Search by Category

- Marg Digital Health

- ABHA 2.0 - Ayushman Bharat

- Marg Nano

- Swiggy & Zomato

- Marg Cloud

-

Masters

- Ledger Master

- Account Groups

- Inventory Master

- Rate and Discount Master

- Refresh Balances

- Cost Centre Master

- Opening Balances

- Master Statistics

- General Reminder

- Shortage Report

- Supplier Vs Company

- Temporary Limit

- Shop QRID and eBusiness

- Cloud Backup Setup

- Password and Powers

- Marg Licensing

- Marg Setup

- Target

- Budget

- Credit Limit Management

- Change ERP Edition

- Ease Of Gst Adoption

-

Transactions

- ERP To ERP Order

- Sale

- Purchase

- Sale Return

- Purchase Return

- Brk / Exp Receive

- Scrap Receive

- Brk / Exp Issue

- Scrap Issue

- GST Inward

- GST Outward

- Replacement Issue

- Replacement Receive

- Stock Issue

- Stock Receive

- Price Diff. Sale

- Price Diff. Purchase

- BOM

- Conversion

- Quotation

- Sale Order

- Purchase Order

- Dispatch Management

- ERP Bridger

- Transaction Import

- Download From Server

- Approvals

- Pendings

- Accounts

- Online Banking

-

Books

- Cash and Bank Book

- All Ledgers

- Entry Books

- Debtors Ledgers

- Creditors Ledger

- Purchase Register

- Sale Register

- Duties & Taxes

- Analytical Summaries

- Outstandings

- Collection Reports

- Depreciation

- T-Format Printing

- Multi Printing

- Bank Reconcilation

- Cheque Management

- Claims & Incentives

- Target Analysis

- Cost Centres

- Interest and Collection

- Final Reports

-

Stocks

- Current Stock

- Stock Analysis

- Filtered Stock

- Batch Stock

- Dump Stock

- Hold/Ban Stock

- Stock Valuation

- Minimum Level Stock

- Maximum Level Stock

- Expiry Stock

- Near Expiry Stock

- Stock Life Statement

- Batch Purchase Type

- Departments Reports

- Merge Report

- Stock Ageing Analysis

- Fast and Slow Moving Items

- Crate Reports

- Size Stock

-

Daily Reports

- Daily Working

- Fast SMS/E-Mail Reports

- Stock and Sale Analysis

- Order Calling

- Business on Google Map

- Sale Report

- Purchase Report

- Inventory Reports

- ABC Analysis

- All Accounting Reports

- Purchase Planning

- Dispatch Management Reports

- SQL Query Executor

- Transaction Analysis

- Claim Statement

- Upbhogkta Report

- Mandi Report

- Audit Trail

- Re-Order Management

- Reports

-

Reports Utilities

- Delete Special Deals

- Multi Deletion

- Multi Editing

- Merge Inventory Master

- Merge Accounts Master

- Edit Stock Balance

- Edit Outstanding

- Re-Posting

- Copy

- Batch Updation

- Structure/Junk Verificarion

- Data Import/Export

- Create History

- Voucher Numbering

- Group of Accounts

- Carry Balances

- Misc. Utilities

- Advance Utilities

- Shortcut Keys

- Exit

- Generals

- Backup

- Self Format

- GST Return

- Jewellery

- eBusiness

- Control Room

- Advance Features

- Registration

- Add On Features

- Queries

- Printing

- Networking

- Operators

- Garment

- Hot Keys

-

GST

- E-Invoicing

- Internal Audit

- Search GSTIN/PARTY

- Export Invoice Print

- Tax Clubbing

- Misc. GST Reports

- GST Self-Designed Reports

- GST Return Video

- GSTR Settings

- Auditors Details

- Update GST Patch

- Misc. GST Returns

- GST Register & Return

- GST RCM Statement

- GST Advance Statement

- GST Payment Statement

- Tax Registers and Summaries

- TDS/TCS Reports

- Form Iss./Receivable

- Mandi

- My QR Code

- E-Way Bill

- Marg pay

- Saloon Setup

- Restaurant

- Pharmanxt free Drugs

- Manufacturing

- Password and Power

- Digital Entry

Home > Margerp > Voucher Entry > How to create sale voucher in Marg Software ?

How to create sale voucher in Marg Software ?

Overview/Introduction to Sale Voucher in Marg ERP Software

Process of Sale Voucher in Marg ERP Software

OVERVIEW/INTRODUCTION TO SALE VOUCHER IN MARG ERP SOFTWARE

- The Sale Voucher entry usually records all the entries related to sales including cash and credit.

- In this sales Voucher entry, the user can only enter the sale amount and tax percentage.

PROCESS OF SALE VOUCHER IN MARG ERP SOFTWARE

Sale Voucher entry can be done in 2 ways i.e.

1. Inclusive Tax

In Inclusive, if the billing of Rs.1000 is to be done then the tax amount to be applied will be included in the total bill value.

2. Exclusive Tax.

In Exclusive, tax will be applied on the billing amount. Suppose, if the billing of Rs.1000 is to be done then tax will be applied on that billing amount i.e. total bill value + tax.

Suppose, take an example for Sale transaction: Goods are sold to Om Distributors for Rs.10000 on 21August 2018 with 5% tax. Following this example, implement sale voucher in both ways: Inclusive and Exclusive tax.

SALE VOUCHER CREATION OF INCLUSIVE TAX:

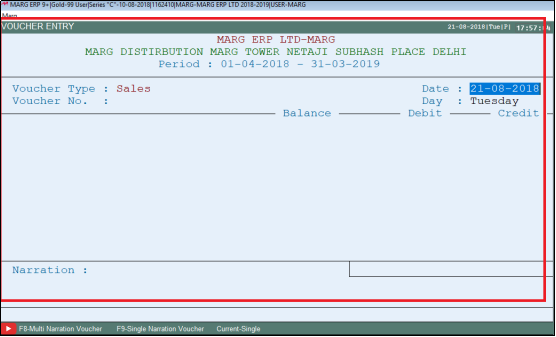

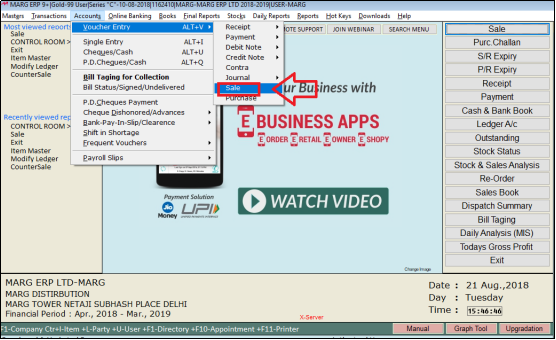

- Go to Accounts > Voucher Entry > Sale. Press Enter.

- A Sale Voucher entry window will be displayed.

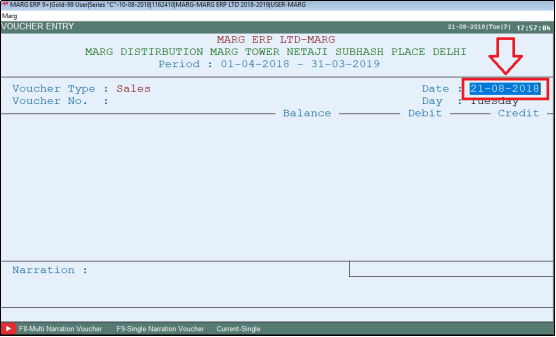

- The user will enter the date on which the purchase has been made.

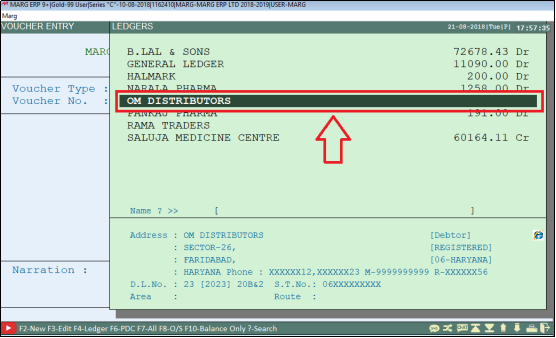

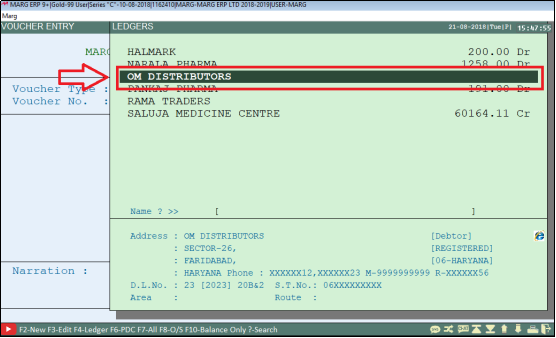

- A Ledger window will appear.

- Now, select the ledger as per the example. Here, select ledger Om Distributors.

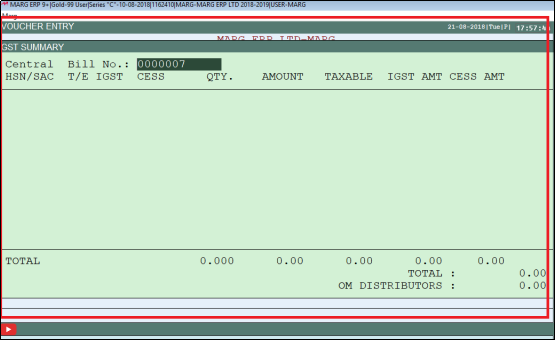

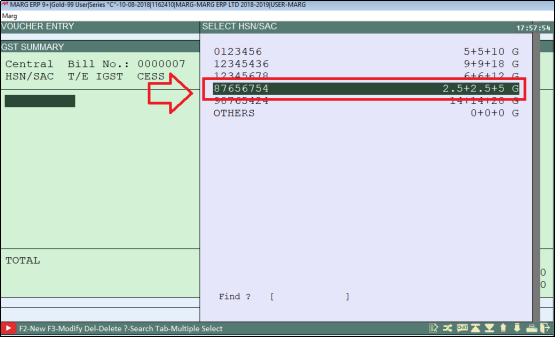

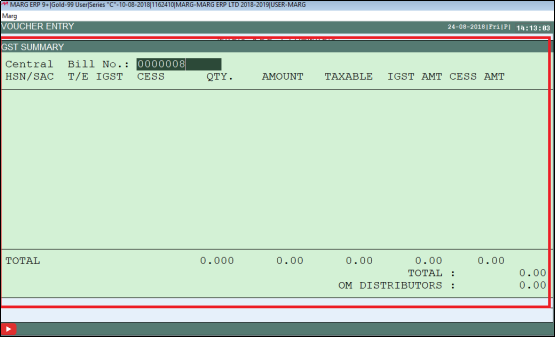

- A window of GST Summary will be displayed. Press Enter.

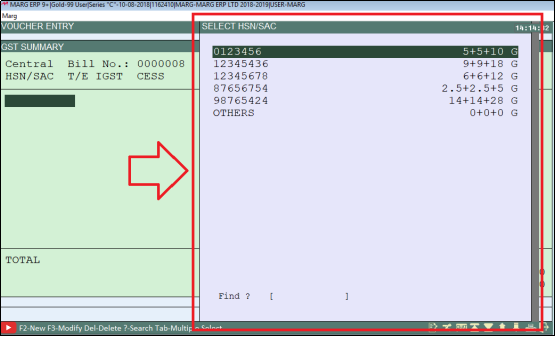

- A window of Select HSN/SAC will be displayed from which select the tax.

- Select the tax on which the sale was made. Suppose, here 5%. Press Enter.

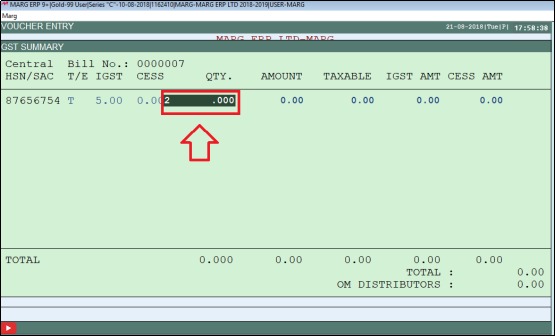

- Now define the quantity. Suppose, here 2.

- Enter the amount as per the example. Set amount as Rs.10000. Press Enter.

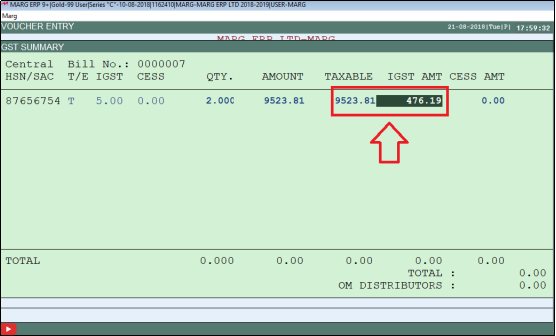

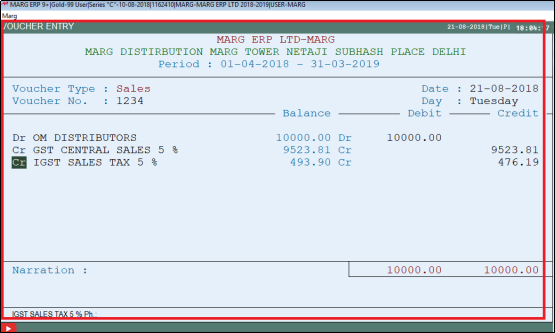

- The user can now view that the amount has changed to Rs. 9523.81 instead of Rs.10000.

- Here, the software has separated the taxable amount and the tax. When the user will calculate the Taxable amount and IGST, then the total will be Rs.10,000 i.e. tax of Rs.476.19 was already included in the bill value.

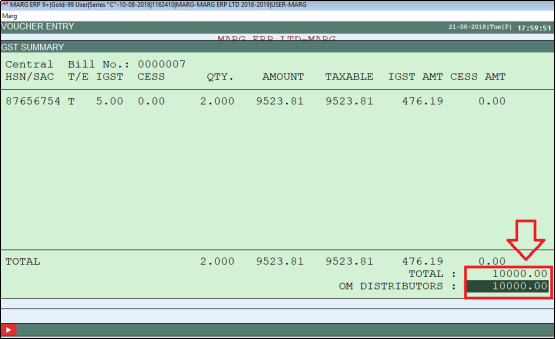

- Press End key. The user can see the total amount of Rs.10000.

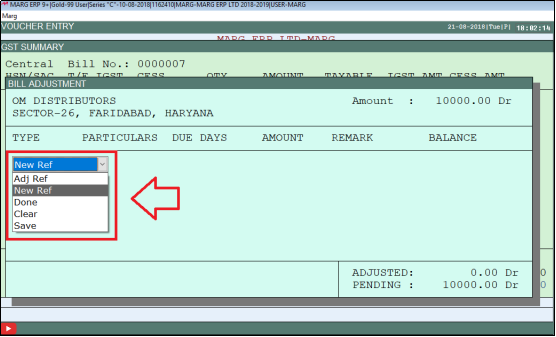

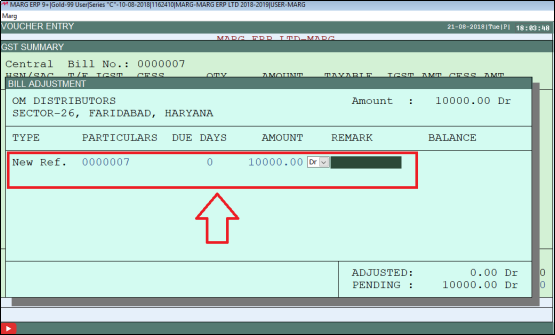

- A Bill Adjustment window will be displayed.

- Select New Ref from the drop down.

- Settle this reference by pressing enter key.

- Come to window of Sale Voucher entry.

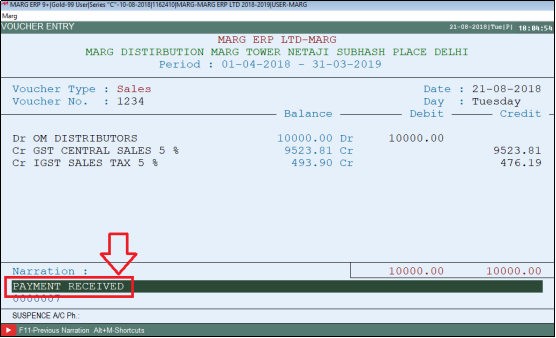

- In narration, if the user wants to feed any narration then mention it here. Suppose, ‘Payment Received’. Press Enter.

- Click on Save button.

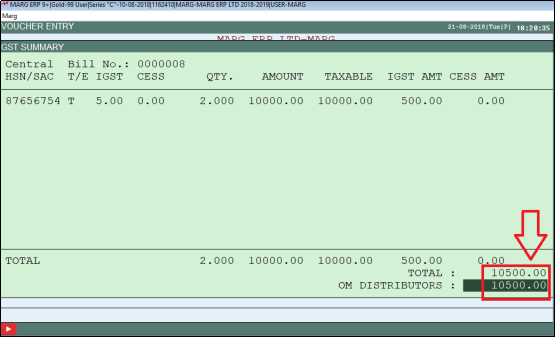

VIEW OF SALE VOUCHER CREATION EXCLUSIVE:

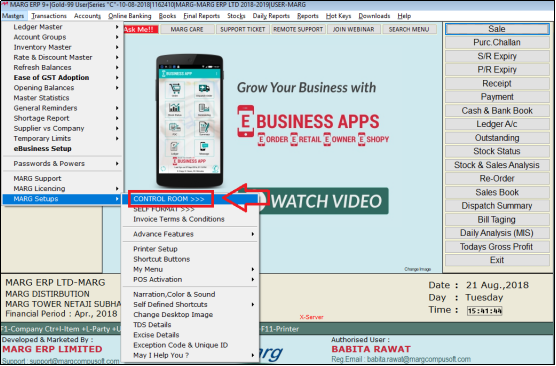

- Go to Masters >> Marg Setups >> Control Room. Press Enter.

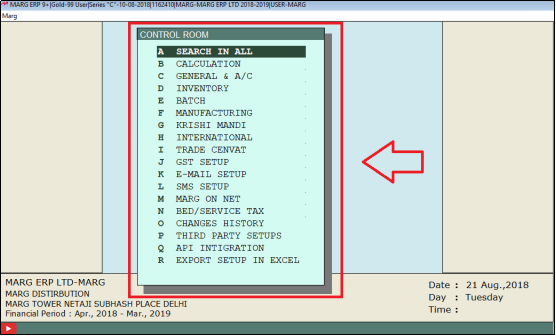

- A Control Room window will appear.

- A Control Room window will appear.

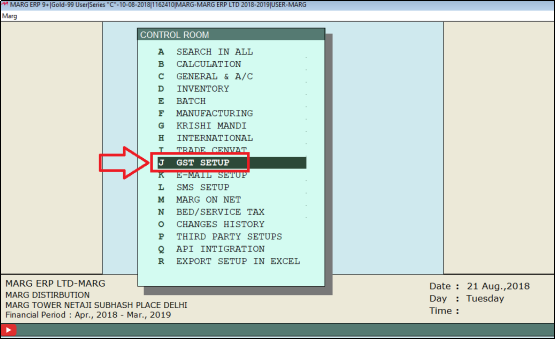

- Then user will Select 'GST Setup'. Press Enter.

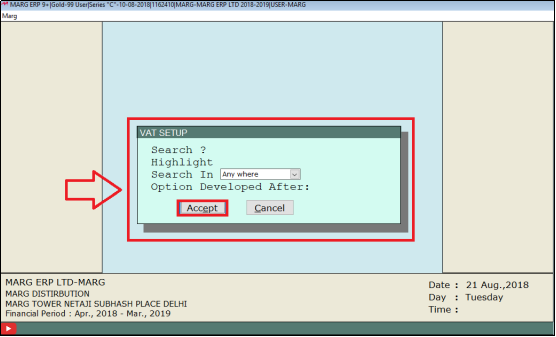

- A VAT Setup window will appear in which the user will click on Accept.

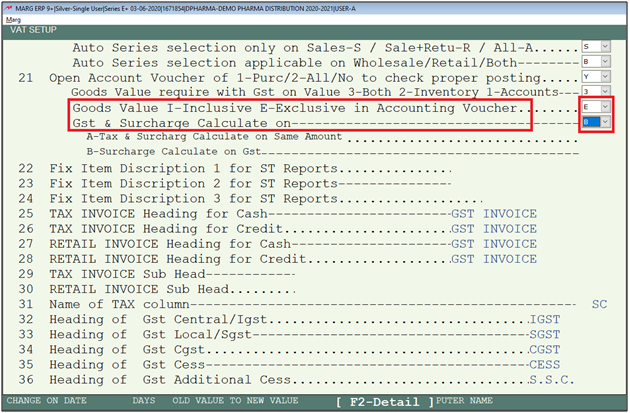

- Then, again a Vat setup window will appear. Press Page down key twice.

- In 'Goods Value I-Inclusive E-Exclusive in Accounting voucher' option, the user will select “E”.

- Now, in 'GST and Surcharge Calculate on' option, the user will select “B” I.e. Surcharge will calculate on GST.

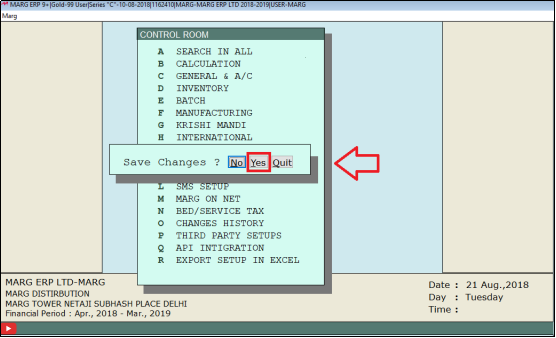

- Press Esc key and then click on 'Yes' to save the changes.

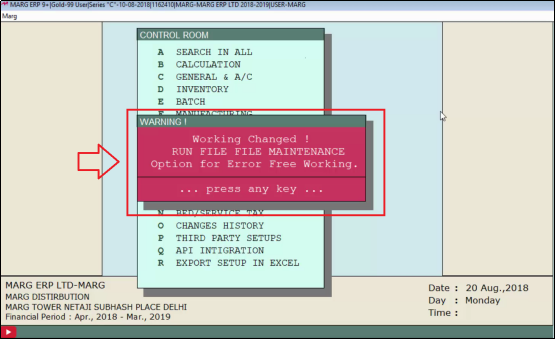

- A Warning Window will appear. Press Enter key.

- Now Run File Maintenance.

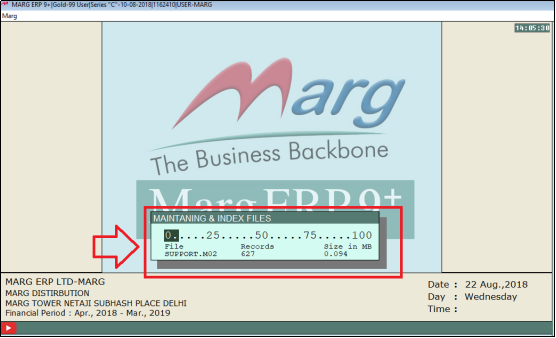

- Select financial year and then press Enter on it.

- An Attention Please window will be displayed. Click on “Ok”.

- Then Maintaining & Index file window will appear.

- Now, Go to Accounts > Voucher Entry > Sale. Press Enter.

- A Voucher Entry window will appear.

- The user will Enter date on which sale has been done.

- Now, select the ledger according to the requirement.

- Suppose, as per the example, here select "Production Department".

- A window of GST Summary will appear. Press Enter.

- A window of HSN/SAC will appear from which select the HSN of tax.

- The user will define the quantity and the amount.

- Suppose, set 2 in Qty and Rs. 10000 in Amount.

- The user can now see that the amount of Rs. 10000 remains the same because the tax will be applied on the amount.

- Press Enter. The tax on the amount of Rs.10000 has been applied and gives the bill value of Rs.10500.

- Press “End” key.

- Now, Again press “End” key to save.

After following the above steps, the user can create Sale voucher.

-

Marg ERP 9+

-

Marg ERP 9+