Search by Category

- Marg Digital Health

- ABHA 2.0 - Ayushman Bharat

- Marg Nano

- Swiggy & Zomato

- Marg Cloud

-

Masters

- Ledger Master

- Account Groups

- Inventory Master

- Rate and Discount Master

- Refresh Balances

- Cost Centre Master

- Opening Balances

- Master Statistics

- General Reminder

- Shortage Report

- Supplier Vs Company

- Temporary Limit

- Shop QRID and eBusiness

- Cloud Backup Setup

- Password and Powers

- Marg Licensing

- Marg Setup

- Target

- Budget

- Credit Limit Management

- Change ERP Edition

- Ease Of Gst Adoption

-

Transactions

- ERP To ERP Order

- Sale

- Purchase

- Sale Return

- Purchase Return

- Brk / Exp Receive

- Scrap Receive

- Brk / Exp Issue

- Scrap Issue

- GST Inward

- GST Outward

- Replacement Issue

- Replacement Receive

- Stock Issue

- Stock Receive

- Price Diff. Sale

- Price Diff. Purchase

- BOM

- Conversion

- Quotation

- Sale Order

- Purchase Order

- Dispatch Management

- ERP Bridger

- Transaction Import

- Download From Server

- Approvals

- Pendings

- Accounts

- Online Banking

-

Books

- Cash and Bank Book

- All Ledgers

- Entry Books

- Debtors Ledgers

- Creditors Ledger

- Purchase Register

- Sale Register

- Duties & Taxes

- Analytical Summaries

- Outstandings

- Collection Reports

- Depreciation

- T-Format Printing

- Multi Printing

- Bank Reconcilation

- Cheque Management

- Claims & Incentives

- Target Analysis

- Cost Centres

- Interest and Collection

- Final Reports

-

Stocks

- Current Stock

- Stock Analysis

- Filtered Stock

- Batch Stock

- Dump Stock

- Hold/Ban Stock

- Stock Valuation

- Minimum Level Stock

- Maximum Level Stock

- Expiry Stock

- Near Expiry Stock

- Stock Life Statement

- Batch Purchase Type

- Departments Reports

- Merge Report

- Stock Ageing Analysis

- Fast and Slow Moving Items

- Crate Reports

- Size Stock

-

Daily Reports

- Daily Working

- Fast SMS/E-Mail Reports

- Stock and Sale Analysis

- Order Calling

- Business on Google Map

- Sale Report

- Purchase Report

- Inventory Reports

- ABC Analysis

- All Accounting Reports

- Purchase Planning

- Dispatch Management Reports

- SQL Query Executor

- Transaction Analysis

- Claim Statement

- Upbhogkta Report

- Mandi Report

- Audit Trail

- Re-Order Management

- Reports

-

Reports Utilities

- Delete Special Deals

- Multi Deletion

- Multi Editing

- Merge Inventory Master

- Merge Accounts Master

- Edit Stock Balance

- Edit Outstanding

- Re-Posting

- Copy

- Batch Updation

- Structure/Junk Verificarion

- Data Import/Export

- Create History

- Voucher Numbering

- Group of Accounts

- Carry Balances

- Misc. Utilities

- Advance Utilities

- Shortcut Keys

- Exit

- Generals

- Backup

- Self Format

- GST Return

- Jewellery

- eBusiness

- Control Room

- Advance Features

- Registration

- Add On Features

- Queries

- Printing

- Networking

- Operators

- Garment

- Hot Keys

-

GST

- E-Invoicing

- Internal Audit

- Search GSTIN/PARTY

- Export Invoice Print

- Tax Clubbing

- Misc. GST Reports

- GST Self-Designed Reports

- GST Return Video

- GSTR Settings

- Auditors Details

- Update GST Patch

- Misc. GST Returns

- GST Register & Return

- GST RCM Statement

- GST Advance Statement

- GST Payment Statement

- Tax Registers and Summaries

- TDS/TCS Reports

- Form Iss./Receivable

- Mandi

- My QR Code

- E-Way Bill

- Marg pay

- Saloon Setup

- Restaurant

- Pharmanxt free Drugs

- Manufacturing

- Password and Power

- Digital Entry

Home > Margerp > Depreciation > What is the process of Depreciation in Marg Software ?

What is the process of Depreciation in Marg Software ?

Overview/Introduction to Depreciation

Methods of Calculating Depreciation

Process of Depreciation in Marg Software

OVERVIEW/INTRODUCTION TO DEPRECIATION

- Depreciation is a term used in accounting, economics and finance to spread the cost of an asset over the span of several years. In common speech, depreciation is the reduction in the cost of an asset used for business purposes during certain amount of time due to usage, passage of time, wear and tear, technological outdating or obsolescence, depletion, inadequacy, rot, rust, decay or other such factors.

- In accounting, however, depreciation is a term used to describe any method of attributing the historical or purchase cost of an asset across its useful life, roughly corresponding to normal wear and tear.

- The use of depreciation affects the financial statements and in some countries the taxes of companies and individuals. The recording of depreciation will cause an expense to be recognized, thereby lowering stated profits on the income statement, while the net value of the asset (the portion of the historical cost of the asset that remains to provide future value to the company) will decline on the balance sheet. Depreciation reported for accounting and tax purposes may differ substantially.

METHODS OF CALCULATING DEPRECIATION

STRAIGHT-LINE METHOD

For example, a vehicle that depreciates over 5 years, is purchased at a cost of Rs.17,000, and will have a salvage value of Rs.2000, will depreciate at Rs.3,000 per year: (Rs.17,000 - Rs.2,000)/ 5 years = Rs.3,000 annual straight-line depreciation expense. In other words, it is the depreciable cost of the asset divided by the number of years of its useful life.

This table illustrates the straight-line method of depreciation. Book value at the beginning of the first year of depreciation is the original cost of the asset. At any time book value equals original cost minus accumulated depreciation.

Book value = original cost - accumulated depreciation Book value at the end of year becomes book value at the beginning of next year. The asset is depreciated until the book value equals scrap value.

|

Book value at |

Depreciation |

Accumulated |

Book value at |

|

Rs.17,000 (original cost) |

Rs.3,000 |

Rs.3,000 |

Rs.14,000 |

|

Rs.14,000 |

Rs.3,000 |

Rs.6,000 |

Rs.11,000 |

|

Rs.11,000 |

Rs.3,000 |

Rs.9,000 |

Rs.8,000 |

|

Rs.8,000 |

Rs.3,000 |

Rs.12,000 |

Rs.5,000 |

|

Rs.5,000 |

Rs.3,000 |

Rs.15,000 |

Rs.2,000 (scrap value) |

If the vehicle were to be sold and the sales price exceeded the depreciated value (net book value) then the excess would be considered a gain and subject to depreciation recapture. In addition, this gain above the depreciated value would be recognized as ordinary income by the tax office. If the sales price is ever less than the book value, the resulting capital loss is tax deductible. If the sale price were ever more than the original book value, then the gain above the original book value is recognized as a capital gain.

If a company chooses to depreciate an asset at a different rate from that used by the tax office then this generates a timing difference in the income statement due to the difference (at a point in time) between the taxation departments and company's view of the profit.

WRITTEN DOWN METHOD or DECLINING BALANCE METHOD

Depreciation methods that provide for a higher depreciation charge in the first year of an asset's life and gradually decreasing charges in subsequent years are called accelerated depreciation methods. This may be a more realistic reflection of an asset's actual expected benefit from the use of the asset: many assets are most useful when they are new. One popular accelerated method is the declining-balance method. Under this method the book value is multiplied by a fixed rate.

Annual depreciation = depreciation rate * book value at beginning of year

The most common rate used is double the straight-line rate. For this reason, this technique is referred to as the double-declining-balance method. To illustrate, suppose a business has an asset with Rs.1,000 original cost, Rs.100 salvage value, and 5 years useful life. First, calculate straight-line depreciation rate. Since the asset has 5 years useful life, the straight-line depreciation rate equals (100% / 5) 20% per year. With double-declining-balance method, as the name suggests, double that rate, or 40% depreciation rate is used. The table below illustrates the double-declining-balance method of depreciation.

|

Book value at |

Depreciation |

Depreciation |

Accumulated |

Book value at |

|

Rs.1,000 (original cost) |

40% |

Rs.400 |

Rs.400 |

Rs.600 |

|

Rs.600 |

40% |

Rs.240 |

Rs.640 |

Rs.360 |

|

Rs.360 |

40% |

Rs.144 |

Rs.784 |

Rs.216 |

|

Rs.216 |

40% |

Rs.86.40 |

Rs.870.40 |

Rs.129.60 |

|

Rs.129.60 |

Rs.129.60 - Rs.100 |

Rs.29.60 |

Rs.900 |

Rs.100 (scrap value) |

When using the double-declining-balance method, the salvage value is not considered in determining the annual depreciation, but the book value of the asset being depreciated is never brought below its salvage value, regardless of the method used. The process continues until the salvage value or the end of the asset's useful life, is reached. In the last year of depreciation a subtraction might be needed in order to prevent book value from falling below estimated Scrap Value.

Since double-declining-balance depreciation does not always depreciate an asset fully by its end of life, some methods also compute a straight-line depreciation each year, and apply the greater of the two. This has the effect of converting from declining-balance depreciation to straight-line depreciation at a midpoint in the asset's life.

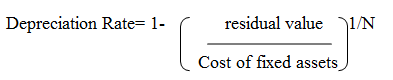

It is possible to find a rate that would allow for full depreciation by its end of life with the formula:

Where N is the estimated life of the asset (for example, in years).

Where N is the estimated life of the asset (for example, in years).

PROCESS OF DEPRECIATION IN MARG SOFTWARE

- Go to Books > Depreciation.

- All the assets which a company owns appear next on the screen, on which Depreciation is applicable.

- This shows the book value of each asset, percentage of depreciation to be charged ,this calculates the amount that should be deducted on account of depreciation per year.

- To enter the percentage of depreciation, the user will press 'F3' key on the Fix Asset.

- Suppose select 'Furniture'.

- Suppose mention '10%'.

- Similarly, on 'Table', the user will press 'F3' key and mention the Depreciation% as per the requirement.

- Suppose mention '40%'.

- Now, the user will press 'Ctrl+S' key to post voucher entry.

- Now the software will automatically create the voucher entry of depreciation.

- The user will mention the 'Date' as per the requirement.

- Suppose mention '31-12-2022'.

- The entry will get auto Post, the user needs to pressing 'Enter' key and click on 'Save' to save the entry.

After following the above steps, the software will deduct the Depreciation value (1000-10%=9000) from the Asset.

|

Rs. |

|

Rs. |

|

Rs. |

-

Marg ERP 9+

-

Marg ERP 9+