Search by Category

- Marg Digital Health

- ABHA 2.0 - Ayushman Bharat

- Marg Nano

- Swiggy & Zomato

- Marg Cloud

-

Masters

- Ledger Master

- Account Groups

- Inventory Master

- Rate and Discount Master

- Refresh Balances

- Cost Centre Master

- Opening Balances

- Master Statistics

- General Reminder

- Shortage Report

- Supplier Vs Company

- Temporary Limit

- Shop QRID and eBusiness

- Cloud Backup Setup

- Password and Powers

- Marg Licensing

- Marg Setup

- Target

- Budget

- Credit Limit Management

- Change ERP Edition

- Ease Of Gst Adoption

-

Transactions

- ERP To ERP Order

- Sale

- Purchase

- Sale Return

- Purchase Return

- Brk / Exp Receive

- Scrap Receive

- Brk / Exp Issue

- Scrap Issue

- GST Inward

- GST Outward

- Replacement Issue

- Replacement Receive

- Stock Issue

- Stock Receive

- Price Diff. Sale

- Price Diff. Purchase

- BOM

- Conversion

- Quotation

- Sale Order

- Purchase Order

- Dispatch Management

- ERP Bridger

- Transaction Import

- Download From Server

- Approvals

- Pendings

- Accounts

- Online Banking

-

Books

- Cash and Bank Book

- All Ledgers

- Entry Books

- Debtors Ledgers

- Creditors Ledger

- Purchase Register

- Sale Register

- Duties & Taxes

- Analytical Summaries

- Outstandings

- Collection Reports

- Depreciation

- T-Format Printing

- Multi Printing

- Bank Reconcilation

- Cheque Management

- Claims & Incentives

- Target Analysis

- Cost Centres

- Interest and Collection

- Final Reports

-

Stocks

- Current Stock

- Stock Analysis

- Filtered Stock

- Batch Stock

- Dump Stock

- Hold/Ban Stock

- Stock Valuation

- Minimum Level Stock

- Maximum Level Stock

- Expiry Stock

- Near Expiry Stock

- Stock Life Statement

- Batch Purchase Type

- Departments Reports

- Merge Report

- Stock Ageing Analysis

- Fast and Slow Moving Items

- Crate Reports

- Size Stock

-

Daily Reports

- Daily Working

- Fast SMS/E-Mail Reports

- Stock and Sale Analysis

- Order Calling

- Business on Google Map

- Sale Report

- Purchase Report

- Inventory Reports

- ABC Analysis

- All Accounting Reports

- Purchase Planning

- Dispatch Management Reports

- SQL Query Executor

- Transaction Analysis

- Claim Statement

- Upbhogkta Report

- Mandi Report

- Audit Trail

- Re-Order Management

- Reports

-

Reports Utilities

- Delete Special Deals

- Multi Deletion

- Multi Editing

- Merge Inventory Master

- Merge Accounts Master

- Edit Stock Balance

- Edit Outstanding

- Re-Posting

- Copy

- Batch Updation

- Structure/Junk Verificarion

- Data Import/Export

- Create History

- Voucher Numbering

- Group of Accounts

- Carry Balances

- Misc. Utilities

- Advance Utilities

- Shortcut Keys

- Exit

- Generals

- Backup

- Self Format

- GST Return

- Jewellery

- eBusiness

- Control Room

- Advance Features

- Registration

- Add On Features

- Queries

- Printing

- Networking

- Operators

- Garment

- Hot Keys

-

GST

- E-Invoicing

- Internal Audit

- Search GSTIN/PARTY

- Export Invoice Print

- Tax Clubbing

- Misc. GST Reports

- GST Self-Designed Reports

- GST Return Video

- GSTR Settings

- Auditors Details

- Update GST Patch

- Misc. GST Returns

- GST Register & Return

- GST RCM Statement

- GST Advance Statement

- GST Payment Statement

- Tax Registers and Summaries

- TDS/TCS Reports

- Form Iss./Receivable

- Mandi

- My QR Code

- E-Way Bill

- Marg pay

- Saloon Setup

- Restaurant

- Pharmanxt free Drugs

- Manufacturing

- Password and Power

- Digital Entry

Home > Margerp > Gst Inward > How to pass GST Inward Entry in Marg Software ?

How to pass GST Inward Entry in Marg Software ?

OVERVIEW/INTRODUCTION OF GST INWARD IN MARG ERP SOFTWARE

-

Marg ERP has provided a provision for GST Inward and GST Outward. GST Inward means the goods & services which we purchase & on the other hand GST Outward means the goods & services which we give/sell. GST Inward works like Purchase and GST Outward works like Sale.

PROCESS OF GST INWARD IN MARG ERP SOFTWARE

In day to day business, the people purchases commodities that does not have any impact on their inventory. In simple terms, it means the commodities that are not resold but receive the Tax Credit on the purchase of those goods.

For Example: If the user purchases a machine for the purpose doing business, or a computer or say if the user purchases some kind of services like booking a Hotel for the purpose if business event or get a telephone bill or electricity bill for the shop. These are few examples of GST Inward where the services or commodities are being purchased but those services or commodities are not being resold.

- In order to claim GST credit for these kinds of purchases that do not effect on the inventory, the particular entry needs to be done with the help of GST Inward in Marg ERP 9+ Software.

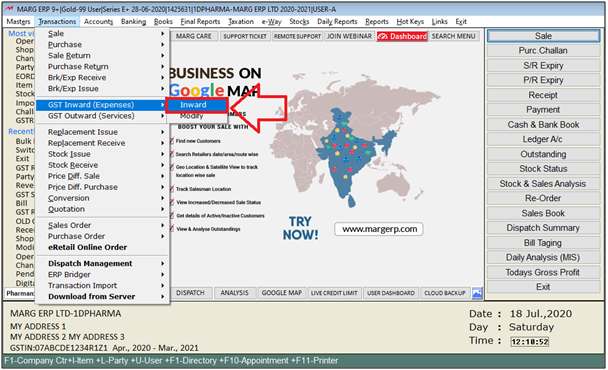

- In order to do GST Inward entry, go to Transactions >> GST Inward >> Inward.

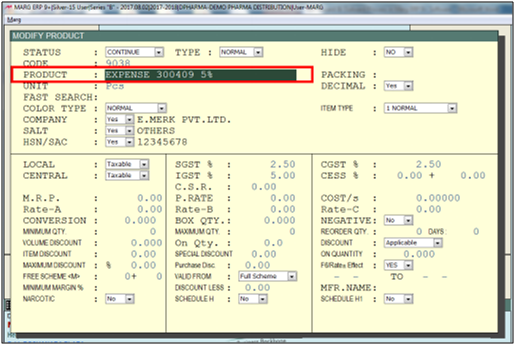

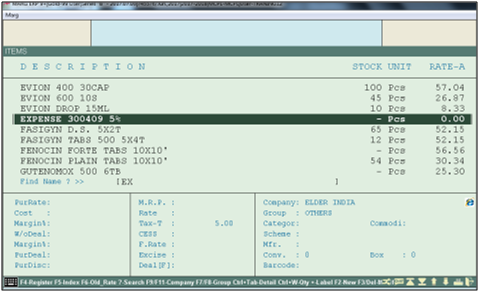

Fig. 1.1 Menu View to GST Inward in Marg ERP 9+ Software

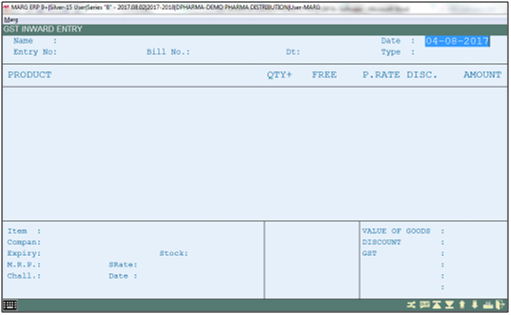

- Here, a ledger window will appear. For Example, the user is booking a hotel i.e. Gyatri Hotel for the purpose of business meeting so for that create a ledger of Gyatri Hotel.

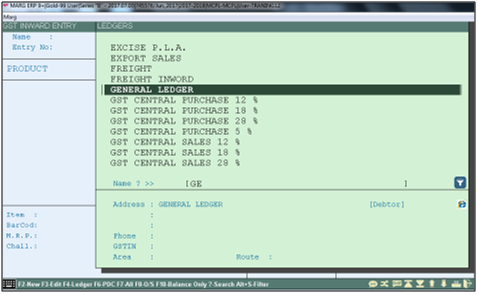

Fig. 1.2 Creation of GST Inward Entry in Marg ERP 9+ Software

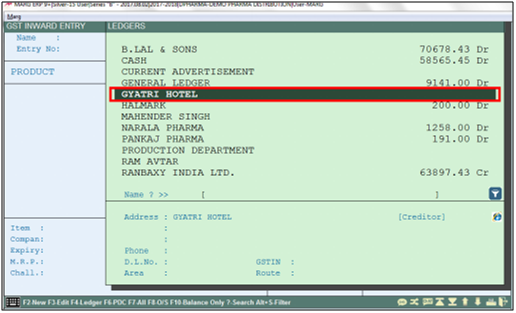

- Select the Ledger of “Gyatri Hotel”.

Fig. 1.3 Selecting Ledger for Creation of GST Inward Bill in Marg ERP 9+ Software

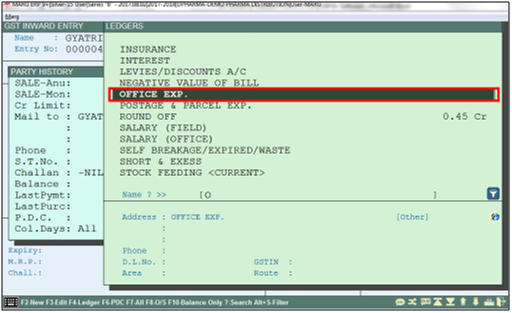

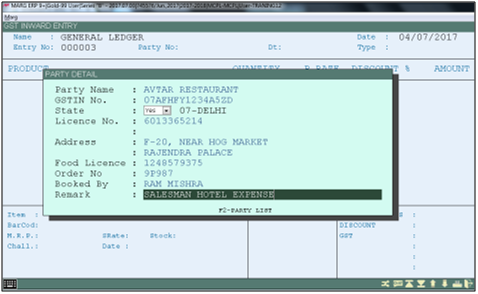

- After selecting the ledger, the user will now select the type of expense under which the bill has to be generated.

- For the purpose of generating a GST Inward Bill for office expenses, select the ledger of “Office Expenses”.

Fig. 1.4 Process for Creation of GST Inward Entry in Marg ERP 9+ Software

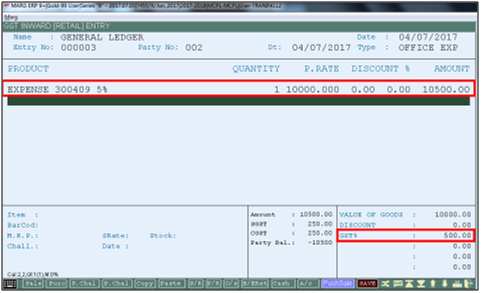

- Once the user will select the ledger of office expenses, now generate the bill.

**Suppose, the HSN Code of Hotel services is 300409. For that create an item/product i.e. Expense, define the HSN Code of that particular product/service i.e. 300409 and lastly whatever the GST% is charged on that particular item/product or services that % must be specified here on the item name so that if the user purchases the service of that same HSN Code then that particular item can be loaded in the bill. **

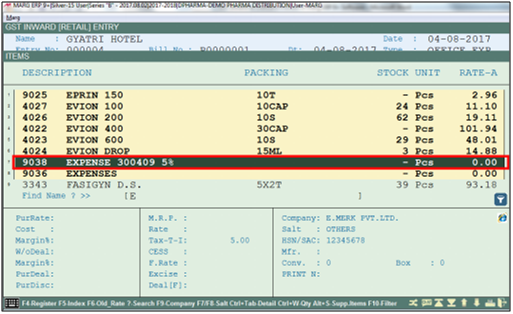

- Now, load the item in the bill.

Fig. 1.5 Process for Creation of GST Inward Entry in Marg ERP 9+ Software

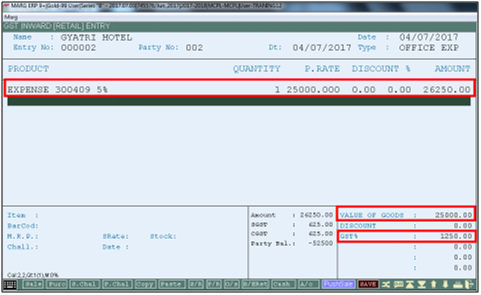

Fig. 1.6 Process for Creation of GST Inward Entry in Marg ERP 9+ Software

Fig. 1.7 Process for Creation of GST Inward Entry in Marg ERP 9+ Software

- Now, if the bill of the hotel was Rs. 25,000 so for that select Quantity as 1 and define Purchase Rate as Rs. 25,000. then the user can view that the GST Tax% calculation as Rs. 1250.

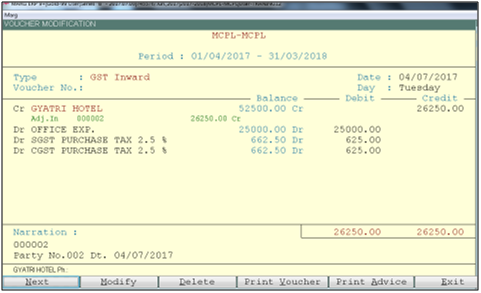

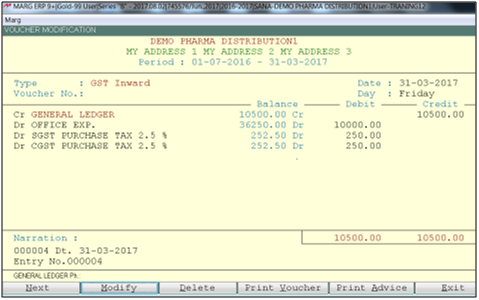

- For GST Inward & GST Outward the software does automatic voucher posting. The user can see the voucher posting of GST Inward bill which is being created. Here, the user will get a tax credit of Rs. 625.

Fig. 1.8 Snapshot of GST Inward Voucher in Marg ERP 9+ Software

- The stock will not get effected for the expense item which was being created while generating the GST Inward Bill i.e. the stock of this particular item will always remain zero as the user has created a separate ledger for Gyatri Hotel and created a GST Inward bill against it.

Fig. 1.9 View of Item with No effect on Stock in Marg EPR 9+ Software

- Similarly, the use can also create a GST Inward Bill against the General Ledger also. Suppose, if there are a number of salesman in the user’s business who visits many hotels for the purpose to stay at at the time of their field job. So, instead of creating separate ledgers for all of hotels wherever the Salesmen visits, the user can do the entry of those particular expenses in General Ledger.

- The user will create the ledger of only those parties with whom the user has dealing on regular basis instead of creating different ledgers. So, Credit card, Cash, General Ledgers are some of the common ledgers.

- If the salesmen has done payment through Cash or Credit card then the user will select Cash or Credit Card Ledger at the time of generating the GST Inward Bill else select General Ledger

Fig. 1.10 Process of Generating GST Inward Bill in Marg ERP 9+ Software

Fig. 1.11 Process of Generating GST Inward Bill in Marg ERP 9+ Software

Fig. 1.12 Process of Generating GST Inward Bill in Marg ERP 9+ Software

In this way, GST Inward Voucher Posting

Fig. 1.13 Snapshot of GST Inward Voucher in Marg ERP 9+ Software

-

Marg ERP 9+

-

Marg ERP 9+