Search by Category

- Marg Digital Health

- ABHA 2.0 - Ayushman Bharat

- Marg Nano

- Swiggy & Zomato

- Marg Cloud

-

Masters

- Ledger Master

- Account Groups

- Inventory Master

- Rate and Discount Master

- Refresh Balances

- Cost Centre Master

- Opening Balances

- Master Statistics

- General Reminder

- Shortage Report

- Supplier Vs Company

- Temporary Limit

- Shop QRID and eBusiness

- Cloud Backup Setup

- Password and Powers

- Marg Licensing

- Marg Setup

- Target

- Budget

- Credit Limit Management

- Change ERP Edition

- Ease Of Gst Adoption

-

Transactions

- ERP To ERP Order

- Sale

- Purchase

- Sale Return

- Purchase Return

- Brk / Exp Receive

- Scrap Receive

- Brk / Exp Issue

- Scrap Issue

- GST Inward

- GST Outward

- Replacement Issue

- Replacement Receive

- Stock Issue

- Stock Receive

- Price Diff. Sale

- Price Diff. Purchase

- BOM

- Conversion

- Quotation

- Sale Order

- Purchase Order

- Dispatch Management

- ERP Bridger

- Transaction Import

- Download From Server

- Approvals

- Pendings

- Accounts

- Online Banking

-

Books

- Cash and Bank Book

- All Ledgers

- Entry Books

- Debtors Ledgers

- Creditors Ledger

- Purchase Register

- Sale Register

- Duties & Taxes

- Analytical Summaries

- Outstandings

- Collection Reports

- Depreciation

- T-Format Printing

- Multi Printing

- Bank Reconcilation

- Cheque Management

- Claims & Incentives

- Target Analysis

- Cost Centres

- Interest and Collection

- Final Reports

-

Stocks

- Current Stock

- Stock Analysis

- Filtered Stock

- Batch Stock

- Dump Stock

- Hold/Ban Stock

- Stock Valuation

- Minimum Level Stock

- Maximum Level Stock

- Expiry Stock

- Near Expiry Stock

- Stock Life Statement

- Batch Purchase Type

- Departments Reports

- Merge Report

- Stock Ageing Analysis

- Fast and Slow Moving Items

- Crate Reports

- Size Stock

-

Daily Reports

- Daily Working

- Fast SMS/E-Mail Reports

- Stock and Sale Analysis

- Order Calling

- Business on Google Map

- Sale Report

- Purchase Report

- Inventory Reports

- ABC Analysis

- All Accounting Reports

- Purchase Planning

- Dispatch Management Reports

- SQL Query Executor

- Transaction Analysis

- Claim Statement

- Upbhogkta Report

- Mandi Report

- Audit Trail

- Re-Order Management

- Reports

-

Reports Utilities

- Delete Special Deals

- Multi Deletion

- Multi Editing

- Merge Inventory Master

- Merge Accounts Master

- Edit Stock Balance

- Edit Outstanding

- Re-Posting

- Copy

- Batch Updation

- Structure/Junk Verificarion

- Data Import/Export

- Create History

- Voucher Numbering

- Group of Accounts

- Carry Balances

- Misc. Utilities

- Advance Utilities

- Shortcut Keys

- Exit

- Generals

- Backup

- Self Format

- GST Return

- Jewellery

- eBusiness

- Control Room

- Advance Features

- Registration

- Add On Features

- Queries

- Printing

- Networking

- Operators

- Garment

- Hot Keys

-

GST

- E-Invoicing

- Internal Audit

- Search GSTIN/PARTY

- Export Invoice Print

- Tax Clubbing

- Misc. GST Reports

- GST Self-Designed Reports

- GST Return Video

- GSTR Settings

- Auditors Details

- Update GST Patch

- Misc. GST Returns

- GST Register & Return

- GST RCM Statement

- GST Advance Statement

- GST Payment Statement

- Tax Registers and Summaries

- TDS/TCS Reports

- Form Iss./Receivable

- Mandi

- My QR Code

- E-Way Bill

- Marg pay

- Saloon Setup

- Restaurant

- Pharmanxt free Drugs

- Manufacturing

- Password and Power

- Digital Entry

Home > Margerp > Vat > How to set Rate wise GST on HSN / SAC bases in Marg Software ?

How to set Rate wise GST on HSN / SAC bases in Marg Software ?

Overview of Rate Wise GST On HSN/SAC Bases

Enable Rate wise GST On HSN/SAC Bases in Marg Software

Process to apply Rate wise GST On HSN/SAC Bases In Marg Software

OVERVIEW OF RATE WISE GST ON HSN/SAC BASES

- In Marg Software if the user needs to apply Rate wise GST on the HSN/SAC Bases, then it can be set easily. For example if any of our products is sold below or equals to Rs. 499 then the GST Tax% that will be charged will be different for that product. If the same or any other product is sold for Rs. 1000 or above then the GST Tax% that will be charged on it will be different.

- This law is applied for different types of products of different categories of trades i.e. shoes, footwear, garments, etc. So, in order to maintain Rate Wise GST on HSN/SAC Bases automatically, Marg Software has a provision for it.

ENABLE RATE WISE GST ON HSN/SAC BASES IN MARG SOFTWARE

Note: Rate wise GST feature not available in Basic Version.

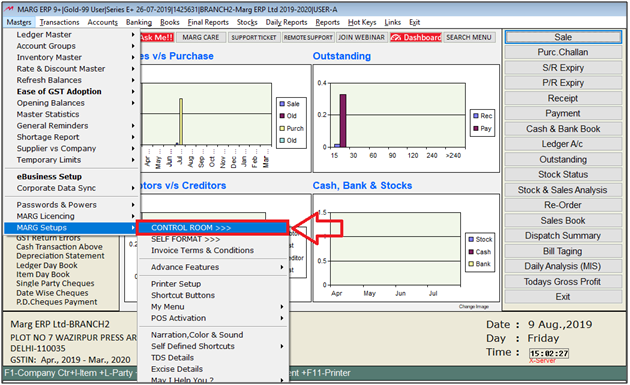

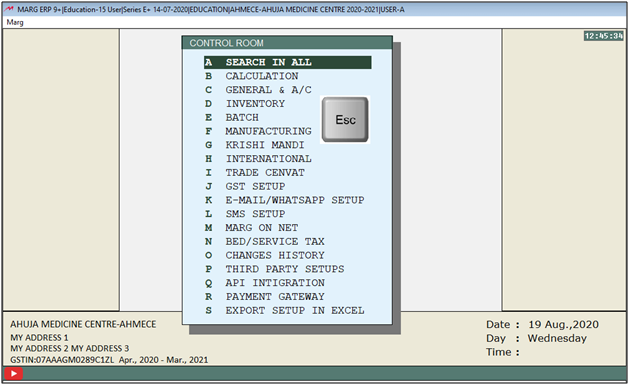

- Go to Masters > Marg Setups > Control Room.

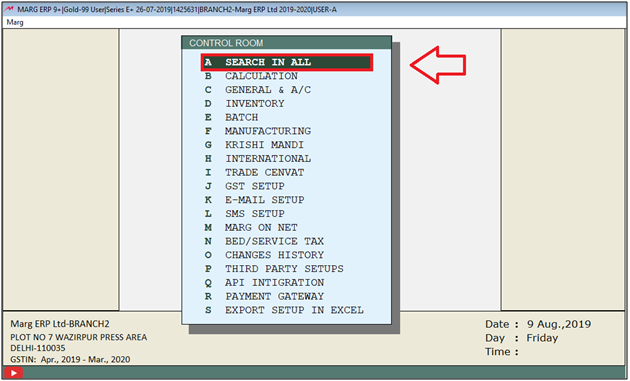

- A 'Control Room' window will appear.

- The user will select ‘Search in all’.

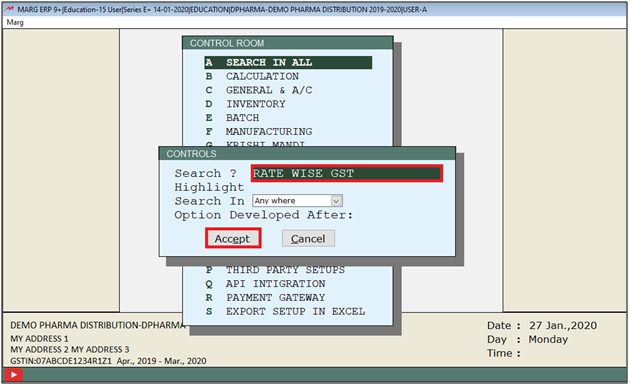

- A 'Controls' window will appear in which the user will Search 'Rate Wise GST'.

- Now click on ‘Accept’

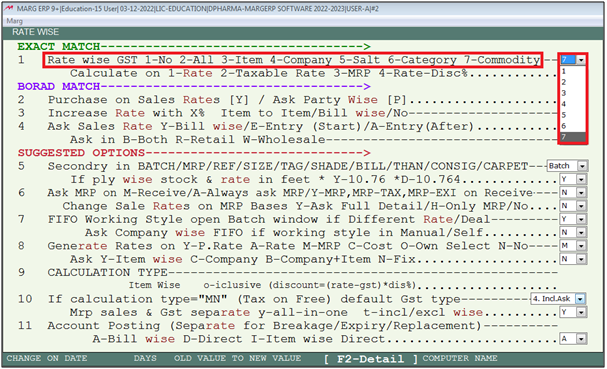

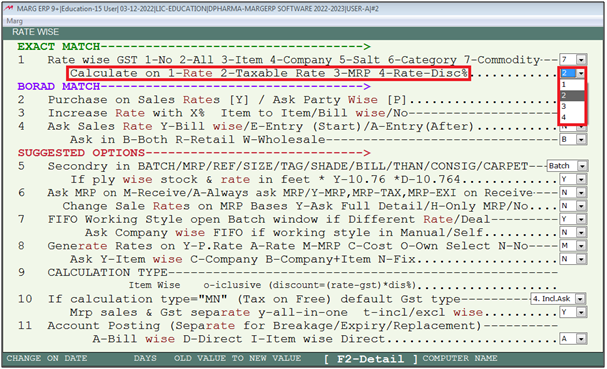

- A 'Rate wise GST' window will appear.

- In 'Rate wise GST 1-No 2-All 3-Item 4-Company 5-Salt 6-Category 7-Commodity', the user will select '7'.

- In 'Calculate on 1-Rate 2-Taxable Value 3-MRP 4-Rate-Disc%', the user will select the option as per the requirement.

- Suppose selects '2' for taxable value.

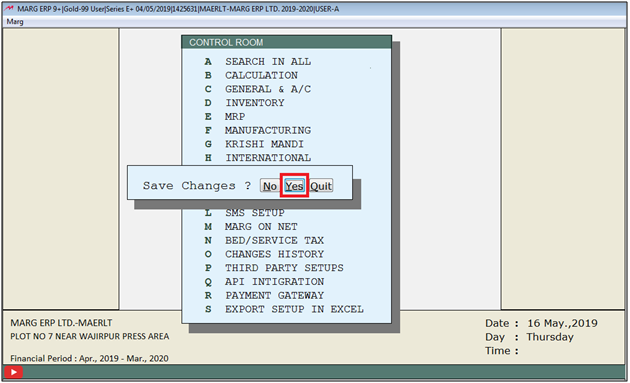

- The user will now press 'ESC' key twice.

- Now click on ‘Yes’ to save changes.

PROCESS TO APPLY RATE WISE GST ON HSN/SAC BASES IN MARG SOFTWARE

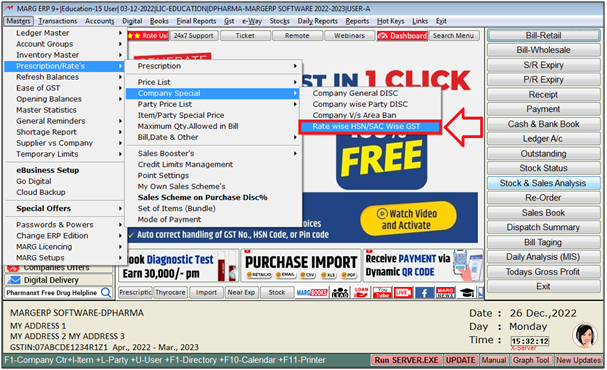

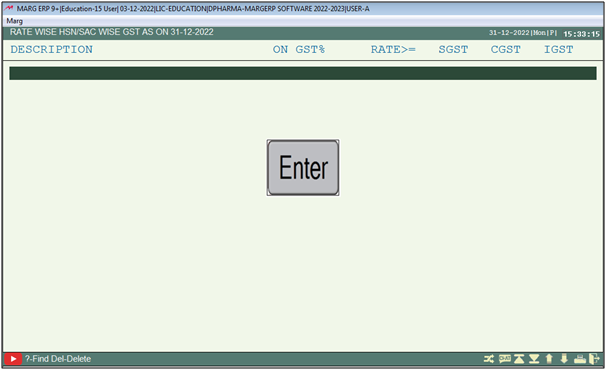

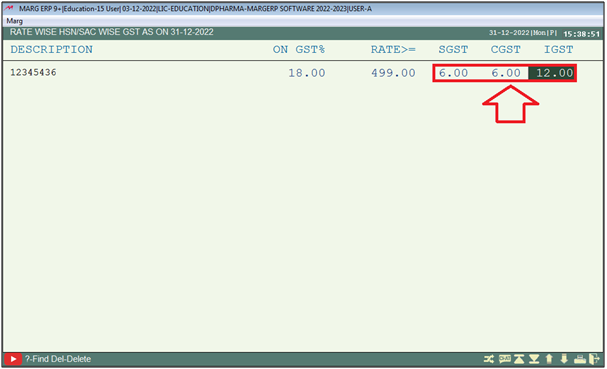

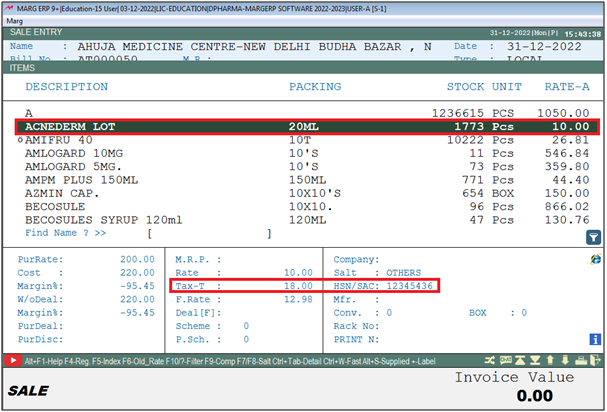

- Go to Masters > Rate & Discount Master > Company Special > Rate wise HSN/SAC wise GST.

- A ‘Rate Wise HSN/SAC Wise Gst As On’ window will appear.

- Suppose the user needs to set if Item having 18% GST and if Rate of item in bill is equals to or above Rs. 499, then GST should be charged (6+6+12%).

- The user will press ‘Enter’ key.

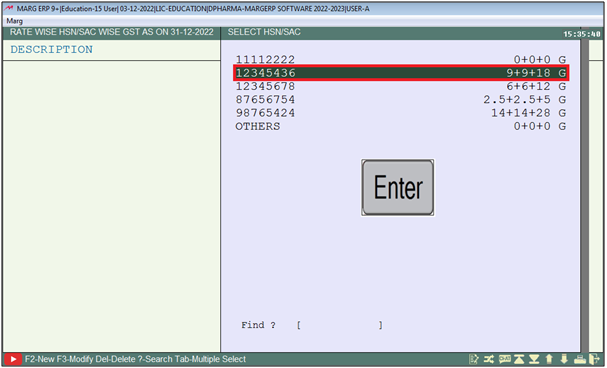

- A 'Select HSN/SAC' window will appear.

- The user will select the HSN/SAC on which Rate Wise GST needs to be set. And press ‘Enter’ key.

- Suppose select ‘12345436’ (9+9+18)’.

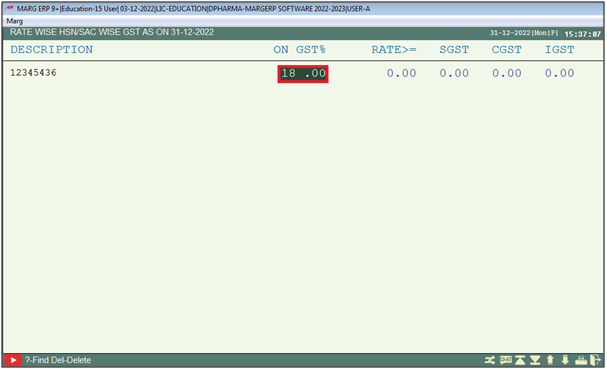

- In 'On GST %', the user will mention the GST% of the selected HSN/SAC.

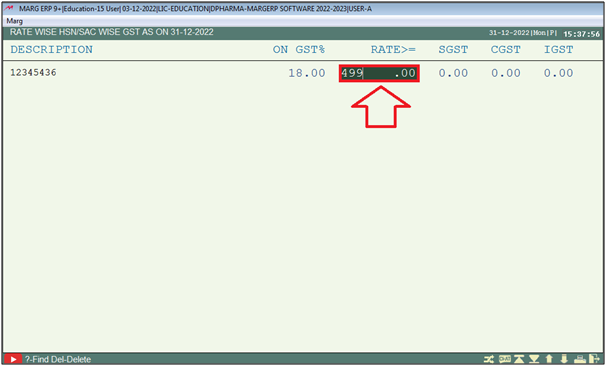

- In ‘Rate>=’ option, the user will mention the rate of the item, equals to or above to which the user needs to Charge different % of GST.

- Suppose mention ‘499’.

- In 'SGST/CGST/IGST' option, the user will mention the GST% which needs to be charged if Item’s Rate is equal to or above 499.

- Suppose mention ‘6+6+12’.

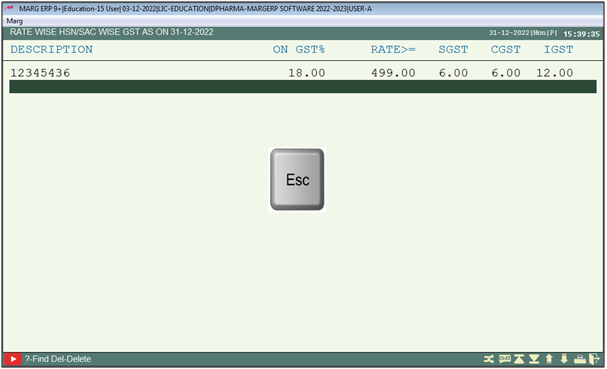

- Now, the user will press 'ESC' key.

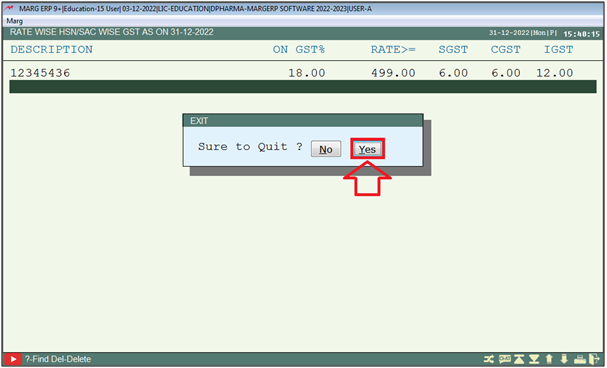

- Click on 'Yes'.

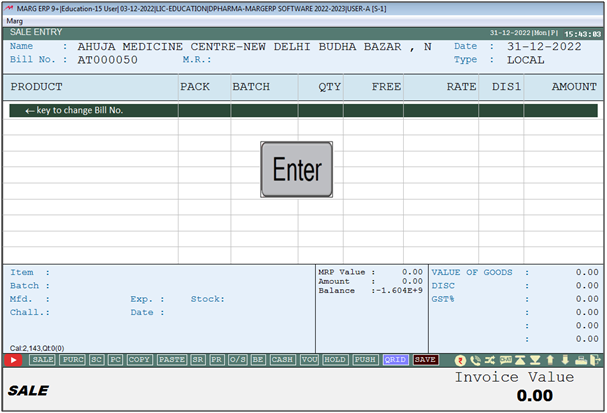

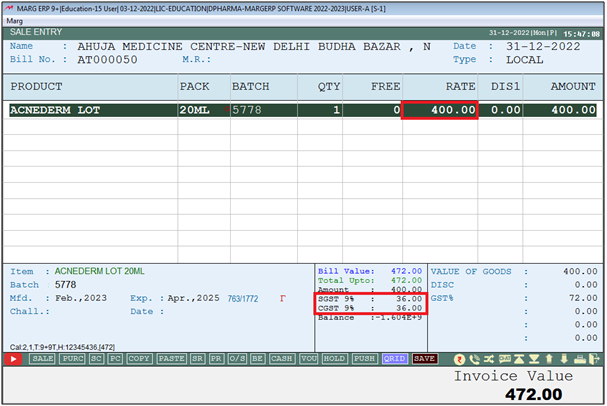

- Now, the user will create a Sale Bill.

- Press 'Enter' key to open the Item List.

- An 'Item List' window will appear.

- The user will now select the Item whose HSN/SAC is '12345436' and GST% is '18'. And Press 'Enter' key.

- Suppose select 'Acnederm Lot'.

- Now, in this Bill the rate of Item is Rs.400 (Which is less than the Rs.499).

- Therefore, the software will auto charge GST '9+9+18'.

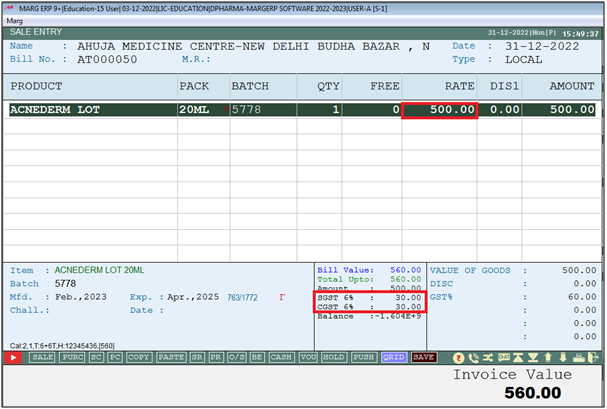

- If the user mention the Rate Greater than Rs. 499 the Gst will auto apply by '6+6+12%'.

- Suppose mention rate 'Rs. 500'.

-

Marg ERP 9+

-

Marg ERP 9+