Search by Category

- Marg Digital Health

- ABHA 2.0 - Ayushman Bharat

- Marg Nano

- Swiggy & Zomato

- Marg Cloud

-

Masters

- Ledger Master

- Account Groups

- Inventory Master

- Rate and Discount Master

- Refresh Balances

- Cost Centre Master

- Opening Balances

- Master Statistics

- General Reminder

- Shortage Report

- Supplier Vs Company

- Temporary Limit

- Shop QRID and eBusiness

- Cloud Backup Setup

- Password and Powers

- Marg Licensing

- Marg Setup

- Target

- Budget

- Credit Limit Management

- Change ERP Edition

- Ease Of Gst Adoption

-

Transactions

- ERP To ERP Order

- Sale

- Purchase

- Sale Return

- Purchase Return

- Brk / Exp Receive

- Scrap Receive

- Brk / Exp Issue

- Scrap Issue

- GST Inward

- GST Outward

- Replacement Issue

- Replacement Receive

- Stock Issue

- Stock Receive

- Price Diff. Sale

- Price Diff. Purchase

- BOM

- Conversion

- Quotation

- Sale Order

- Purchase Order

- Dispatch Management

- ERP Bridger

- Transaction Import

- Download From Server

- Approvals

- Pendings

- Accounts

- Online Banking

-

Books

- Cash and Bank Book

- All Ledgers

- Entry Books

- Debtors Ledgers

- Creditors Ledger

- Purchase Register

- Sale Register

- Duties & Taxes

- Analytical Summaries

- Outstandings

- Collection Reports

- Depreciation

- T-Format Printing

- Multi Printing

- Bank Reconcilation

- Cheque Management

- Claims & Incentives

- Target Analysis

- Cost Centres

- Interest and Collection

- Final Reports

-

Stocks

- Current Stock

- Stock Analysis

- Filtered Stock

- Batch Stock

- Dump Stock

- Hold/Ban Stock

- Stock Valuation

- Minimum Level Stock

- Maximum Level Stock

- Expiry Stock

- Near Expiry Stock

- Stock Life Statement

- Batch Purchase Type

- Departments Reports

- Merge Report

- Stock Ageing Analysis

- Fast and Slow Moving Items

- Crate Reports

- Size Stock

-

Daily Reports

- Daily Working

- Fast SMS/E-Mail Reports

- Stock and Sale Analysis

- Order Calling

- Business on Google Map

- Sale Report

- Purchase Report

- Inventory Reports

- ABC Analysis

- All Accounting Reports

- Purchase Planning

- Dispatch Management Reports

- SQL Query Executor

- Transaction Analysis

- Claim Statement

- Upbhogkta Report

- Mandi Report

- Audit Trail

- Re-Order Management

- Reports

-

Reports Utilities

- Delete Special Deals

- Multi Deletion

- Multi Editing

- Merge Inventory Master

- Merge Accounts Master

- Edit Stock Balance

- Edit Outstanding

- Re-Posting

- Copy

- Batch Updation

- Structure/Junk Verificarion

- Data Import/Export

- Create History

- Voucher Numbering

- Group of Accounts

- Carry Balances

- Misc. Utilities

- Advance Utilities

- Shortcut Keys

- Exit

- Generals

- Backup

- Self Format

- GST Return

- Jewellery

- eBusiness

- Control Room

- Advance Features

- Registration

- Add On Features

- Queries

- Printing

- Networking

- Operators

- Garment

- Hot Keys

-

GST

- E-Invoicing

- Internal Audit

- Search GSTIN/PARTY

- Export Invoice Print

- Tax Clubbing

- Misc. GST Reports

- GST Self-Designed Reports

- GST Return Video

- GSTR Settings

- Auditors Details

- Update GST Patch

- Misc. GST Returns

- GST Register & Return

- GST RCM Statement

- GST Advance Statement

- GST Payment Statement

- Tax Registers and Summaries

- TDS/TCS Reports

- Form Iss./Receivable

- Mandi

- My QR Code

- E-Way Bill

- Marg pay

- Saloon Setup

- Restaurant

- Pharmanxt free Drugs

- Manufacturing

- Password and Power

- Digital Entry

Home > Margerp > Gstr 3b > What is the process of GSTR 3B Report in Marg ERP Software ?

What is the process of GSTR 3B Report in Marg ERP Software ?

Process to Generate GSTR-3B Report in Marg Software

Details to be Mentioned in GSTR-3B Form

Process to File GSTR-3B Return on the GST Portal

OVERVIEW OF GSTR-3B REPORT

- GSTR-3B is a simple provisional tax return form introduced by the Central Board of Excise and Customs (CBEC)/GST Council only for the month of July and August.

**When to File GSTR-3B ?

The GSTR-3B for a particular month should be filed by the 20th of the following month.For example, GSTR-3B for July should be filed by the 20th of August, and the GSTR-3B for the month of August should be filed by the 20th of September and so on.

PROCESS TO GENERATE GSTR-3B REPORT IN MARG SOFTWARE

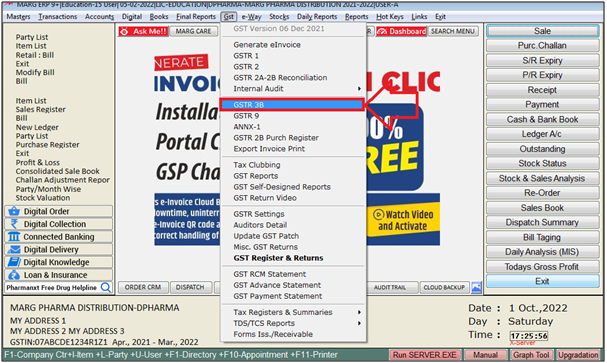

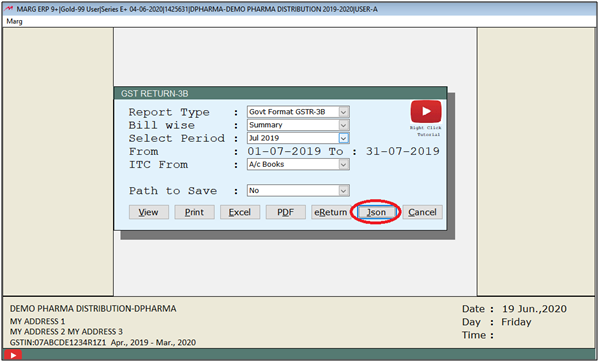

- Firstly, Go to GST > GSTR 3B.

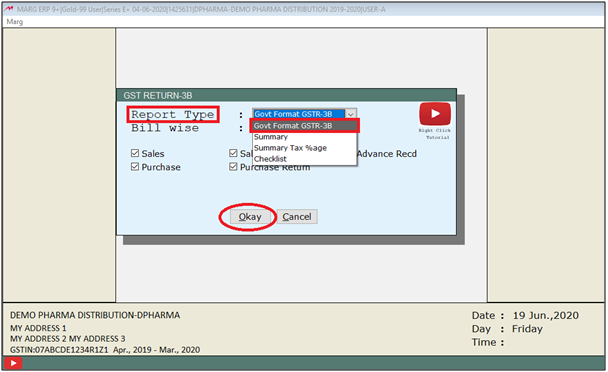

- A 'GST Return-3B' window will appear. In 'Report Type' option the user will select Report type according to the requirement.

- Suppose Select 'Govt Format GSTR-3B'.

- Then click on 'Okay'.

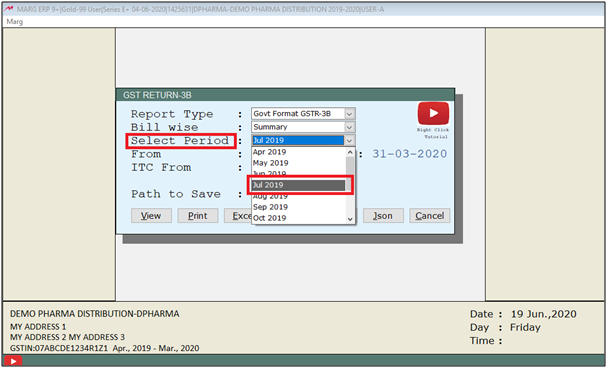

- In 'Select Period' option, the user will select the period for which returns needs to be field.

- Suppose Select 'JULY 2019'.

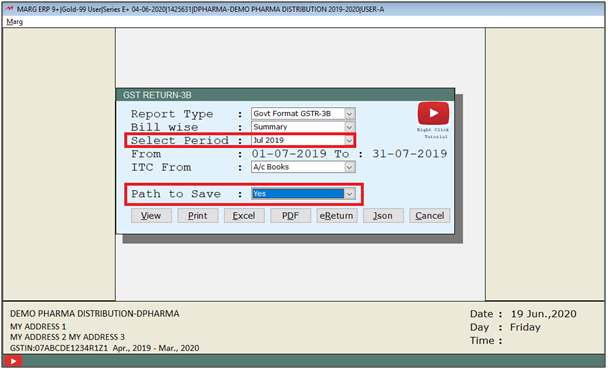

Now, in 'Path to Save', the user will select:

1. 'Yes', if the user needs the software to ask for the file save path.

2. 'No', if the user does not need to ask for the file save path.

Suppose Select 'Yes'.

- Then the user can view, print or view the report in the PDF, Excel, eReturn & JSON format.

- Suppose Select 'Excel'.

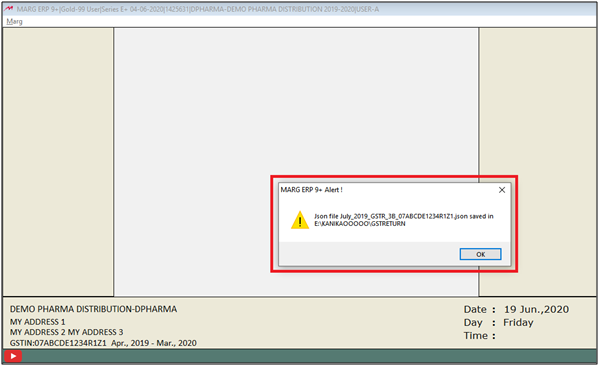

- Now, the user can view that an GSTR-3B JSON file will be generated.

- click on 'Ok'.

DETAILS TO BE MENTIONED IN GSTR-3B FORM

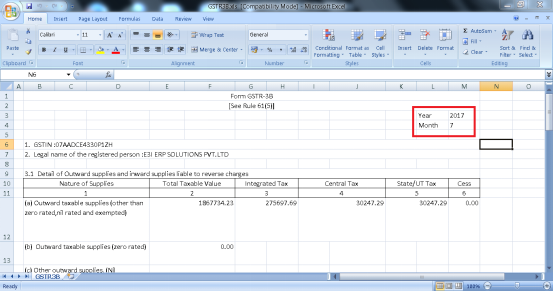

Firstly, the user needs to mention the year & month of the Return

1. Year: Mention the year for which the returns are filed.

2. Month: Mention the month for which the returns are filed.

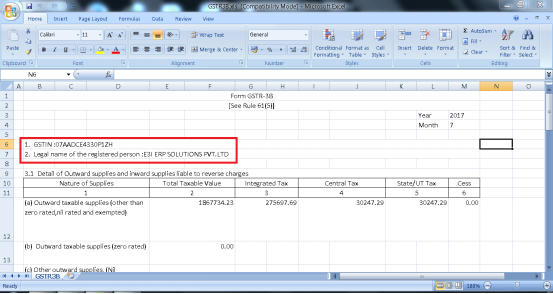

1. GSTIN : In this field it displays GSTIN Number of the company (user can use provisional id as your GSTIN if user did not have a GSTIN) of the dealer for the purpose of filing the return.

2. Legal Name of the Registered Person : In this field it displays the Company Name of the dealer and kindly note that this field is auto populated after entering GSTIN of the dealer.

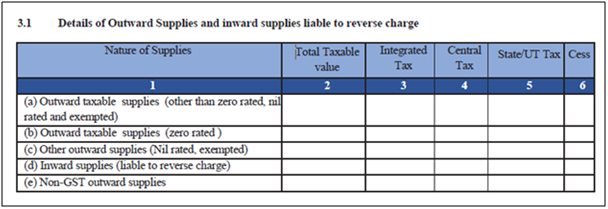

3.1 Detail of Outward supplies and Inward supplies to reverse charges i.e. Details where tax is payable by user.

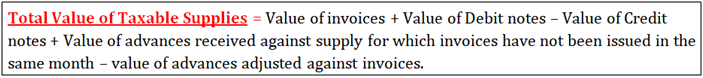

This section tells that whatever your liabilities are there i.e. whatever the taxable supplies are there for which GST has been collected or advanced taken against the supplies + if any purchases has been done and tax has to be paid on the basis of reverse charges, all that details will be shown here.

(a) Outward taxable supplies (other than zero rated, nil rated and exempted) :- It includes all the taxable supplies. It does not include supplies which are zero rated, or have a nil rate of tax or are exempt from GST. These must be provided separately. It Include only those supplies on which GST has been charged by you.

(b) Outward taxable Supplies (zero rated) :- If user have done any export or supplies made in SEZ (Special economic zone) then those will be entered here i.e. it includes only those supplies on which GST rate is zero.

(c) Other Outward Supplies (NIL Rated, Exempted) :- It include supplies which are exempt from GST or are NIL rated will come under this. Nil rated supplies are those for which the GST rate is NIL or which have been kept exempt from GST.

(d) Inward supplies (liable to reverse charge) :- It means that if user have provided details of purchases made by from unregistered dealers on which reverse charge applies. In such cases you have to prepare an invoice to yourself and pay the applicable GST rate of tax.

(e) Non-GST outward supplies :- It includes Details of any supplies made by you kept wholly out of GST. For eg, alcohol and petroleum products.

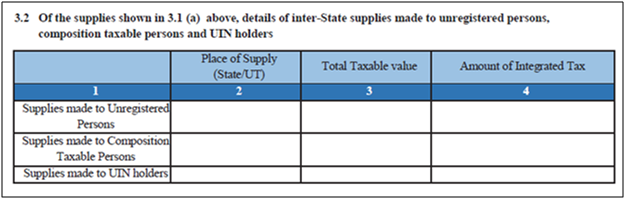

3.2 This section is same as section 3.1 (a) in which the details of inter-state supplies made to Unregistered persons, Composition Taxable persons and UIN holders

Under this head further, break up of ‘Outward taxable supplies’ in the above table must be provided. Here user must mention the inter-state supplies which are made to

- Unregistered persons

- Composition dealers

- UIN holders

*UIN holders mean those who have a Unique Identification Number instead of a GSTIN. These are specialized agencies of the UNO (United Nations Organization) or an embassy. Or any Multilateral Financial Institution and Organization notified under the United Nations (Privileges and Immunities) Act, 1947. Any other persons may also be notified by the Commissioner.

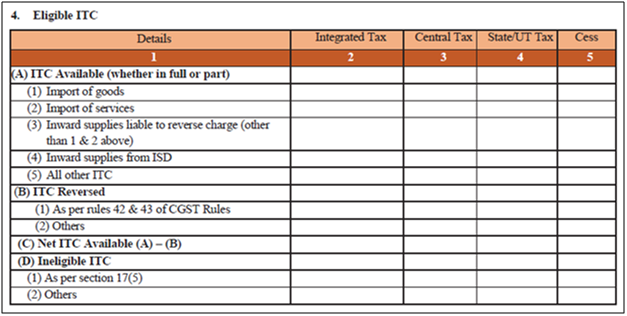

4. Eligible ITC

This section includes whatever the ITC claim needs to done, that tax amount will be entered here. The detail required for input tax credit must be provided separately for IGST, CGST, SGST, UTGST and CESS. Only total values have to be reported and invoice level information is not required.

(A) ITC Available (whether in full or part) : The information that is available related to goods will come under:

Import of goods.

Import of services.

Inward supplies liable to reverse charge : Suppose if any purchase has been made from unregistered on which reverse charge is applicable then that same amount will be entered here.

Inward supplies from ISD : The tax claim which needs to be taken from the Input service distributor then those details will be mentioned here.

All Other ITC : This includes the details except all the Import, Reverse Charge or ISD.

(B) ITC Reversed :

(1) As per rules 42 & 43 of CGST Rules : It requires the input credit must be reversed for goods and services, where they have been used partly for business and partly for other purposes, to the extent not used for business.

Similarly, input credit reversal is also required where supplies include taxable, exempt and nil rated supplies. In the same manner, input credit related to capital goods used for business and other purposes, for taxable, exempt, nil rated supplies must also be reversed to the extent not used for business. Details formulae have been prescribed on how to go about doing this.

(2) Others : Any other ITC which has been reversed in the books by user i.e. the debit note will be mentioned here.

(C) Net ITC Available (A)-(B) : This means the ITC which would be available from (A-B) that would be mentioned here.

(D) Ineligible ITC

(1) As per Section 17 (5) : This is for your block credit for example if any car is purchased for the purpose of business, service taken for any food and beverages, service taken for outdoor catering or services taken for spa then on these input tax credit is not available and will come under block credit category. So, the details would be mentioned here.

(2) Others : Those which do not come under Section 17(5) then also on that ITC is not available so that details will come under this.

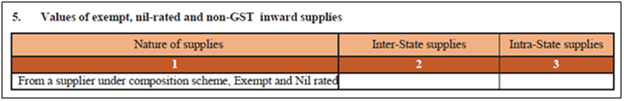

5. Values of Exempt, NIL-rated and Non-GST Inward Supplies

Here you have to report any purchases made by you of goods or services, which are from a composition dealer, are exempt, nil rated or not covered by GST at all. This information must be broken down into inter-state and intra-state.

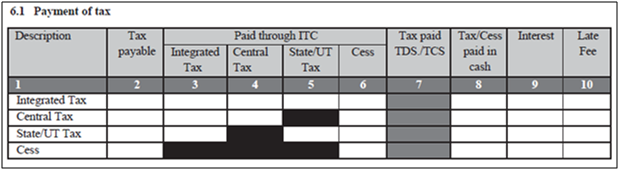

6.1. Payment of Tax

In this the final tax would be mentioned and the figures (IGST, CGST, SGST, and CESS) will automatically be picked from 3.1. After that the figures will come for which the ITC is claimed.

Under this section, you have to report the final tax payable by you on taxable supplies made by you, which will match with 3.1.(a) above. The amount is separately reported under IGST, CGST, SGST, and UTGST. And also report the credit which has been availed against these. This amount is under 4(C). The balance tax must be deposited by user and appears under column 8. If any interest or late fee has been deposited that must also be reported.

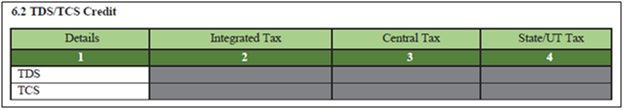

6.2 TDS/TCS credit

No information is required to be given in point number 6.2 .as the provisions of TDS/TCS credit have been deferred by the government.

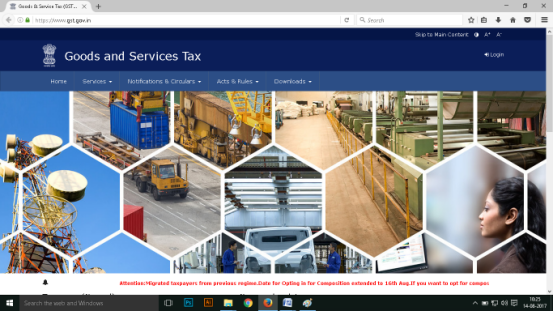

PROCESS TO FILE GSTR-3B RETURN ON THE GST PORTAL

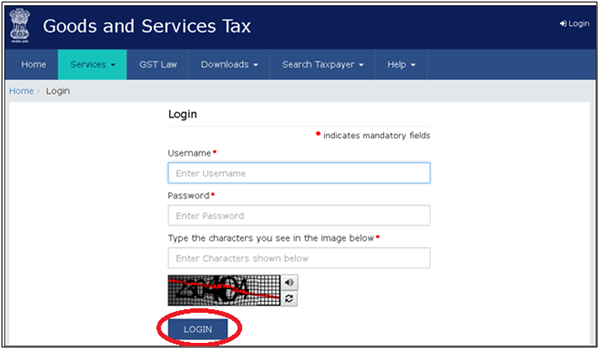

- For that you will go to www.gst.gov.in Then click on Login.

- Now, the user will enter the Username & Password and then click on 'Login' tab.

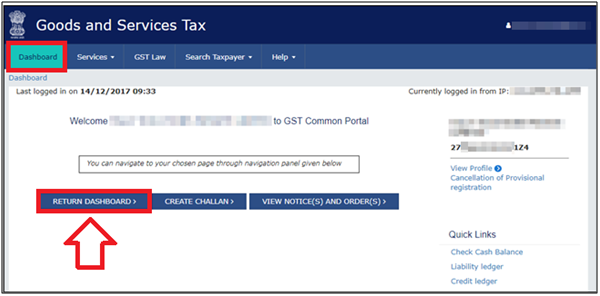

- Then, Go to Dashboard > Return Dashboard.

- Thereafter, a File Return window will appear.

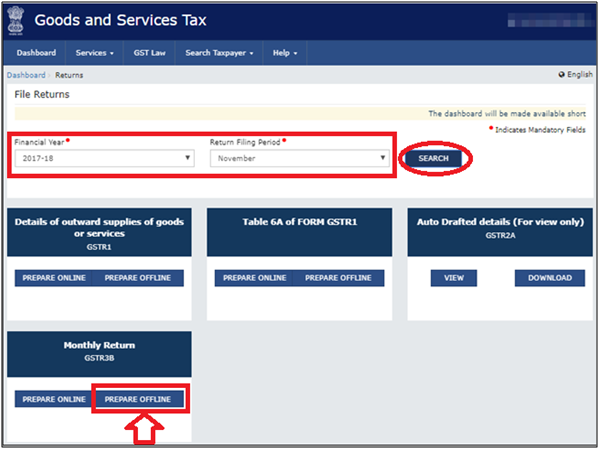

- Select the Return Filing Financial year & Period and then click on 'Search' tab.

- Click on 'Prepare Offline' Under Monthly Return GSTR3B .

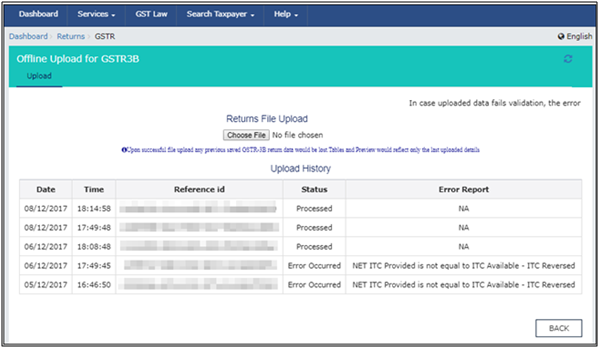

- An Offline upload GSTR3B window will appear. Click on 'Choose File' to import the GSTR-3B JSON file generated from Marg Software.

- Once your JSON files are uploaded successfully, you will be notified with a message. Once the file is successfully uploaded the Error Report displays NA.

- Now, click on 'Back'.

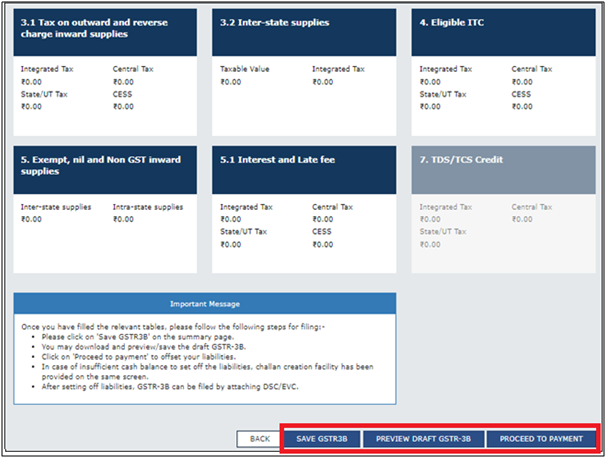

- In 'Monthly Return GSTR3B', the user will click on "Prepare Online". The values get posted in the relevant tables of GSTR-3B.

- Click on 'SAVE GSTR3B' to save the details of return.

- Click on 'PREVIEW DRAFT GSTR-3B' to preview or download the form, check the details, and correct it if required.

- Click on 'Proceed To Payment' to view the available input tax credit. You can modify the values if required.

- Confirm the input tax credit, to offset against the payable value. For the balance amount payable, challan gets generated automatically with the relevant details, and payment options appear.

- Once you make the online payment, the payments table appears.

- Click 'Proceed to File' , select the authorised signatory and then click on 'Submit' with EVC or DSC.

Note: Once you click the SUBMIT button, GSTR-3B cannot be revised.

This way, GSTR-3B file will get uploaded on GST Portal.

-

Marg ERP 9+

-

Marg ERP 9+