Search by Category

- Marg Digital Health

- ABHA 2.0 - Ayushman Bharat

- Marg Nano

- Swiggy & Zomato

- Marg Cloud

-

Masters

- Ledger Master

- Account Groups

- Inventory Master

- Rate and Discount Master

- Refresh Balances

- Cost Centre Master

- Opening Balances

- Master Statistics

- General Reminder

- Shortage Report

- Supplier Vs Company

- Temporary Limit

- Shop QRID and eBusiness

- Cloud Backup Setup

- Password and Powers

- Marg Licensing

- Marg Setup

- Target

- Budget

- Credit Limit Management

- Change ERP Edition

- Ease Of Gst Adoption

-

Transactions

- ERP To ERP Order

- Sale

- Purchase

- Sale Return

- Purchase Return

- Brk / Exp Receive

- Scrap Receive

- Brk / Exp Issue

- Scrap Issue

- GST Inward

- GST Outward

- Replacement Issue

- Replacement Receive

- Stock Issue

- Stock Receive

- Price Diff. Sale

- Price Diff. Purchase

- BOM

- Conversion

- Quotation

- Sale Order

- Purchase Order

- Dispatch Management

- ERP Bridger

- Transaction Import

- Download From Server

- Approvals

- Pendings

- Accounts

- Online Banking

-

Books

- Cash and Bank Book

- All Ledgers

- Entry Books

- Debtors Ledgers

- Creditors Ledger

- Purchase Register

- Sale Register

- Duties & Taxes

- Analytical Summaries

- Outstandings

- Collection Reports

- Depreciation

- T-Format Printing

- Multi Printing

- Bank Reconcilation

- Cheque Management

- Claims & Incentives

- Target Analysis

- Cost Centres

- Interest and Collection

- Final Reports

-

Stocks

- Current Stock

- Stock Analysis

- Filtered Stock

- Batch Stock

- Dump Stock

- Hold/Ban Stock

- Stock Valuation

- Minimum Level Stock

- Maximum Level Stock

- Expiry Stock

- Near Expiry Stock

- Stock Life Statement

- Batch Purchase Type

- Departments Reports

- Merge Report

- Stock Ageing Analysis

- Fast and Slow Moving Items

- Crate Reports

- Size Stock

-

Daily Reports

- Daily Working

- Fast SMS/E-Mail Reports

- Stock and Sale Analysis

- Order Calling

- Business on Google Map

- Sale Report

- Purchase Report

- Inventory Reports

- ABC Analysis

- All Accounting Reports

- Purchase Planning

- Dispatch Management Reports

- SQL Query Executor

- Transaction Analysis

- Claim Statement

- Upbhogkta Report

- Mandi Report

- Audit Trail

- Re-Order Management

- Reports

-

Reports Utilities

- Delete Special Deals

- Multi Deletion

- Multi Editing

- Merge Inventory Master

- Merge Accounts Master

- Edit Stock Balance

- Edit Outstanding

- Re-Posting

- Copy

- Batch Updation

- Structure/Junk Verificarion

- Data Import/Export

- Create History

- Voucher Numbering

- Group of Accounts

- Carry Balances

- Misc. Utilities

- Advance Utilities

- Shortcut Keys

- Exit

- Generals

- Backup

- Self Format

- GST Return

- Jewellery

- eBusiness

- Control Room

- Advance Features

- Registration

- Add On Features

- Queries

- Printing

- Networking

- Operators

- Garment

- Hot Keys

-

GST

- E-Invoicing

- Internal Audit

- Search GSTIN/PARTY

- Export Invoice Print

- Tax Clubbing

- Misc. GST Reports

- GST Self-Designed Reports

- GST Return Video

- GSTR Settings

- Auditors Details

- Update GST Patch

- Misc. GST Returns

- GST Register & Return

- GST RCM Statement

- GST Advance Statement

- GST Payment Statement

- Tax Registers and Summaries

- TDS/TCS Reports

- Form Iss./Receivable

- Mandi

- My QR Code

- E-Way Bill

- Marg pay

- Saloon Setup

- Restaurant

- Pharmanxt free Drugs

- Manufacturing

- Password and Power

- Digital Entry

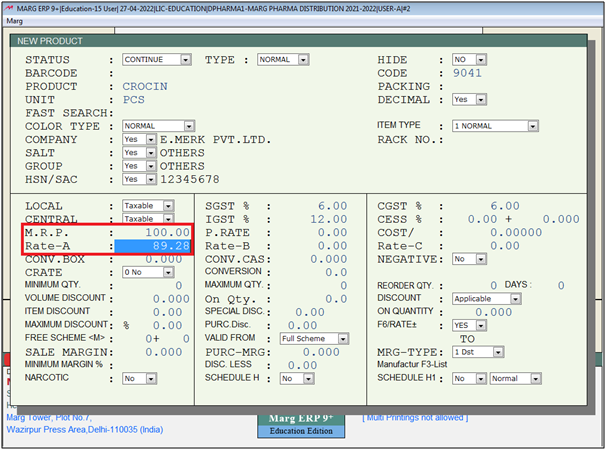

Home > Margerp > Batch > How to generate Rate-A on the bases of MRP with inclusive Tax in Marg Software?

How to generate Rate-A on the bases of MRP with inclusive Tax in Marg Software?

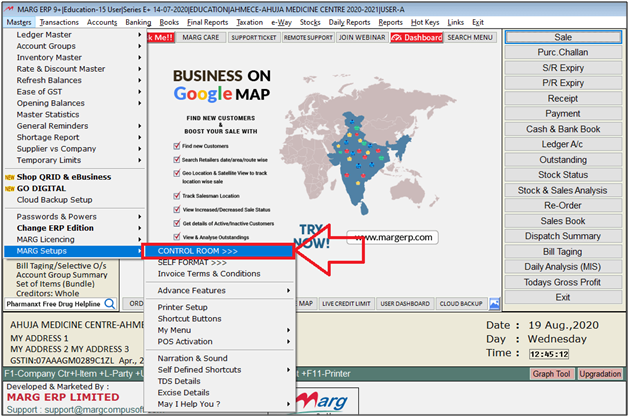

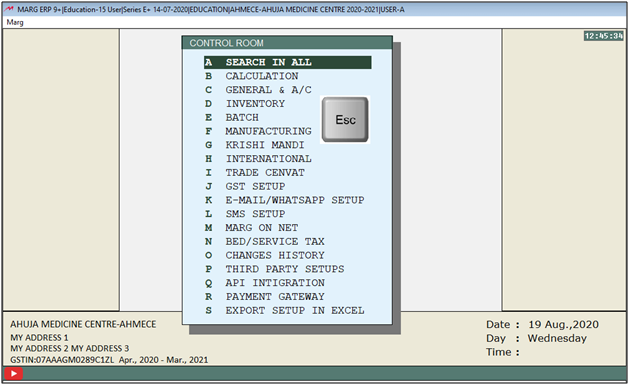

- Firstly, Go to Masters >> Marg Setups >> Control Room.

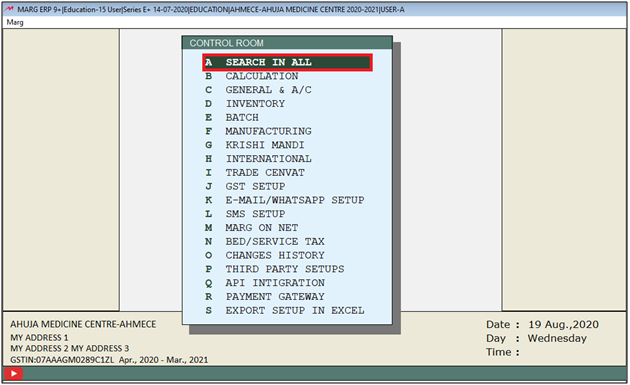

- A 'Control Room' window will appear.

- The user will select ‘Search in all’.

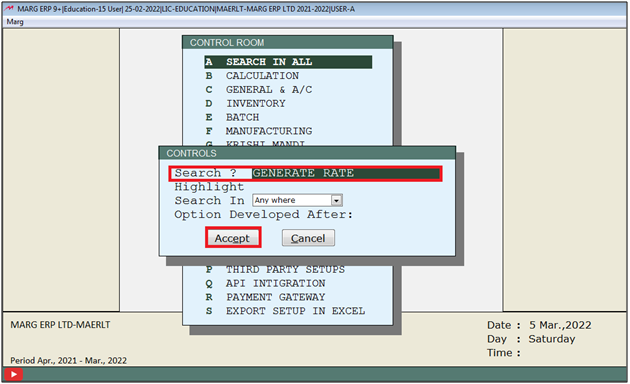

- A 'Controls' window will appear in which the user will Search 'Generate Rate'.

- Now click on ‘Accept’.

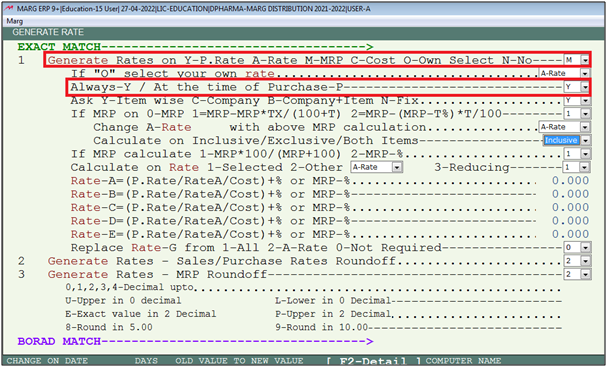

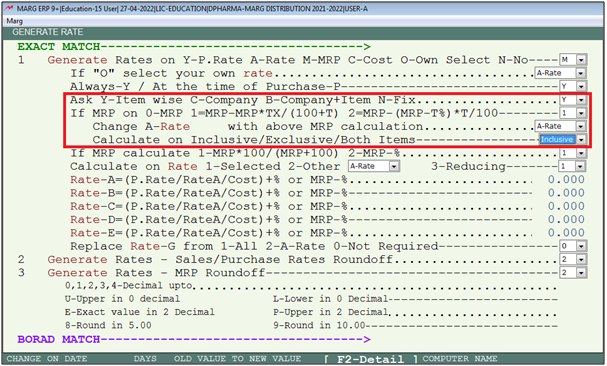

- A 'Generate Rate' window will appear.

- In 'Generate Rates on Y-P.Rate A-Rate M-MRP C-Cost O-Own Select N-No' option, the user will select 'M'.

- In 'Always-Y / At the time of Purchase-P, the user will select 'Y' to generate rate always or select 'P' to ask generate rate at the time of purchase.

- Suppose the user will select 'Y'.

- In 'Ask Y-Item wise C-Company B-Company+Item N-Fix', the user will select 'Y'.

- In 'If MRP on 0-MRP 1=MRP-MRP*TX/(100+T) 2=MRP-(MRP-T%)*T/100', the user will select '1'.

- In 'Change A-Rate with above MRP calculation', the user will select 'Rate-A'.

- In 'Calculate on Inclusive/Exclusive/Both Items', the user will select 'Inclusive'.

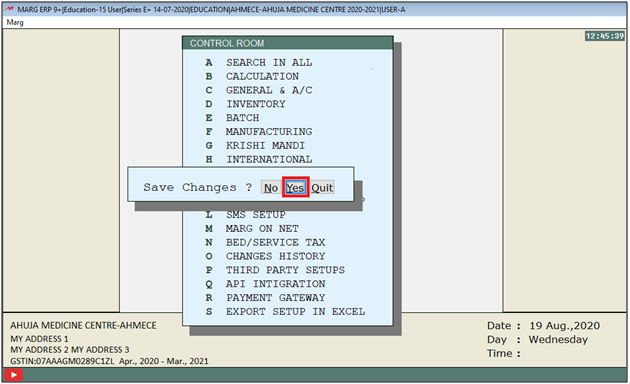

- The user will now press 'ESC' key twice.

- Now click on ‘Yes’ to save the changes.

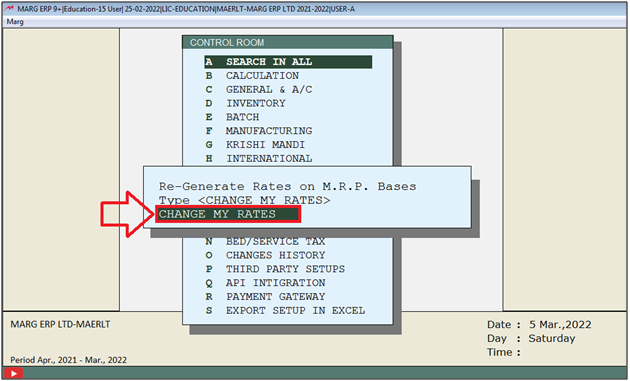

- A 'Re-Generate Rates on M.R.P Bases' window will appear in which the user will type 'CHANGE MY RATES' and press 'Enter'.

After following the above steps, the Rate will be generated on the bases of MRP with inclusive Tax.

Suppose, there is an item 'Crocin' whose MRP is Rs.'100' and Tax -12% so the Rate -A will be generate as (Rate A = MRP/MRP+Tax*100)= (Rate A = 100/100+12*100= Rs 89.28).

-

Marg ERP 9+

-

Marg ERP 9+