Home > Marg Book > Pdc Cheques Cash > How to pass the entry for PDC Receive in Marg Books?

How to pass the entry for PDC Receive in Marg Books?

What is Post Dated Cheque (PDC) Management in Marg Books ?

Why to Use Post Dated Cheque (PDC) Management in Marg Books ?

Who Uses the Post Dated Cheque (PDC) Feature in Marg Books ?

What is the End Result of PDC Management in Marg Books ?

Process of PDC (Receive) in Marg Books

Process to Deposit Cheque into Bank in Marg Books

Process to View Posted PDC in Marg Books

What is Post Dated Cheque (PDC) Management in Marg Books ?

- Post Dated Cheque in Marg Books is used when the customer gives the user an advance cheque. So whenever the user will generate the sale bill or creation of any outstanding then the user will deposit that cheque and can receive the amount against it.

- Post Dated Cheque is similar to Advance cheque but there is a bit different like in PDC there is a post date or some amount is mentioned but Advance Cheque is totally blank.

- The Post Dated Cheque (PDC) Management feature in Marg Books was developed to help businesses efficiently receive, record, and deposit advance cheques while minimizing errors and delays.

Why to Use Post Dated Cheque (PDC) Management in Marg Books ?

In Traditional business setups, handling cheques manually often leads to several operational challenges such as:

- Misplacement of cheques or deposit delays.

- Lack of linkage between Cheques and Outstanding Bills.

- Time-consuming manual preparation of Bank Slips.

- High chances of Human error and financial discrepancies.

- Difficulty in tracking the Deposit and Pending Status of Cheques.

To overcome these inefficiencies, businesses required a system that could:

- Record Post Dated Cheques during sale or bill generation.

- Link cheques to specific invoices for Tracking Purposes.

- Prepare Bank Pay-in Slips quickly and accurately.

- Post and Un-post Cheques with ease.

- Keep digital records for better Bank Reconciliation.

Especially for businesses that handle dozens of cheques daily, such as wholesalers and distributors, manually handling PDCs could take over an hour each day and often resulted in accounting mismatches.The PDC feature in Marg Books was introduced to digitize and automate this entire workflow, making cheque management faster, safer, and more transparent.

Who Uses the Post Dated Cheque (PDC) Feature in Marg Books ?

a. Distributors & Wholesalers:

- Manage bulk PDCs received from retailers.

- Ensure timely cheque deposits linked to invoices.

- Save time on preparing slips and reconciling entries.

b. Retail Businesses:

- Handle credit customers efficiently.

- Digitally record advance payments via cheques.

- Track the pending cheque list within seconds.

c. Finance & Accounts Teams:

- Maintain cheque ledger with entry and deposit status.

- Easily generate reports for audit or management.

- Eliminate chances of duplicate or missed entries.

d. Business Owners & Admins:

- Get real-time visibility of PDC status.

- Identify delayed or missed deposits.

- Unpost cheques for correction if needed.

e. Multi-Branch Operators:

- Centralize cheque handling across branches.

- Monitor cheque flow without relying on local staff.

- Reduce fraud or delayed cash realization.

What is the End Result of PDC Management in Marg Books ?

The Post Dated Cheque Management feature in Marg Books solves one of the most time-consuming and error-prone aspects of credit business operations. By automating cheque entry, linking it to bills, and enabling efficient deposit workflows, the system brings Time savings of cheque handling, Better visibility of pending and deposited cheques, Reduced risk of errors and Faster Reconciliation and reporting for financial control. As businesses continue to grow and handle higher volumes of credit transactions, the importance of a reliable cheque management system becomes essential.

Process Of PDC (Receive) In Marg Books

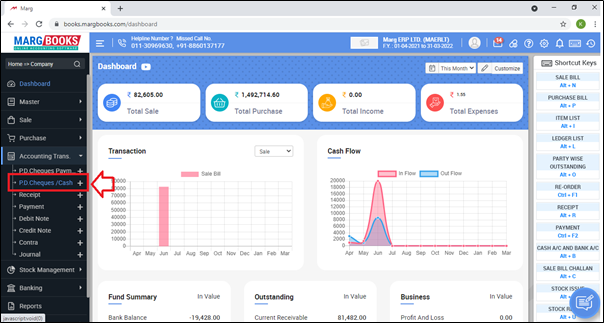

- Firstly, Go to Accounting Transaction >> P.D Cheques/Cash (+).

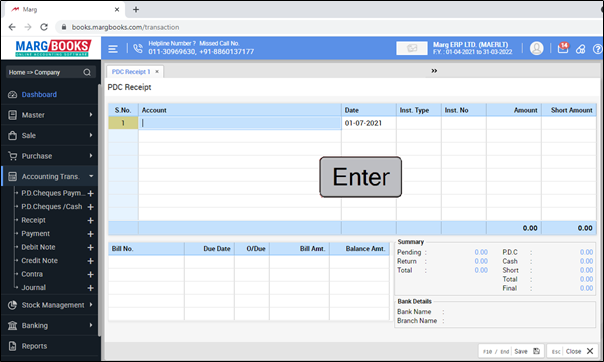

- A PDC Receipt window will appear.

- Press 'Enter' to select party.

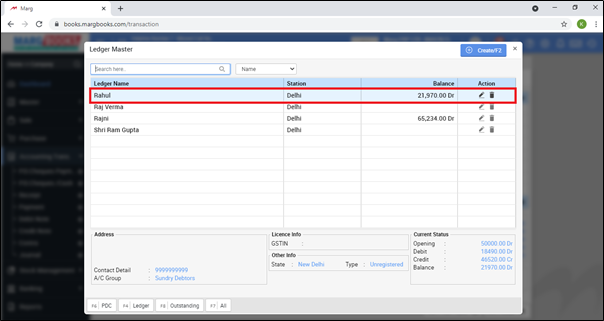

- A Ledgers window will appear in which the user will select the ledger/party name as per the requirement.

- Suppose select 'Rahul'.

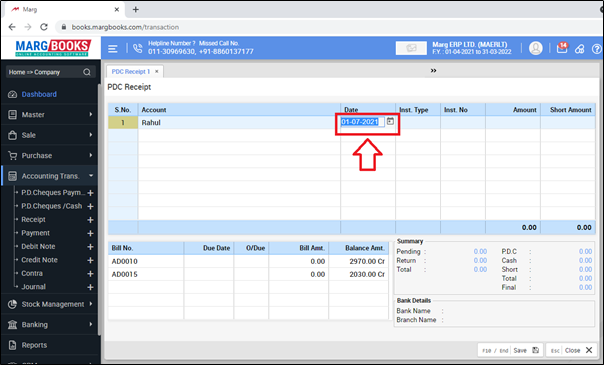

- In ‘Entry date’ the user will enter the date on which PDC was received.

- Suppose enter '01/07/2021'.

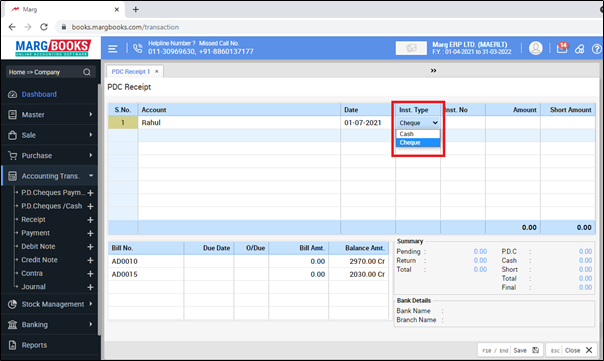

- Now the user will select the Instrument Type i.e. Cash or Cheque as per the requirement.

- Suppose select 'Cheque'.

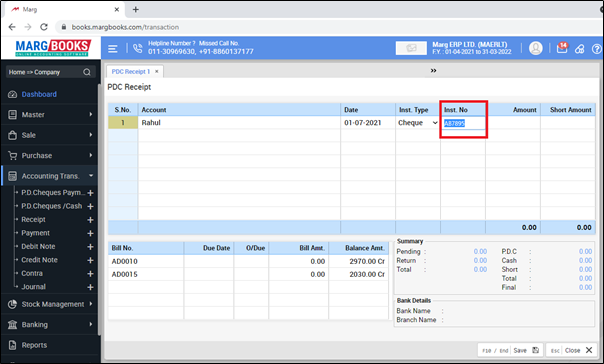

- Now the user will enter the cheque number.

- Suppose enter 'AB7895'.

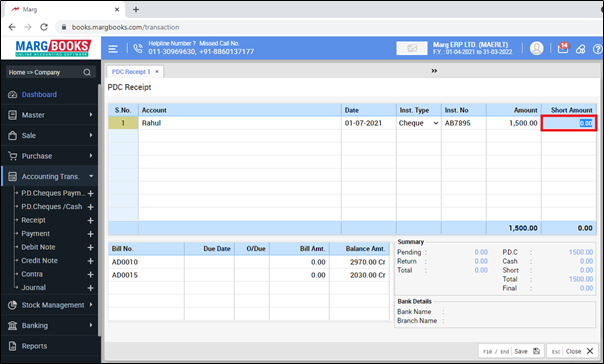

- Now here in ‘Amount’, the user will enter the amount.

- Enter the Short amount (If any).

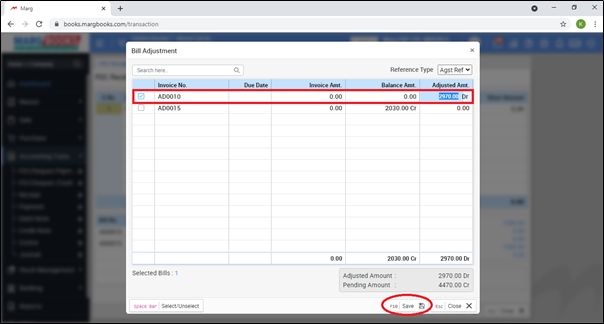

- Thereafter a Bill adjustment window will appear in which the user will select that bill against which the PDC cheque was received.

- Then click on 'Save' tab.

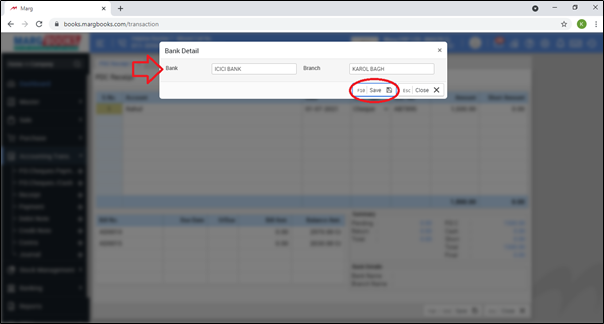

- A Bank detail window will appear.

- Enter the name of the bank and branch.

- Click on 'Save'.

- Similarly, the user will create the more PDC receipt entry.

- Then click on 'Save' to save the transaction.

Process To Deposit Cheque Into Bank In Marg Books

When depositing the cheque in bank then the user has to fill a slip in which the user has to mention the name of the bank, the branch, account number, date and party details. This process almost takes 4-5 minutes and if there are cheques 40-50 cheques, then it will take almost one hour & chances of mistakes are increased.

Bank has provided book type format in which this process is easy and can complete the process in 1-2 minutes.

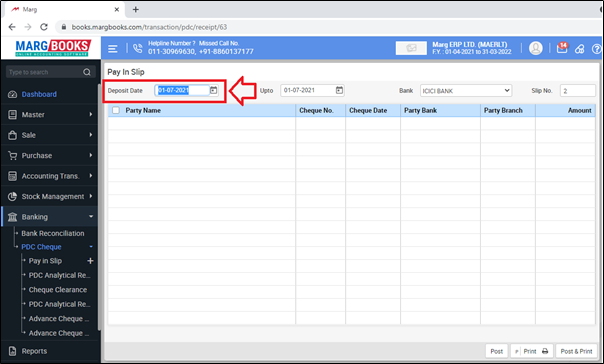

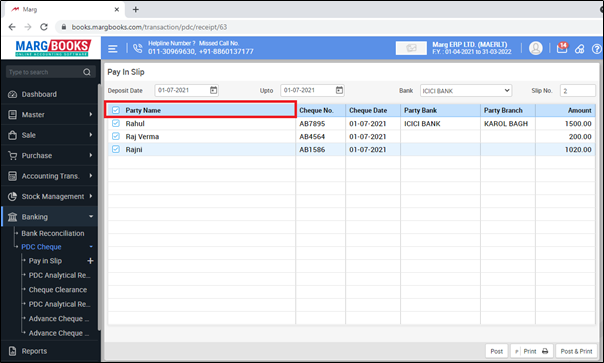

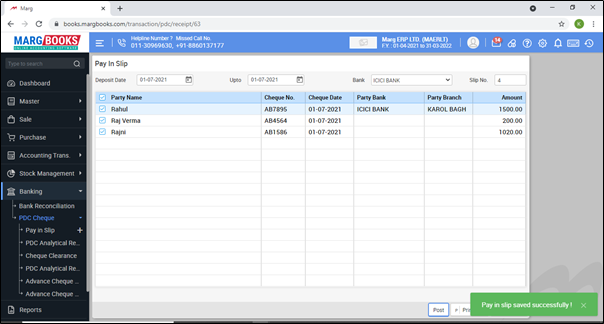

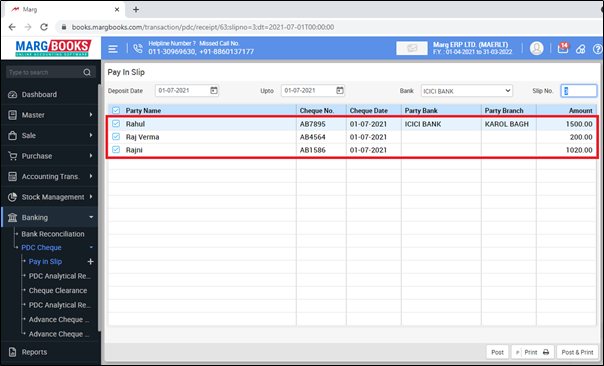

- Go to Banking >> PDC Cheque >> Pay in slip (+).(Click on + sign)

- A ‘Bank Paying Slip’ window will appear.

- Enter the deposit date on which the user will deposit the cheque.

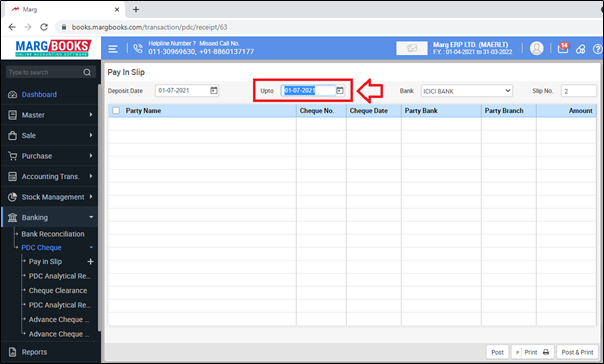

- Cheques up to, of which date the user is depositing the cheque in bank.

Select bank to deposit the cheques from the drop down.

- Suppose select 'ICICI Bank'.

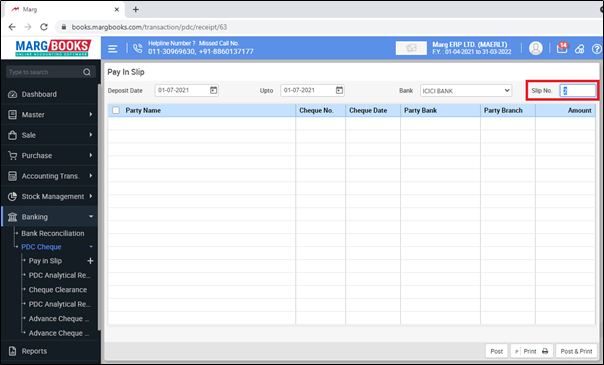

- In slip no, enter the slip no. manually.

- Those cheques that have been received in PDC are shown here.

- Select the cheques by tick in the checkbox which needs to be posted.

- In order to select all cheques, the user will tick the check box of Party name.

- Then click on 'Post' tab to post the cheques.

After following the above steps, all the PDC cheques will be posted into the bank.

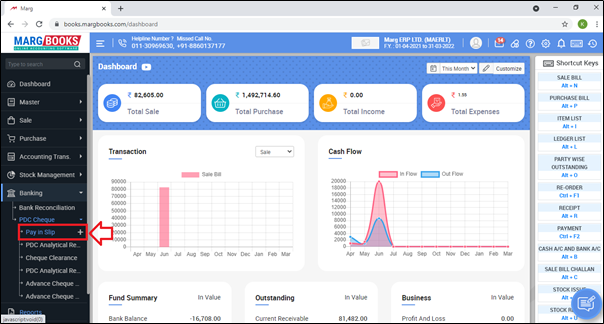

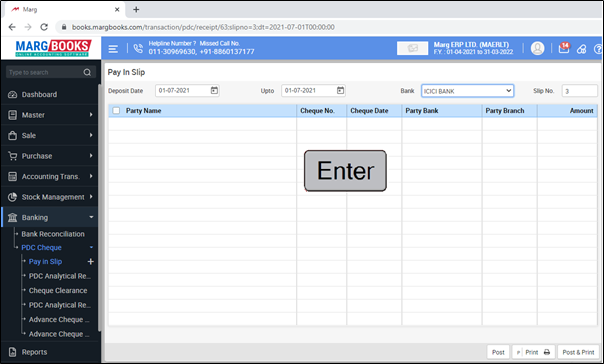

Process To View Posted PDC In Marg Books

- Go to Banking >> PDC Cheque >> Pay in slip.

- A Paying Slip Posted window will appear.

- Now the user will select the Bank as per the requirement.

- Press 'Enter' on it.

- Now keep pressing 'Enter' on it.

- The user can now view the cheques that were deposited.

Note: In order to un-post the posted cheques, the user will un-tick the check box of that cheques which needs to be un-posted then click on 'Un-post' tab.

-

Marg Books

-

Marg Books