Home > Marg Books > Sale Return > What is the process of Sale Return in Marg Books ?

What is the process of Sale Return in Marg Books ?

Overview of Sale Return Transaction in Marg Books

Process to Create Sale Return Transaction in Marg Books

Process to Modify Sale Return Transaction in Marg Books

Process to Delete Sale Return Transaction in Marg Books

OVERVIEW OF SALE RETURN TRANSACTION IN MARG BOOKS

- In normal day to day functioning of a business, goods/stocks which are sold, being returned is quite common. This can happen for a variety of reasons like defects in goods, quality standards not matching with the required quality demanded, buyer not requiring stock, etc.

- Therefore, with the help of Marg Books the user can easily create the entry of sale return and also can modify or delete it as per the requirement.

PROCESS TO CREATE SALE RETURN TRANSACTION IN MARG BOOKS

- Firstly from the left side of the Dashboard, go to Sale >> Return (+).

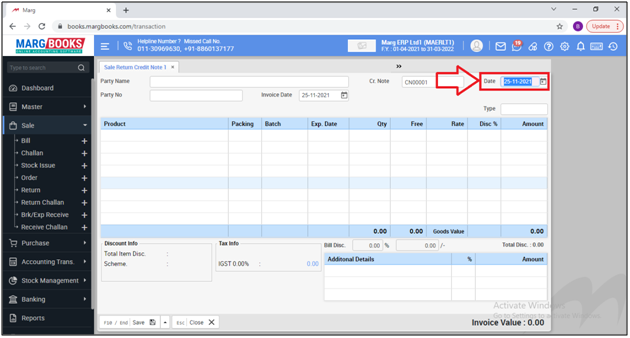

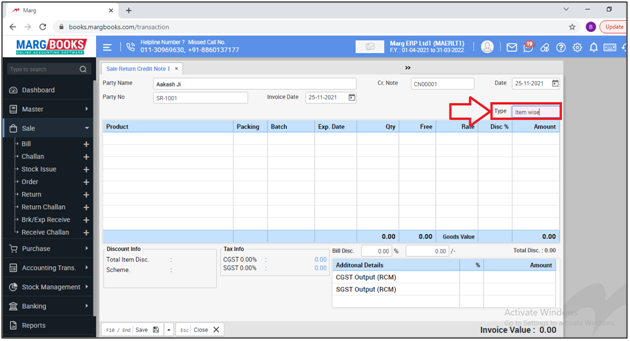

- A 'Sale Return Credit Note' window will display.

Date: The user needs to mention the date as per the requirement.

Suppose mention 25.11.2021

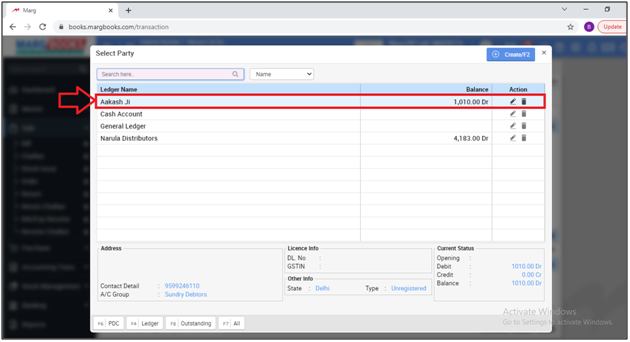

- A 'Select Party' window will appear.

- The user will select the party for which the sale return transaction needs to be created.

- Suppose select ‘Aakash Ji’. Press ‘Enter’.

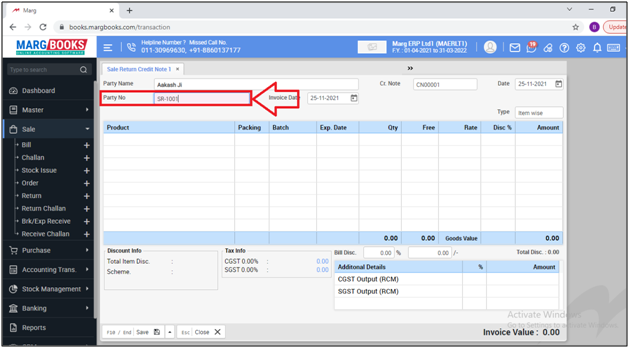

- The cursor will switch to ‘Party No.’ field.

Party No.: The user will mention the ‘Party No.’ and press ‘Enter’.

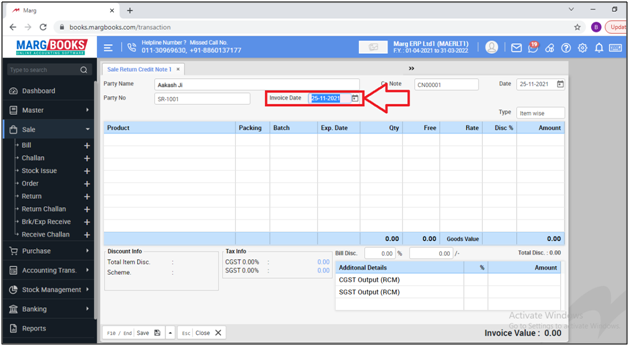

Invoice Date: The invoice date will be auto selected on the basis of the bill date. Press ‘Enter’.

Type: The user will select the 'Rate of Tax' i.e. 5%, 12% which needs to be charged on the sale return transaction.

Suppose select 'Item Wise'.

- A 'Bill Details' window will appear.

a. Return of Bills: The user will select either the transaction is being created against the single sale bill or being created on the manual basis.

Suppose select 'Single'.

b. Bill No.: If in the above option the user has selected 'Single' then the software will automatically pick the last bill number of the selected party or in case selected 'Manual' the user needs to mention the bill number manually.

c. Date: Software will automatically pick the 'Data of Entry' as per the mentioned Bill Number.

d. Amount: Software will automatically pick the 'Amount of Entry' as per the mentioned Bill Number.

Then click on 'Ok'.

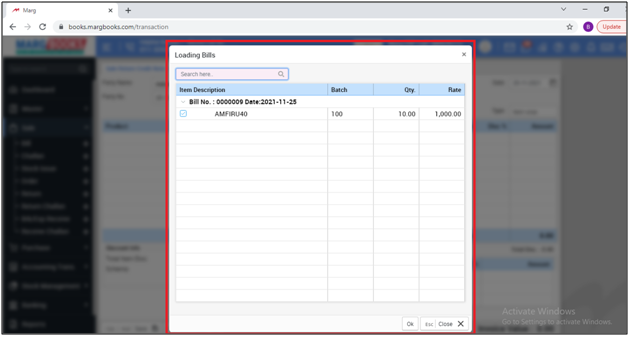

- A ‘Loading Bills’ window will appear where the user can view the items that has been selected in the sale bill (against which the sale return transaction is being created).

- Now select the item by placing a check mark on them and then press 'Enter'.

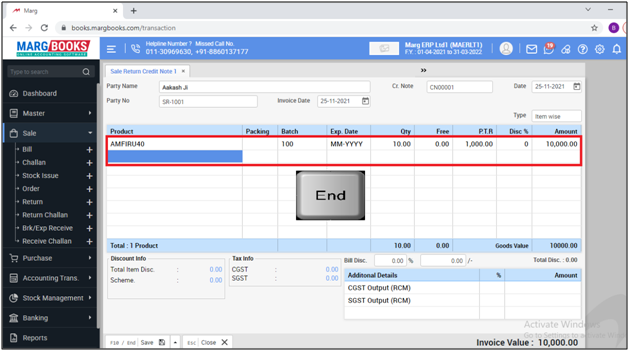

- Now, the item will get loaded in the sale return transaction and the user can also change the details i.e. Quantity of the item, rate of the item as per the requirement.

- Now the user will save the transaction by pressing 'End' key.

- Then click on 'Save' to save the sale return transaction.

After following the above steps, the user can view that the sale return transaction has been created successfully.

PROCESS TO MODIFY SALE RETURN TRANSACTION IN MARG BOOKS

- Firstly from the left side of the Dashboard, go to Sale >> Return.

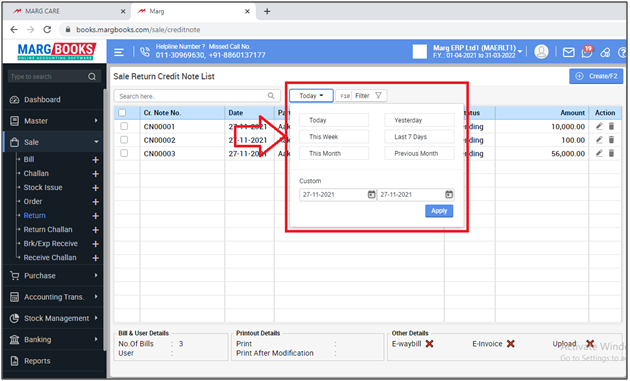

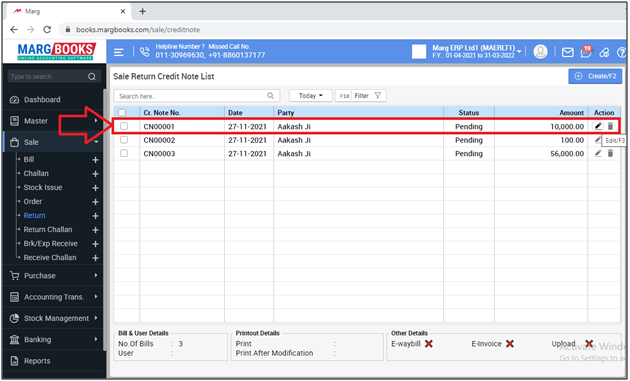

- A ‘Sale Return Credit Note List’ window will appear.

- The user can filter the bills by clicking on 'Today' button as per the requirement.

- In order to modify a Sale Return Transaction, like if an item needs to modified/changed, quantity needs to be increased or decreased for an item, etc., the user will click on ‘Modify’ icon.

- The user can make the changes in the transaction as per the requirement.

- Suppose we are changing the Quantity of the item from '10' to '9'.

- Then click on ‘Save’ tab to save the changes.

- After following the above steps, the changes has been saved successfully.

PROCESS TO DELETE SALE RETURN TRANSACTION IN MARG BOOKS

- Firstly from the left side of the Dashboard, go to Sale >> Return.

- A ‘Sale Return Credit Note List’ window will appear.

- The user can filter the bills by clicking on 'Today' button as per the requirement.

- In order to delete a Sal return Credit Note, click on ‘Delete’ icon on the selected bill.

- A ‘Confirmation’ message of ‘Are you sure you want to delete the selected record’ will appear.

- The user will click on ‘Yes’ to delete that particular sale return transaction .

- After following the above steps, the selected sale return entry will get deleted.

-

Marg Books

-

Marg Books