Home > Marg Books > Statutory Report > How to generate e - Way Bill through Marg Books ?

How to generate e - Way Bill through Marg Books ?

Overview of E-Way Bill in Marg Books

Who Should Generate an E-Way Bill

Process to set GSP on E-Way Bill Portal

Process to Generate E-Way Bill Through Marg Books

Process to Upload JSON File on E-Way Bill Portal

OVERVIEW OF E-WAY BILL IN MARG BOOKS

- E-Way Bill i.e. Electronic Way Bill is basically an electronic document generated on the GST portal indicating the movement of goods within the state or from one state to another state.

- e-Way bill is mandatory if the value of goods is more than Rs. 50,000 and e-Way bill is optional if the value of goods is less than Rs. 50,000.

- In Marg ERP Software, the user can easily generate E-Way Bill after registering on GSP and upload each and every process related to E-Way Bills on the Portal.

WHO SHOULD GENERATE AN E-WAY BILL

- Registered Person– E-way bill should be generated once there's a movement of products of over Rs. 50,000 in worth to or from a registered person. A Registered person or the transporter could value more highly to generate and carry eway bill though the worth of products is a smaller amount than Rs. 50,000.

- Unregistered Persons– Unregistered persons also are needed to come up with e-Way Bill. However, wherever a provide is created by AN unregistered person to a registered person, the receiver can have to be compelled to guarantee all the compliances area unit met as if they were the provider.

- Transporter– Transporters carrying product by road, air, rail, etc. conjointly have to be compelled to generate e-Way Bill if the provider has not generated an e-Way Bill.

PROCESS TO SET GSP ON E-WAY BILL PORTAL

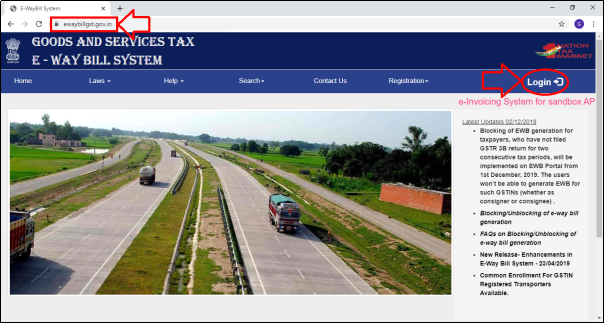

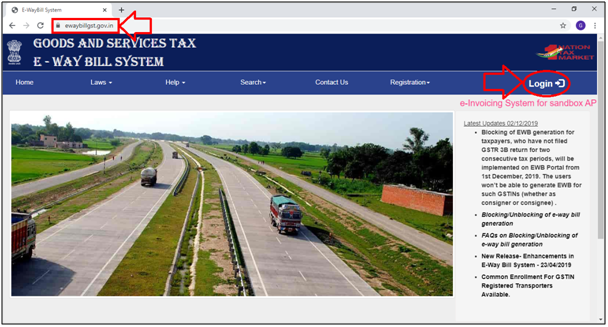

- Firstly, the user will visit to http://www.ewaybillgst.gov.in & Click on ‘Login’.

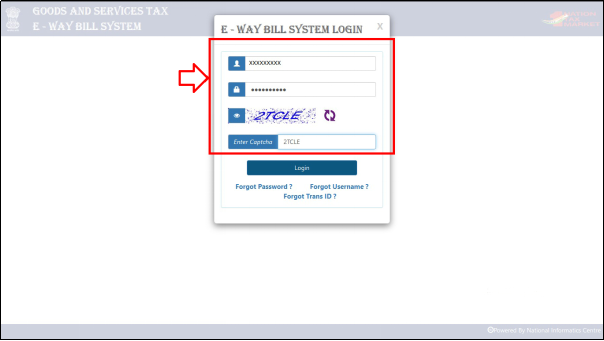

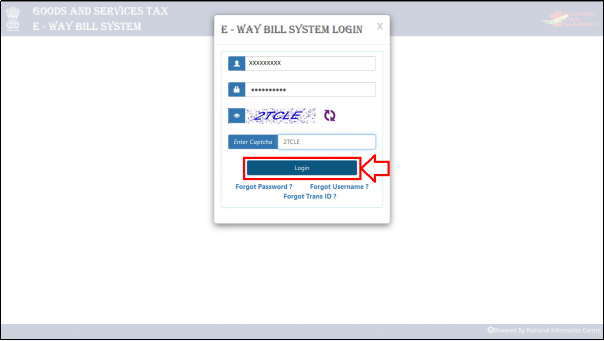

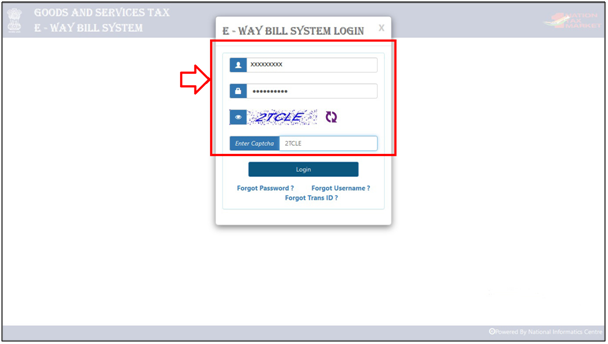

- Enter the Login Credentials i.e. Username & Password.

- Then mention the Captcha.

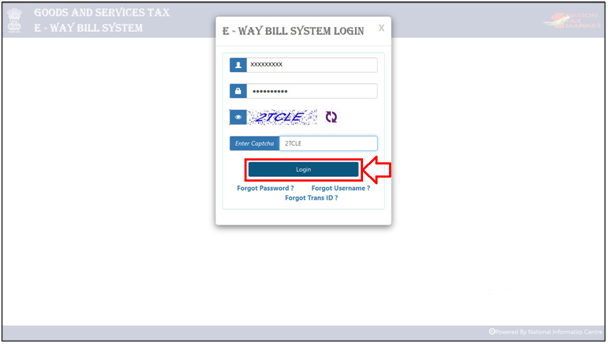

- Click on ‘Login’.

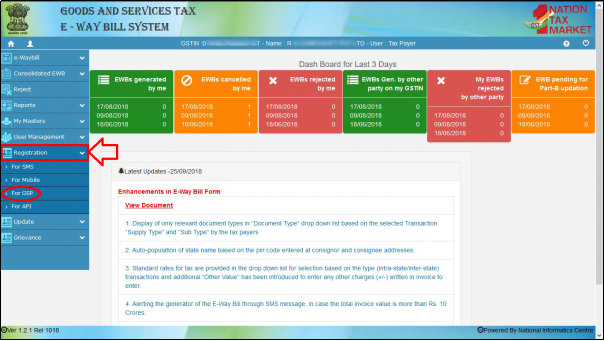

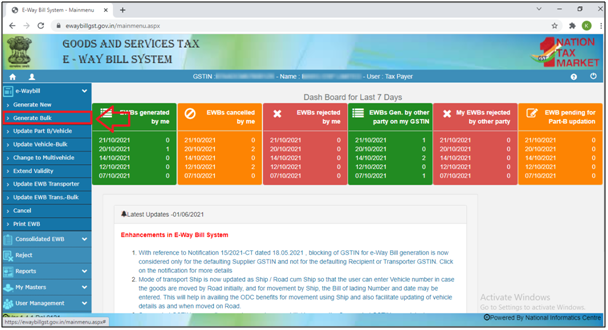

- A Dashboard of E-Way Bill Portal will appear.

- Click on 'Registration' >> Then select 'For GSP'.

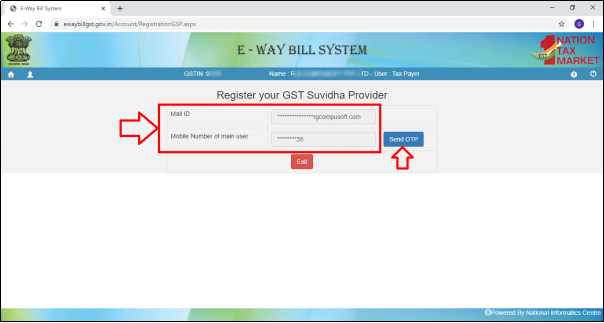

- A 'Register your GST Suvidha Provider' window will get displayed.

- The user will Enter the E-mail ID, Mobile No. then click on 'Send OTP'.

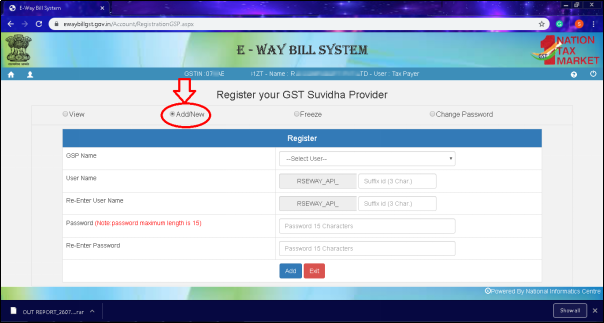

Fig. 1.1 Process to Register Your GST Suvidha Provider on E-Way Bill Portal

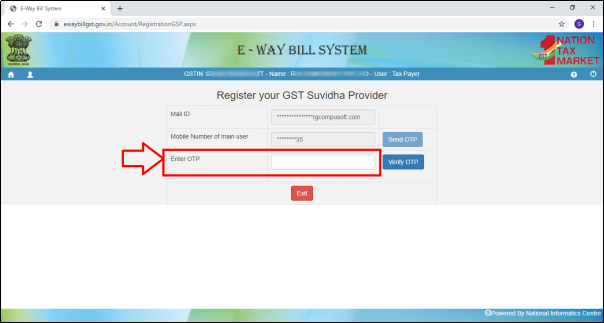

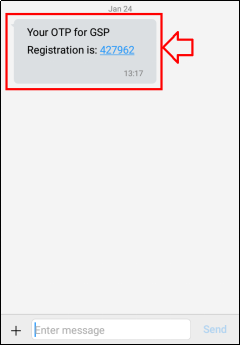

- The user will receive an OTP on their registered mobile no.

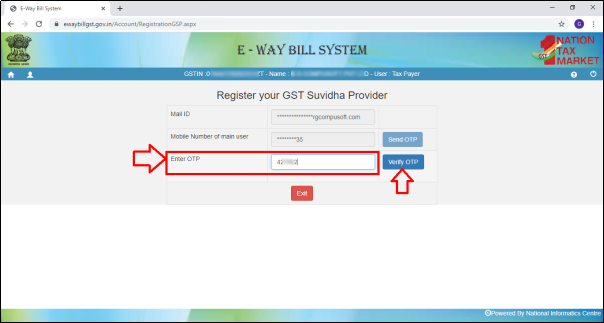

- Then enter the OTP and click on 'Verify OTP'.

- Click on 'Add/New'.

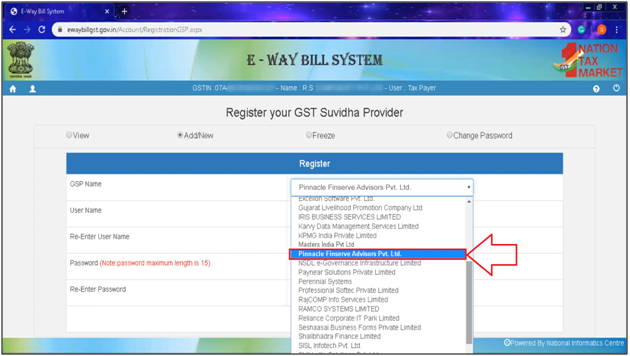

- Select the GSP Name i.e. Pinnacle Finserve Advisors Pvt. Ltd.'

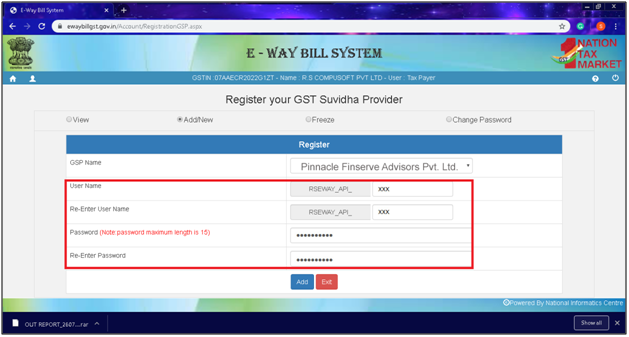

- Then Enter the Username and Password.

The username which is been received and the password entered here are the Login details e-Way Bill.

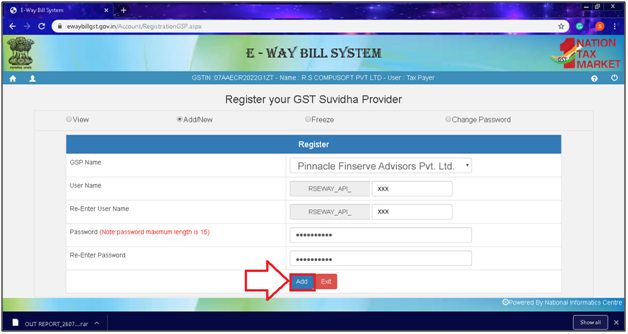

- Click on 'Add'.

- The user will then view the message of 'Account Created Successfully'.

PROCESS TO GENERATE E-WAY BILL THROUGH MARG BOOKS

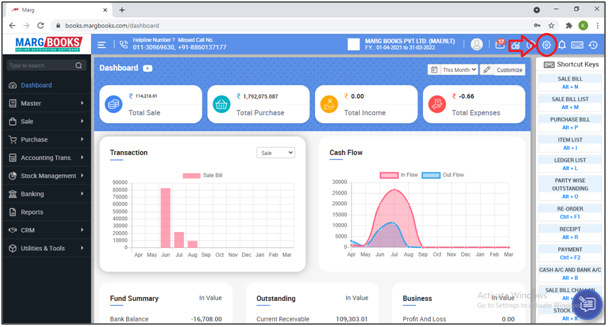

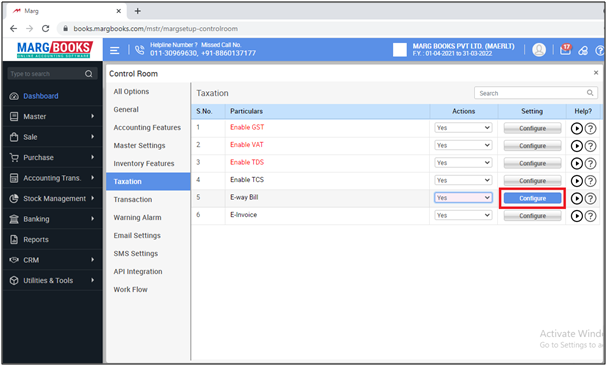

- From the right side of the dashboard window, click on the ‘Settings’ icon.

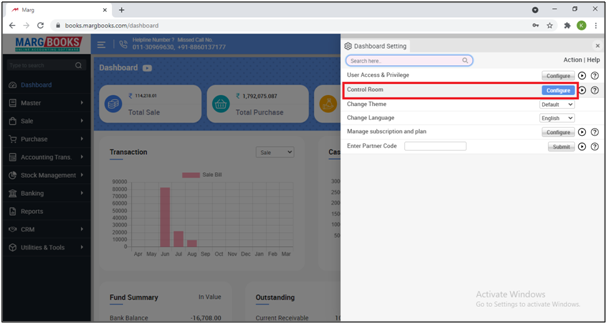

- A ‘Dashboard setting’ window will appear.

- In Control Room field, click on ‘Configure’ tab.

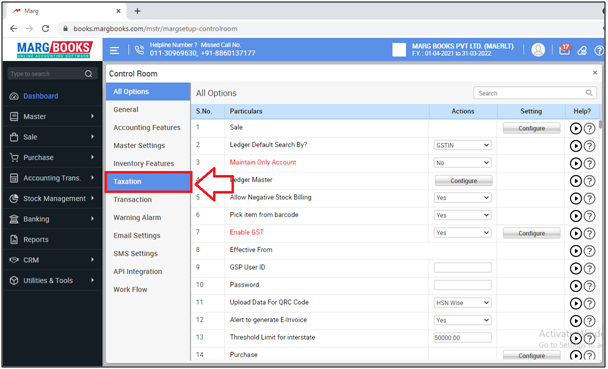

- Now click on 'Taxation' option.

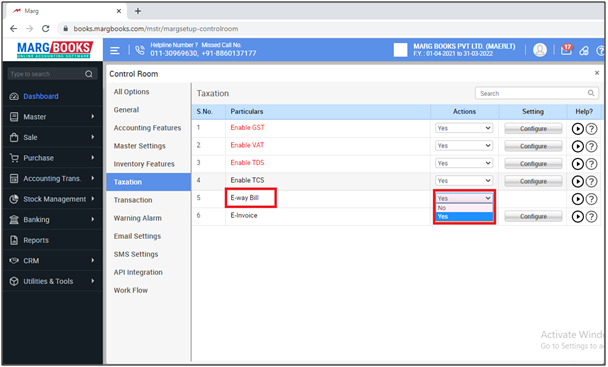

- Then in the ‘E-Way Bill’ option, the user will select ‘Yes’.

- Then click on ‘Configure’ tab.

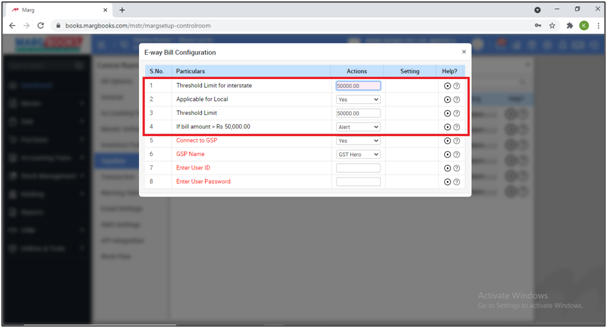

An ‘E-Way Bill Configuration’ window will appear with some different fields:

a. Threshold Limit for interstate……50,000: It means if the Bill value is above 50,000 then the E-way bill will be generated for that invoice.

b. Applicable for Local: Here, the user will select whether the E-way bill should be applicable on local bills or not.

c. If Bill Value > Rs. 50,000: In this option user will select that if bill value is more than 50,000 then software will indicate to generate e-way bill at the time of billing

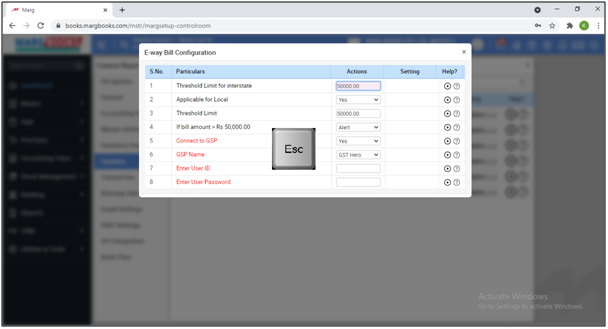

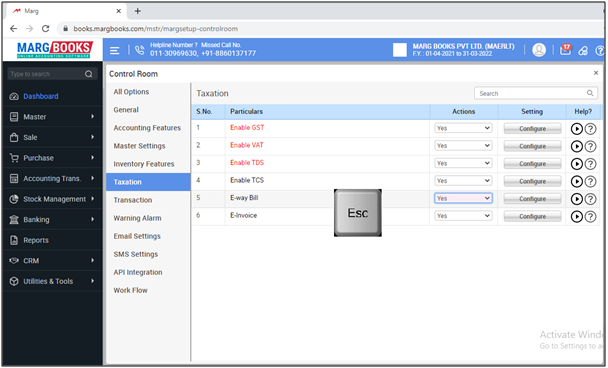

- Now the user will press ‘ESC’ key to save the changes.

- Again the user will press ‘ESC’ key.

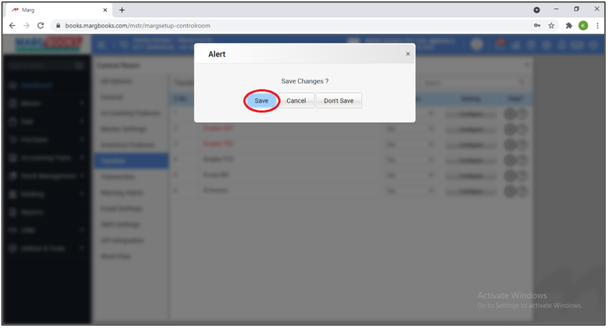

- An alert window of Save Changes will appear.

- Select ‘Yes’ to save the changes.

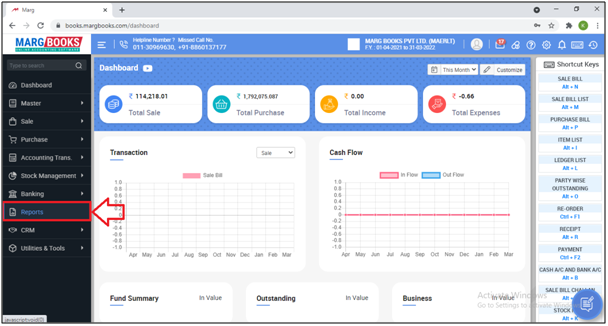

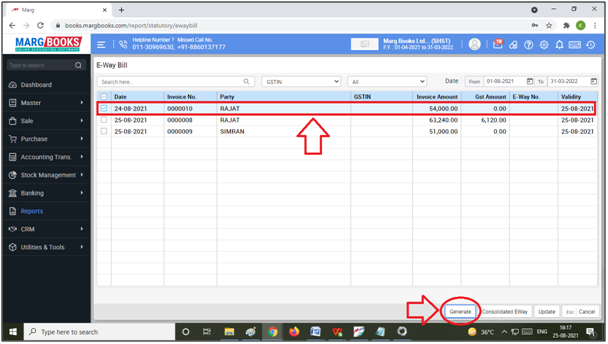

- Now in order to generate e-Way bill, go to ‘Reports’.

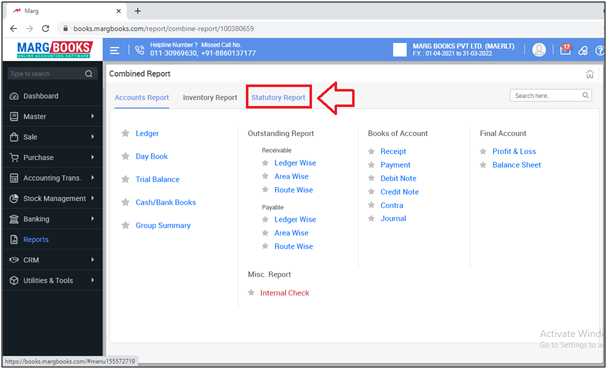

- Select ‘Statuary Report’.

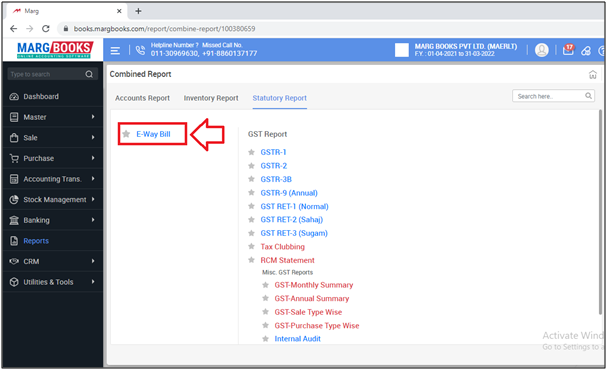

- Now click on ‘E-Way Bill’.

- A ‘e-Way Bill’ window will appear.

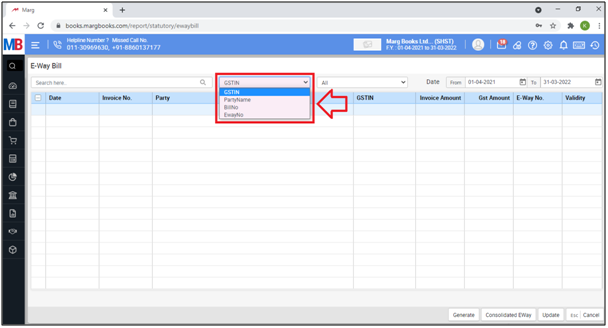

i) Search Bar: With the help of this option, user can search the Bill on different basis i.e. Party Name, Bill No., GSTIN, E-way No. etc. as per the requirement.

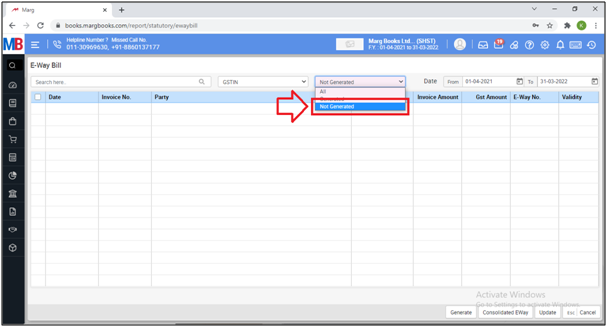

- ii) With the help of this option, the user can filter the bills whose e-way bill has been generated or whose e-way bill has not been generated.

- Suppose select ‘Not Generated’.

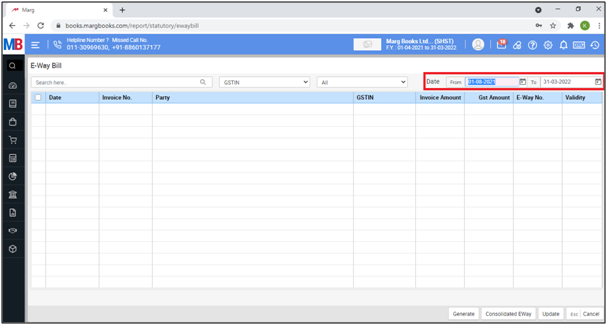

iii) Date: Enter the ‘Date’ i.e. from which till which date the user needs to generate e-Way bills.

Then press ‘Enter’.

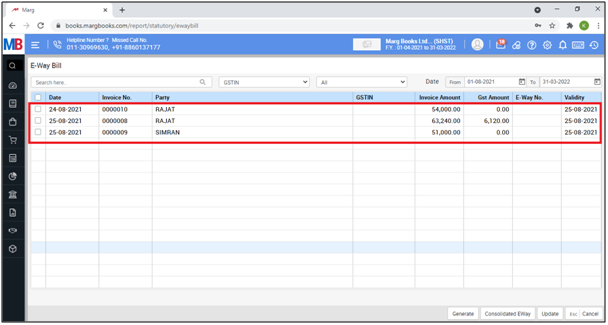

- Now all the Invoices of ‘Sales’ will appear.

- The bills for which e-Way bill is being created will be shown along with the validity.

- Then select the invoice of whose e-Way bill is being created.

- Click on ‘Generate’.

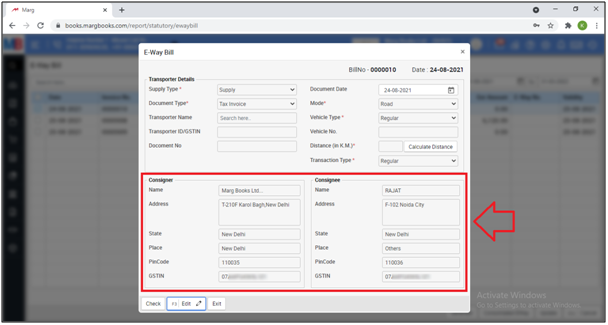

- So, the consignor and consignee details will get auto filled here.

Note: The user can’t change the details of Consignor and Consignee in this window.

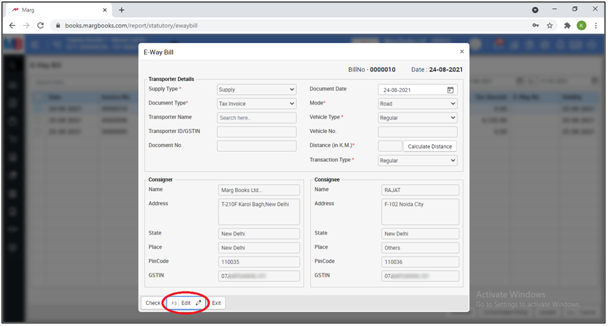

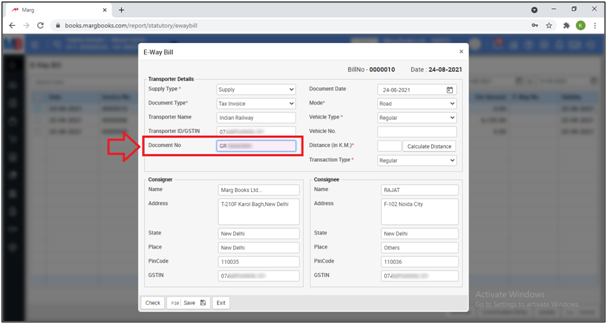

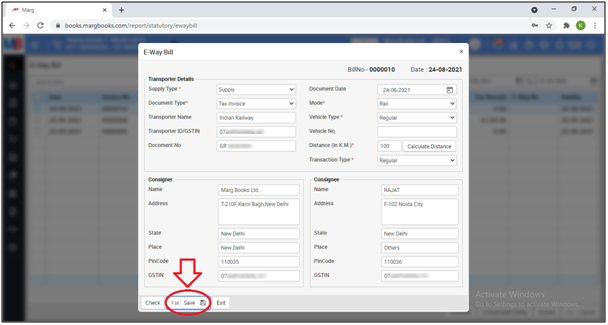

- In order to add Transport details, the user will click on ‘Edit’ button.

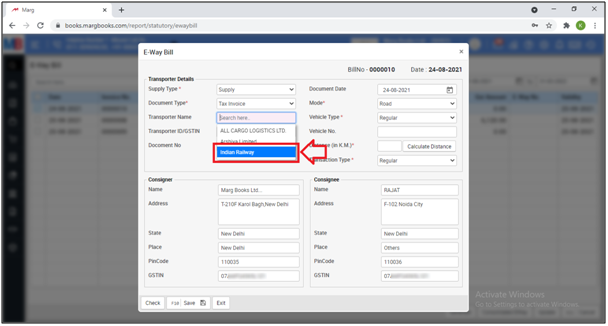

- Select ‘Transporter Name’ as per the requirement.

- Suppose select ‘Indian Railway’.

- Enter ‘Document No.’.

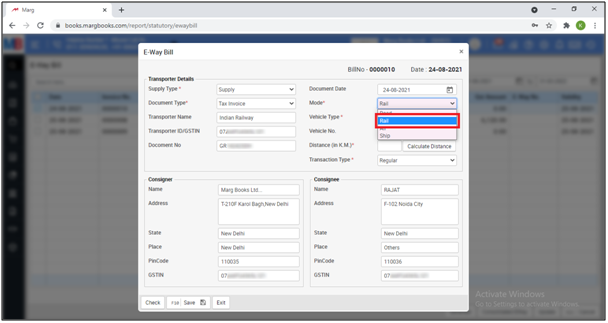

- Now select ‘Mode of Transport’.

- Suppose select ‘Rail’.

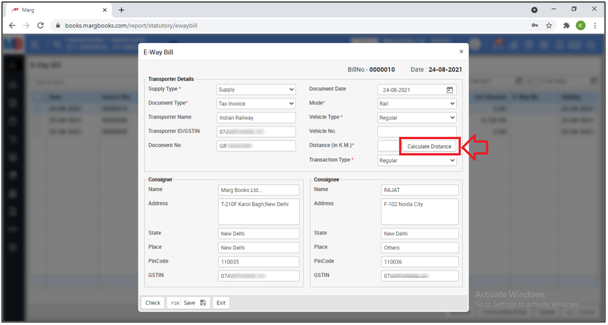

- Now if the user needs to calculate the distance from the dispatch location to ship location then clicks on ‘Calculate Distance’.

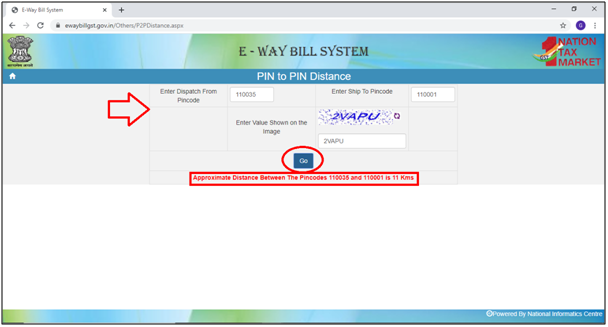

- A page of ‘e-Way Bill System’ will appear. The user will mention the ‘Dispatch from Pin Code’ and ‘Ship to Pin Code’ i.e. the user will mention the pin code of that location from where it is going to whichever location.

- Then mention those characters which is been shown in the image and click on ‘Go’.

- So, in this way the distance between both Pin Codes will be shown after the calculation.

- After this, the user will click on ‘Save’ to save these details.

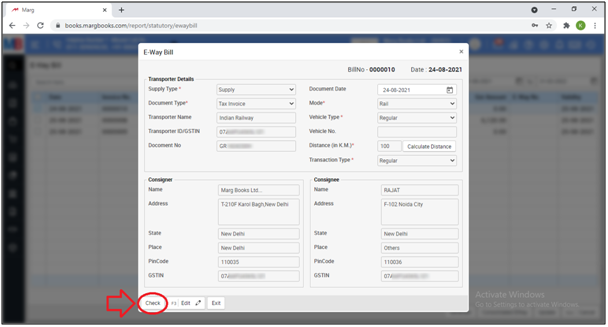

- After saving the details, the can check that if these details are accurate or not by clicking on ‘Check’.

- As there are no errors means these details are correct.

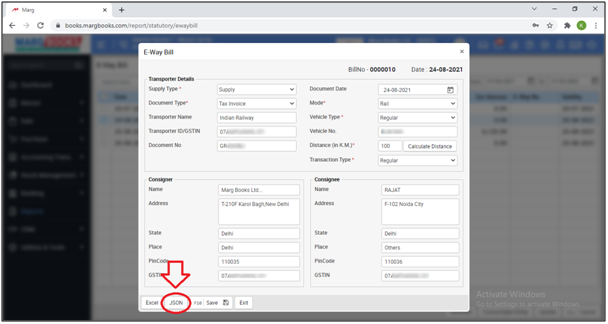

After this, the user can view the three options to generate e-way bill get displayed which are mentioned below:

a. Excel

b. JSON

- When the user saves the e-Way bill through ‘Excel’ or ‘JSON’ then the user needs to login on e-Way portal and can upload the e-Way bill.

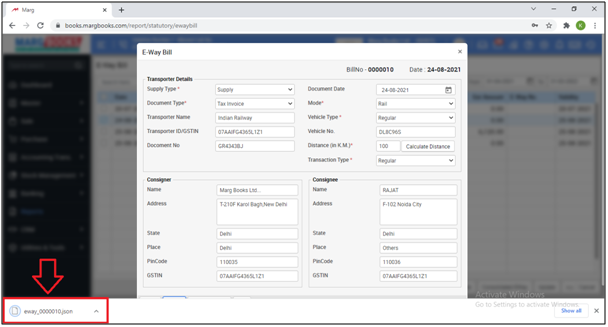

- Suppose click on ‘JSON’.

- Then the user can view that the e-Way bill JSON has been generated.

PROCESS TO UPLOAD JSON FILE ON E-WAY BILL PORTAL

- After the generation of the JSON file from the Marg Books, the user will follow the below mentioned steps to generate a Single E-Way bill or a Consolidated E-Way bill through e-Way bill portal.

- Firstly, the user will visit to www.e-Waybillgst.gov.in & Click on ‘Login’.

- Enter the Login Credentials i.e. Username & Password.

- Then mention the Captcha.

- Click on ‘Login’.

- A Dashboard of E-Way Bill Portal will appear.

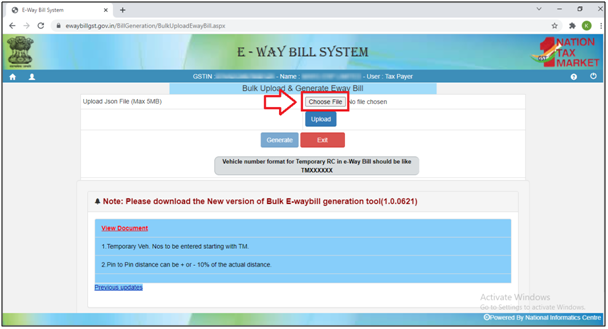

- Click on e-Way Bill >> Then select 'Generate Bulk'.

- A new screen where the JSON file can be uploaded will appear.

- Click on ‘Choose File’ option.

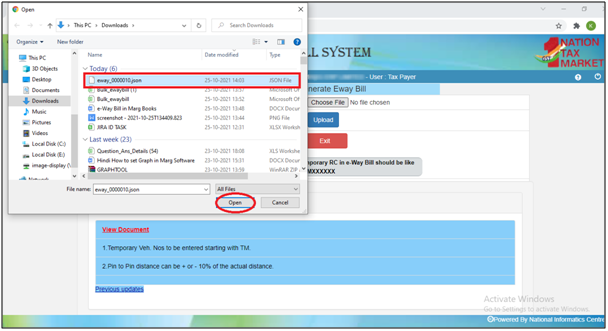

- Now the user will select the JSON file which needs to be uploaded.

- Click on ‘Open’.

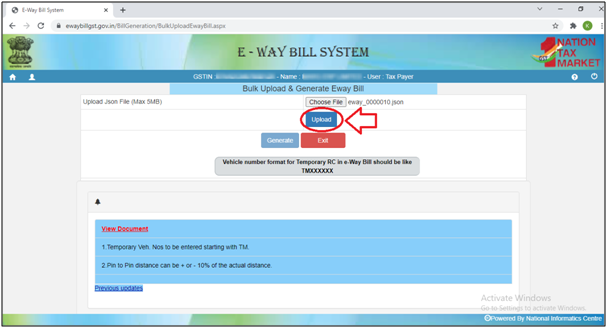

- Then click on ‘Upload’.

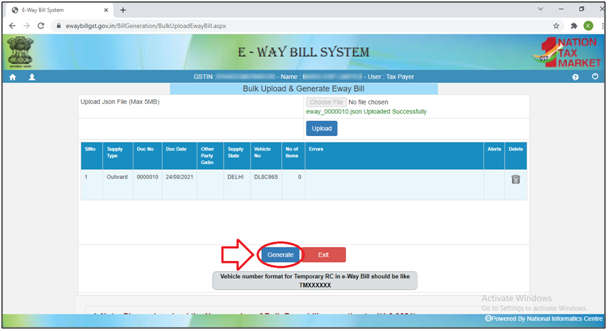

- The selected JSON file will get uploaded successfully.

- Click on ‘Generate’ to generate e-way bill number.

If one of the fields has been left unfilled, an error message will be generated. If there are any other errors, it is necessary to make the respective changes and repeat the process. Considering there are no errors or if all the errors have been rectified, generating the E-Way bill will end in a success.

-

Marg Books

-

Marg Books