the user will tick into the check box beside the other income.

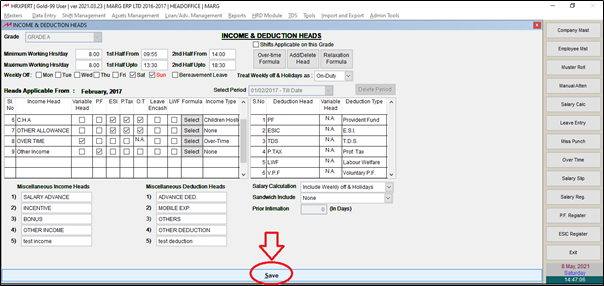

- Then click on 'Save' to save the details.

After following the above steps, the P.F. will be applied on the other income.